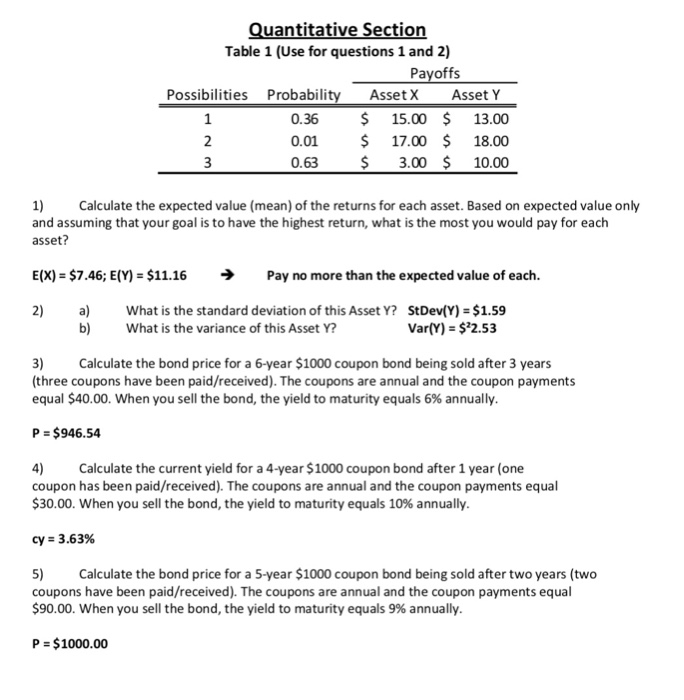

Question: uantitative Section Table 1 (Use for questions 1 and 2) Payoffs Possibilities Probabili AssetX Asset Y 0.36 15.00 $13.00 S 17.00 18.00 3.0010.00 0.01 0.63

uantitative Section Table 1 (Use for questions 1 and 2) Payoffs Possibilities Probabili AssetX Asset Y 0.36 15.00 $13.00 S 17.00 18.00 3.0010.00 0.01 0.63 1 Calculate the expected value (mean) of the returns for each asset. Based on expected value only and assuming that your goal is to have the highest return, what is the most you would pay for each asset? E(X) = $7.46; E(Y) = $11.16 Pay no more than the expected value of each. What is the standard deviation of this Asset Y? StDev(Y) $1.59 b) 2) What is the variance of this Asset Y? Var(Y) $2.53 3 Calculate the bond price for a 6-year $1000 coupon bond being sold after 3 years (three coupons have been paid/received). The coupons are annual and the coupon payments equal $40.00. When you sell the bond, the yield to maturity equals 6% annually P = $946.54 4) Calculate the current yield for a 4-year $1000 coupon bond after 1 year (one coupon has been paid/received). The coupons are annual and the coupon payments equal $30.00, when you sell the bond, the yield to maturity equals 10% annually cy = 3.63% 5) Calculate the bond price for a 5-year $1000 coupon bond being sold after two years(two coupons have been paid/received). The coupons are annual and the coupon payments equal $90.00, when you sell the bond, the yield to maturity equals 9% annually P $ 1000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts