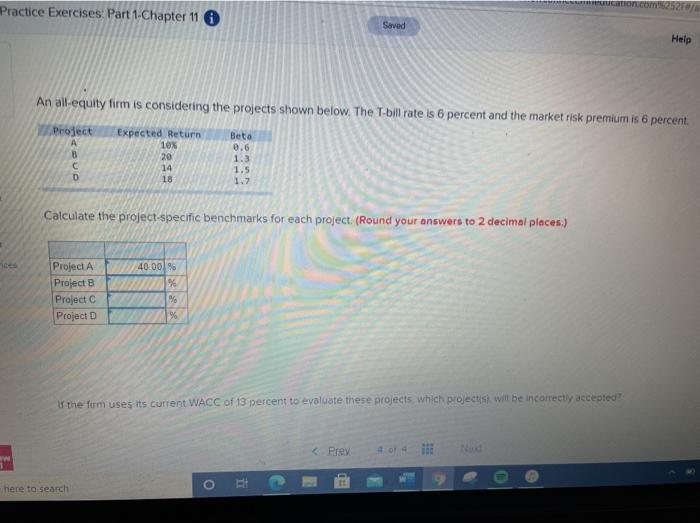

Question: ucation.com'.252 Practice Exercises Part 1 Chapter 11 Saved Help An all-equity firm is considering the projects shown below. The T-bill rate is 6 percent and

ucation.com'.252 Practice Exercises Part 1 Chapter 11 Saved Help An all-equity firm is considering the projects shown below. The T-bill rate is 6 percent and the market risk premium is 6 percent. Project A B D Expected Return 10% 20 14 18 Beta 0.6 1.3 1.5 1.7 Calculate the project-specific benchmarks for each project. (Round your answers to 2 decimal places.) 40.00% Project A Project B Project C Project D the fum uses its current WACC of 13 percent to evaluate these projects, which projects will be incorrectly accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts