Question: U Proceeds from Notes Payable On January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 120-day note with a face amount of

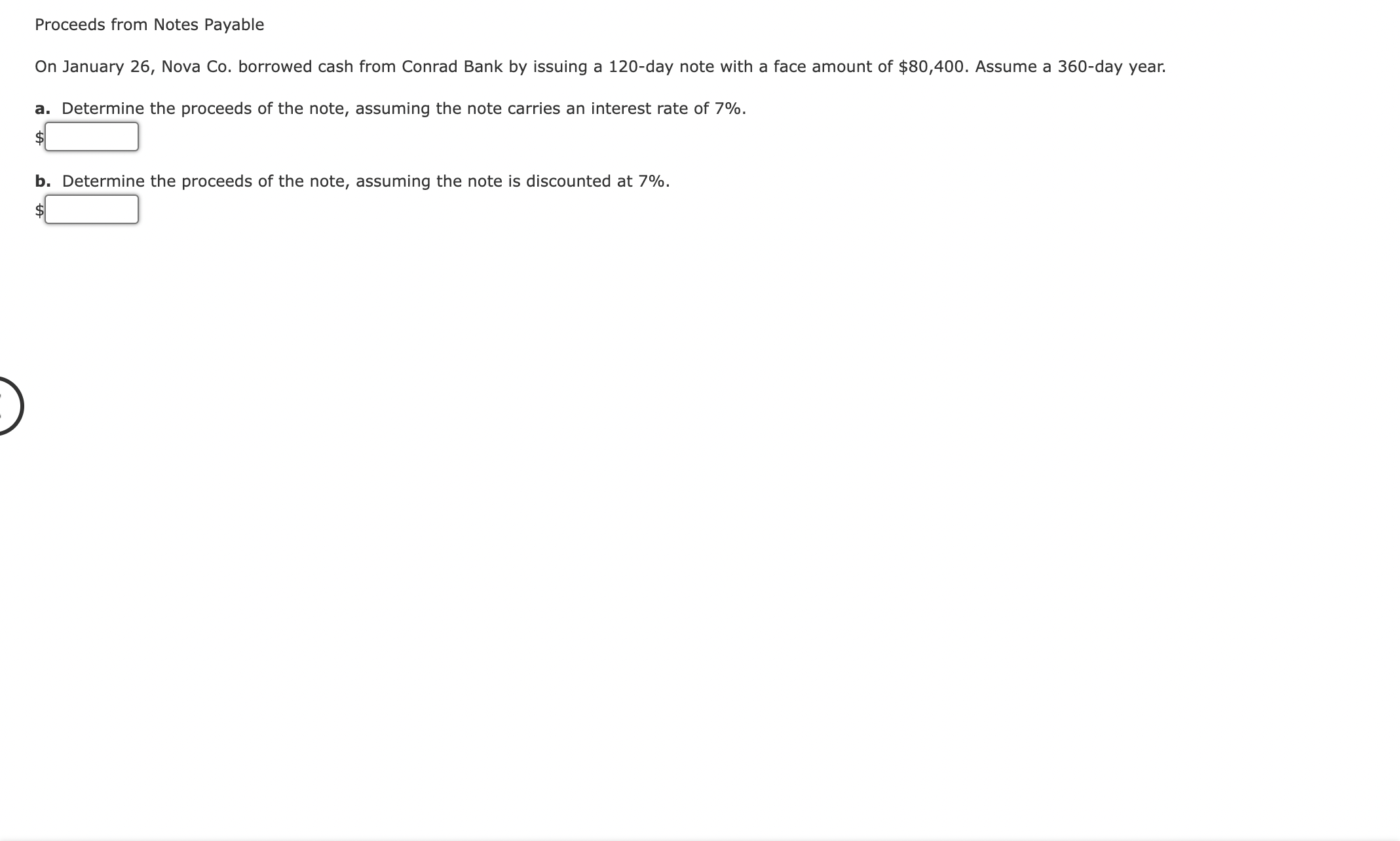

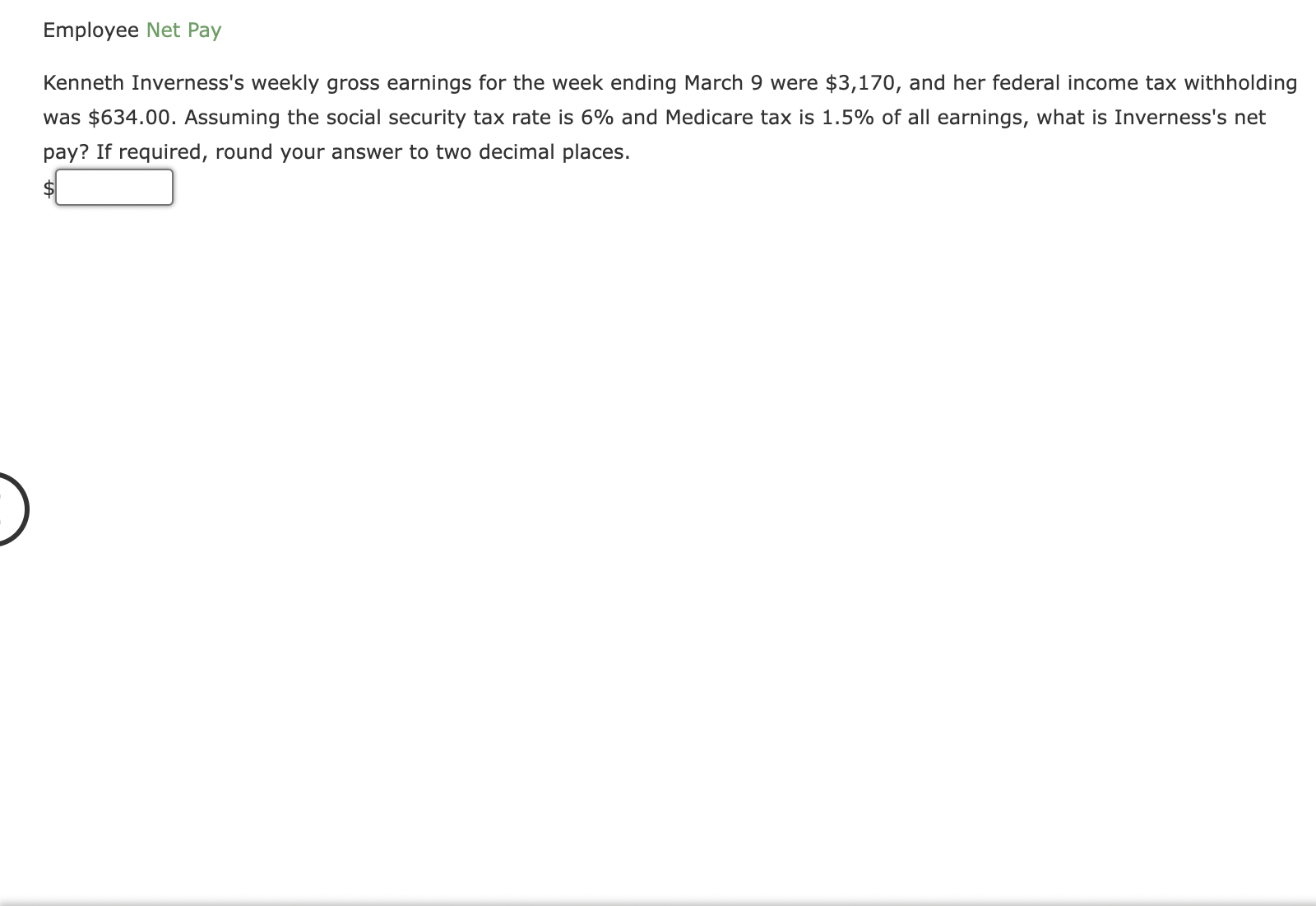

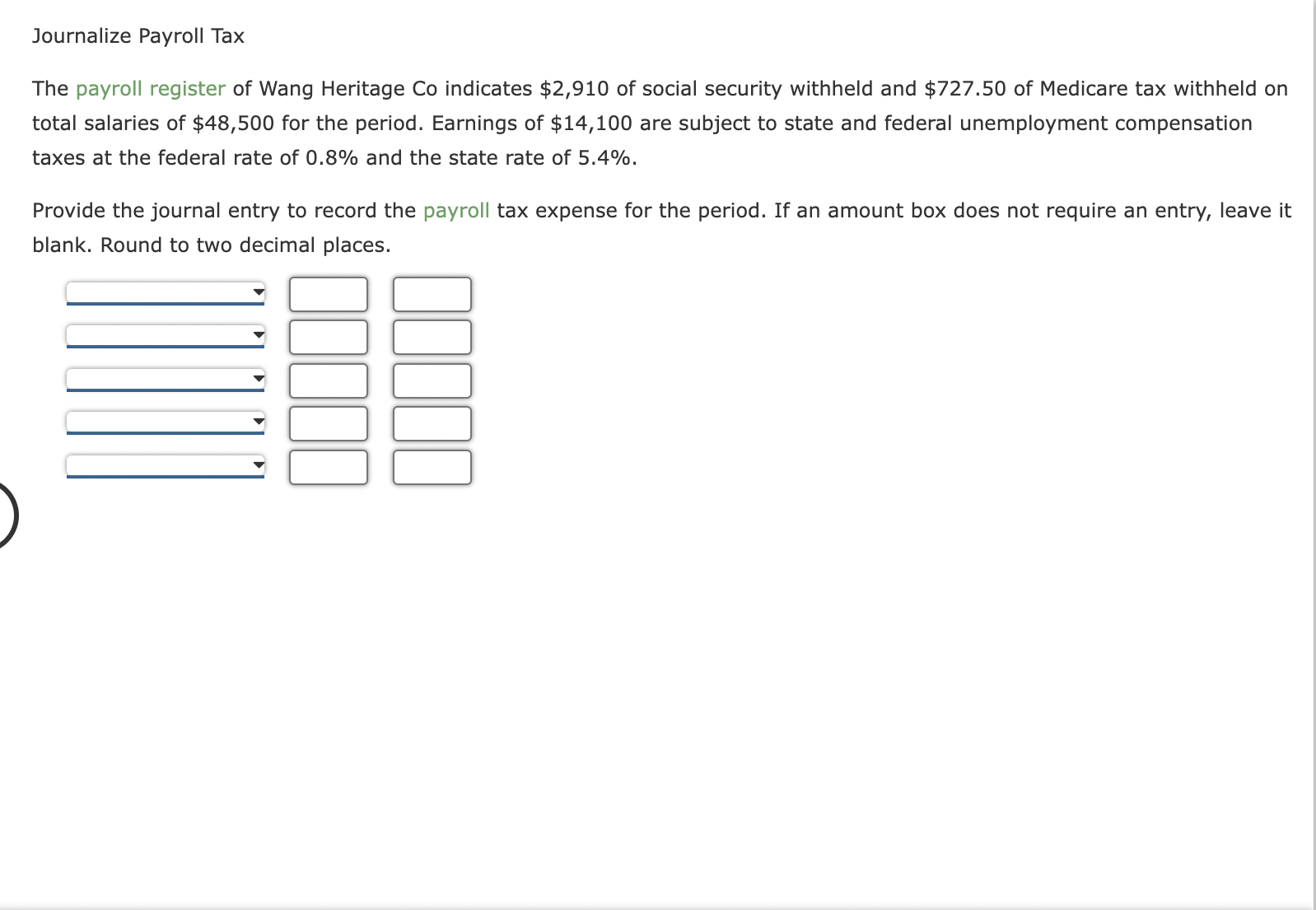

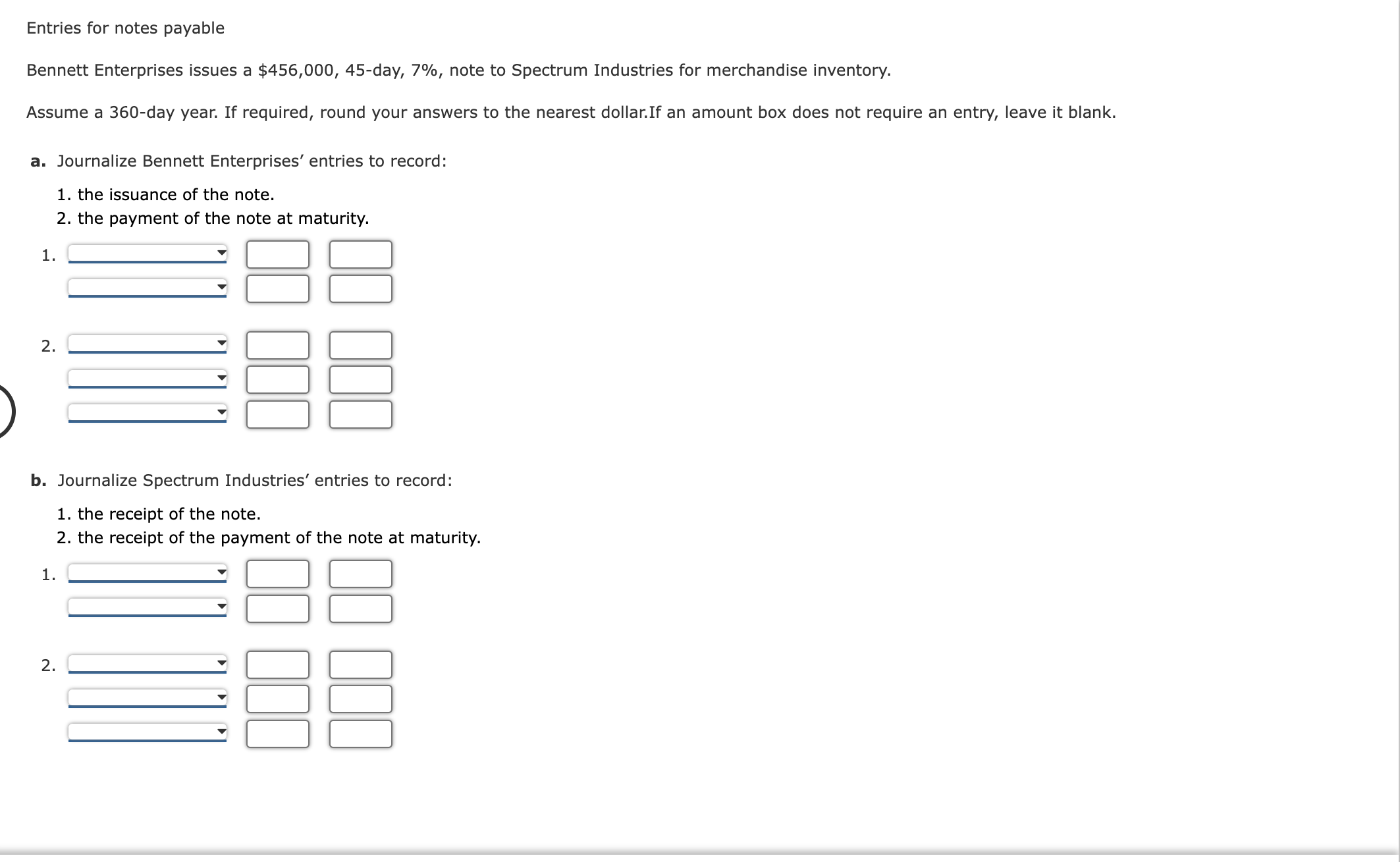

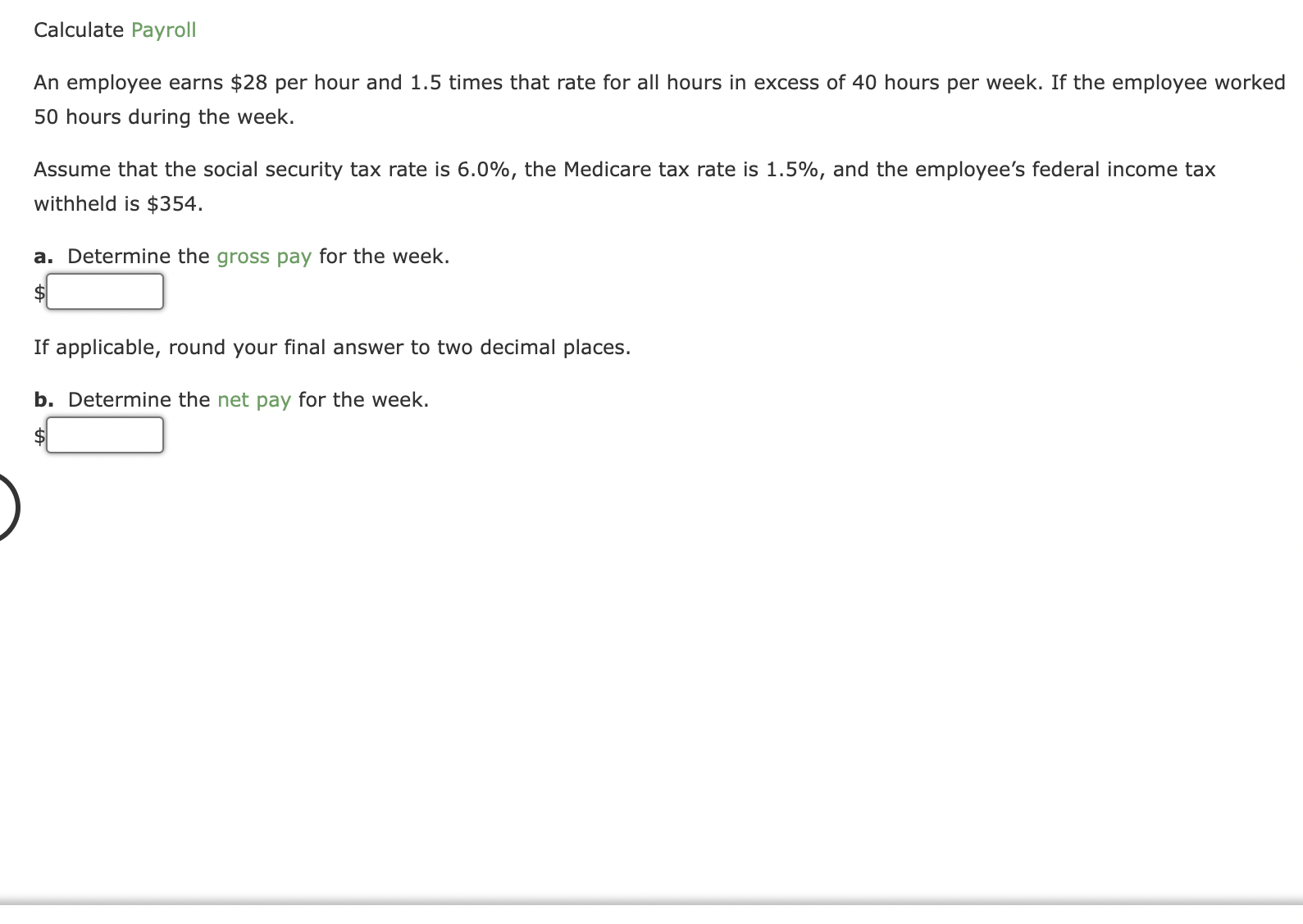

U Proceeds from Notes Payable On January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 120-day note with a face amount of $80,400. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries an interest rate of 7%. E b. Determine the proceeds of the note, assuming the note is discounted at 7%. 56:] Employee Net Pay Kenneth Inverness's weekly gross earnings for the week ending March 9 were $3,170, and her federal income tax withholding was $634.00. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Inverness's net pay? If required, round your answer to two decimal places. $[:1 Journalize Payroll Tax The payroll register of Wang Heritage Co indicates $2,910 of social security withheld and $727.50 of Medicare tax withheld on total salaries of $48,500 for the period. Earnings of $14,100 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places. 1 l Vi UUDUU DEBUG Entries for notes payable Bennett Enterprises issues a $456,000, 45-day, 7%, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar.If an amount box does not require an entry, leave it blank. 3. Journalize Bennett Enterprises' entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. 1-'\" '\" DUO 00 BUD DD b. Journalize Spectrum Industries' entries to record: 1. the receipt of the note. 2. the receipt of the payment of the note at maturity. 1-'' i 1 DUB DU 000 DE Calculate Payroll An employee earns $28 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 50 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $354. a. Determine the gross pay for the week. 3;:1 If applicable, round your nal answer to two decimal places. b. Determine the net pay for the week. G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts