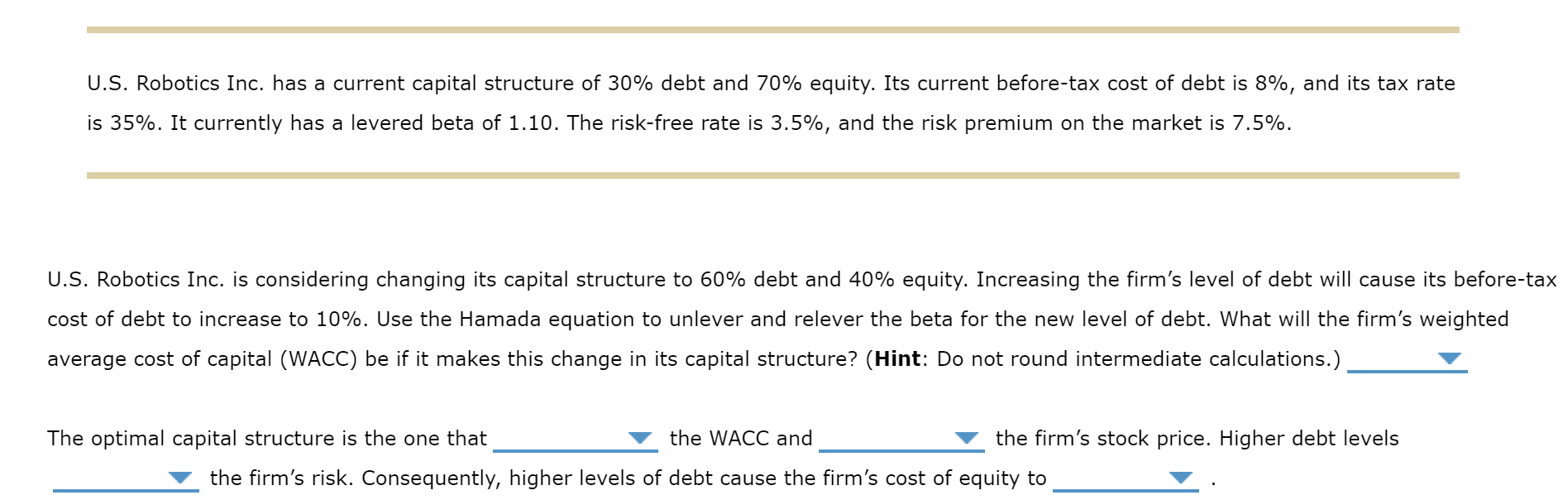

Question: U . S . Robotics Inc. has a current capital structure of 3 0 % debt and 7 0 % equity. Its current before -

US Robotics Inc. has a current capital structure of debt and equity. Its current beforetax cost of debt is and its tax rate

is It currently has a levered beta of The riskfree rate is and the risk premium on the market is

US Robotics Inc. is considering changing its capital structure to debt and equity. Increasing the firm's level of debt will cause its beforetax

cost of debt to increase to Use the Hamada equation to unlever and relever the beta for the new level of debt. What will the firm's weighted

average cost of capital WACC be if it makes this change in its capital structure? Hint: Do not round intermediate calculations.

The optimal capital structure is the one that

the WACC and

the firm's stock price. Higher debt levels

the firm's risk. Consequently, higher levels of debt cause the firm's cost of equity to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock