Question: U Question 4 1 pts A $14,888 par value bond whose coupon rate is 4.4% is purchased. If the investment represents a current yield of

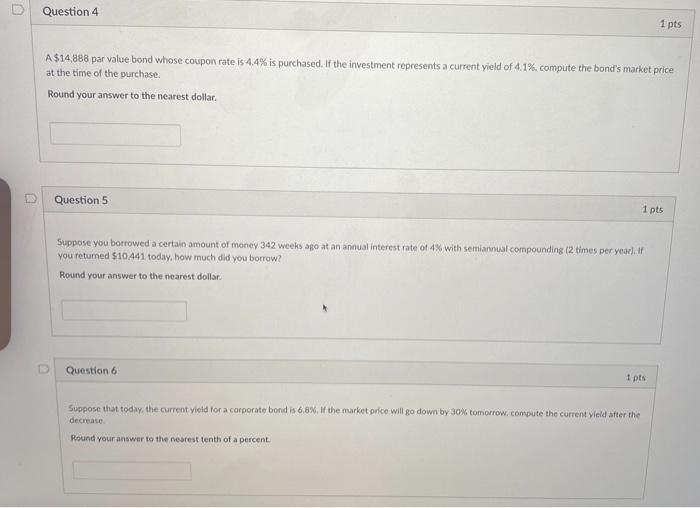

U Question 4 1 pts A $14,888 par value bond whose coupon rate is 4.4% is purchased. If the investment represents a current yield of 4.1%, compute the bond's market price at the time of the purchase. Round your answer to the nearest dollar Question 5 1 pts Suppose you borrowed a certain amount of money 342 weeks ago at an annual interest rate of 4% with semiannual compounding (2 times per year). Ir you returned $10,441 today, how much did you borrow? Round your answer to the nearest dollar Question 6 1 pts Suppose that today, the current yield for a corporate bond is 6,8%. If the market price will go down by 30% tomorrow.compute the current yield after the decrease Round your answer to the nearest tenth of a percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts