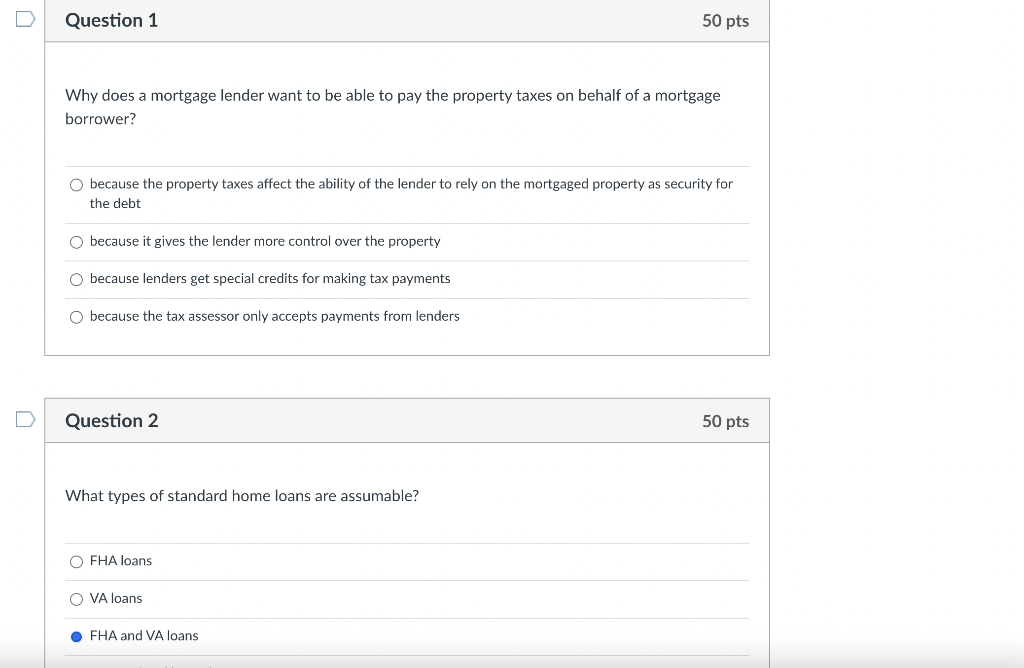

Question: u Question 1 50 pts Why does a mortgage lender want to be able to pay the property taxes on behalf of a mortgage borrower?

u Question 1 50 pts Why does a mortgage lender want to be able to pay the property taxes on behalf of a mortgage borrower? because the property taxes affect the ability of the lender to rely on the mortgaged property as security for the debt because it gives the lender more control over the property because lenders get special credits for making tax payments because the tax assessor only accepts payments from lenders Question 2 50 pts What types of standard home loans are assumable? O FHA loans OVA loans FHA and VA loans

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock