Question: u Problem 1. You have won a jackpot in a lottery. You have the following two options: a. You will receive 26 annual payments of

u

u

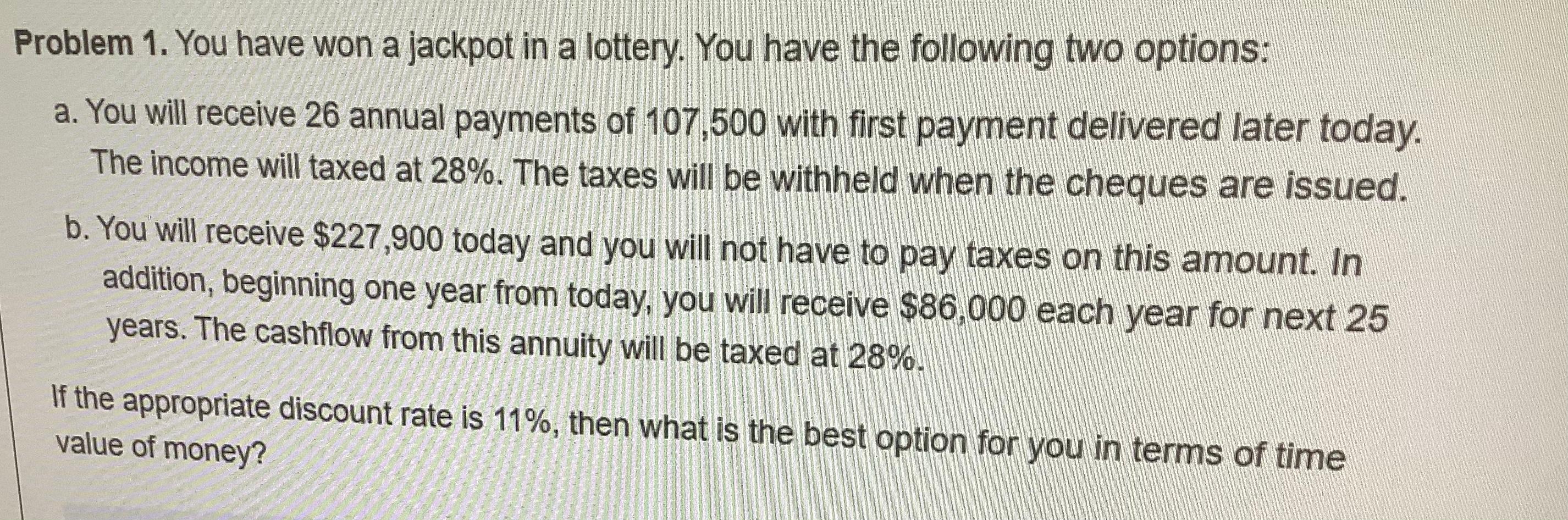

Problem 1. You have won a jackpot in a lottery. You have the following two options: a. You will receive 26 annual payments of 107,500 with first payment delivered later today. The income will taxed at 28%. The taxes will be withheld when the cheques are issued. b. You will receive $227,900 today and you will not have to pay taxes on this amount. In addition, beginning one year from today, you will receive $86,000 each year for next 25 years. The cashflow from this annuity will be taxed at 28%. If the appropriate discount rate is 11%, then what is the best option for you in terms of time value of money

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock