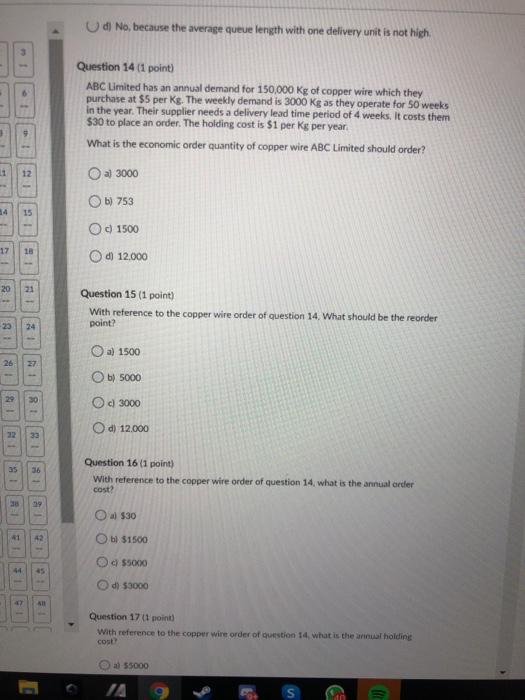

Question: Ud No, because the average queue length with one delivery unit is not high Question 14 (1 point) ABC Limited has an annual demand for

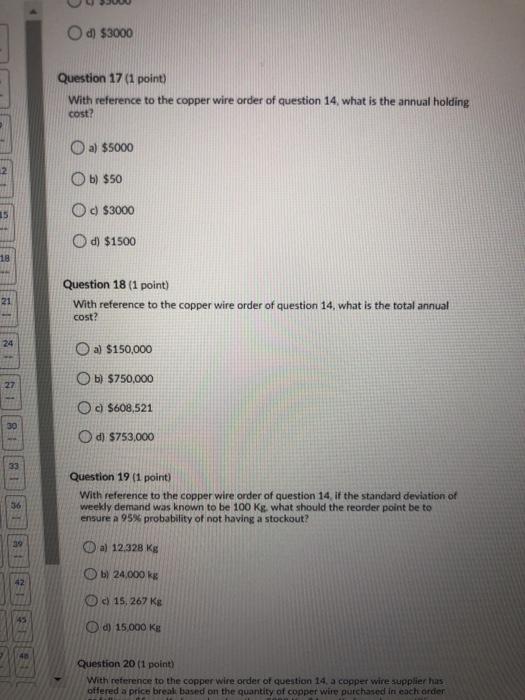

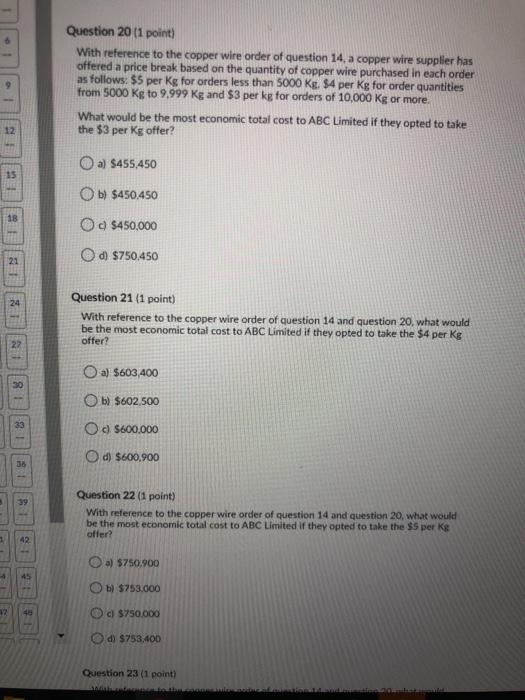

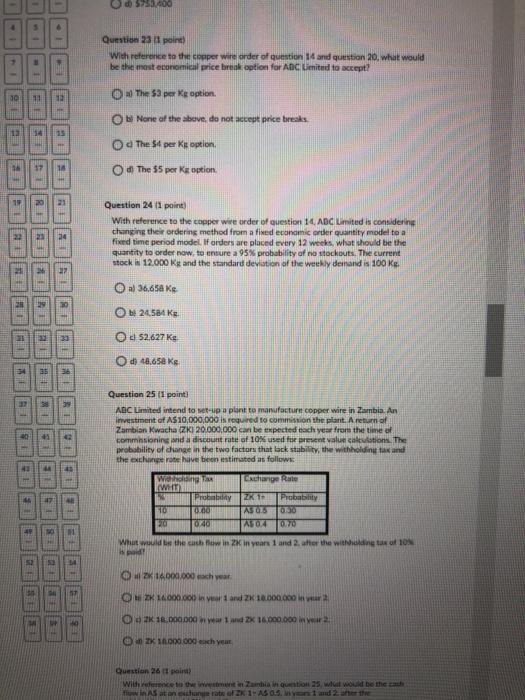

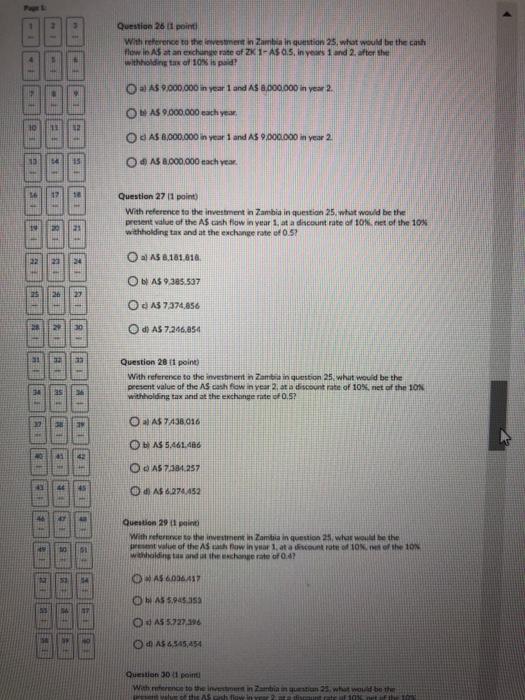

Ud No, because the average queue length with one delivery unit is not high Question 14 (1 point) ABC Limited has an annual demand for 150.000 kg of copper wire which they purchase at $5 per Kg. The weekly demand is 3000 kg as they operate for 50 weeks in the year. Their supplier needs a delivery lead time period of 4 weeks. It costs them $30 to place an order. The holding cost is $1 per kg per year What is the economic order quantity of copper wire ABC Limited should order? 12 O a 3000 14 15 b) 753 Od 1500 17 18 d) 12,000 20 21 Question 15 (1 point) With reference to the copper wire order of question 14. What should be the reorder point? 23 26 27 a) 1500 O 5000 Od 3000 18 O d) 12.000 1 36 Question 16 (1 point) With reference to the copper wire order of question 14, what is the annual order cost? 19 O $30 O $1500 41 12 O $5000 Od 53000 Question 17 (1 point) With reference to the copper wire order of question 14, what is the annual holding cost a 55000 1A Od $3000 Question 17 (1 point) With reference to the copper wire order of question 14, what is the annual holding cost? a) $5000 2 b) $50 15 O $3000 Od) $1500 18 21 Question 18 (1 point) With reference to the copper wire order of question 14, what is the total annual cost? O a) $150,000 Ob) $750,000 O $608,521 NI 18 O 753,000 18 Question 19 (1 point) 36 With reference to the copper wire order of question 14. if the standard deviation of weekly demand was known to be 100 Kg what should the reorder point be to ensure a 95% probability of not having a stockout? 39 a) 12,328 Kg Ob 24.000 42 Od 15,267 Ks d) 15,000 Ks 45 Question 20 (1 point) With reference to the copper wire order of question 14 a copper wire supplier has offered a price break based on the quantity of copper wire purchased in each order Question 20 (1 point) With reference to the copper wire order of question 14, a copper wire supplier has offered a price break based on the quantity of copper wire purchased in each order as follows: $5 per kg for orders less than 5000 kg. $4 per kg for order quantities from 5000 Kg to 9,999 Kg and $3 per kg for orders of 10,000 kg or more. What would be the most economic total cost to ABC Limited if they opted to take the $3 per kg offer? a) $455,450 Ob) $450.450 18 O $450,000 Od) $750.450 21 18 Question 21 (1 point) With reference to the copper wire order of question 14 and question 20, what would be the most economic total cost to ABC Limited if they opted to take the $4 per kg offer? 27 a) $603,400 Ob) $602,500 O $600.000 d) $600,900 39 Question 22 (1 point) With reference to the copper wire order of question 14 and question 20, what would be the most economic total cost to ABC Limited if they opted to take the $5 per ke offer? 1 42 a) $750.900 O ) $753.000 12 Od $750.000 Od $753.400 Question 23 (1 point) SW - Od 5753.400 Question 23 point) With reference to the copper wire order of question 14 and question 20, what would be the most economical price break option for ADC Limited to accept? ge 11 12 13 14 O The 53 per Ke option Ou None of the above, do not accept price breaks O a The St per Kis option O The 55 per Ke option RE SP 23 Question 24 11 point) With reference to the copper wwe order of question 14. ADC Limited is considering changing the ordering method from a fixed economic order quantity model to a fixed time period model. If orders are placed every 12 weeks, what should be the quantity to order now, to ensure a 95% probability of a stockouts. The current stock 12.000 kg and the standard deviation of the weekly demand is 100K al 36.650 kg 20.54 AL 52.627 Ke O di 42.658 K 18 Question 25 (1 point ADC Limited intend to set up a plant to manufacture copper wire in Zambia An investment of A$10,000,000 is required to commission the plant. A return of Zambian Kwacha (ZKI 20.000,000 can be expected each year from the time of commisioning and a discount rate of 10% used for present value cautions. The probability of change in the two factors that lack stability, the withholding tax and the exchange rate have been estimated as follows Wig Change (WHIT) ZKT Probably 0 050 00 ASO 0,70 What would be the cash flow in 2 in year 1 and 2. after the wholding tax of 10 52 ZK 14000.000 each year O ZK 16.000.000 V1 and ZK 10.000.000 O2 1.000.000 1 and 2 16.000.000 OK 1.000.000 each you Question 26 11 pair Wilhece to the intentia in questions will be the cash fiwwins to exchange rate of 21-ASO.S. Mivant and 2 after the Question 261 pointi With reference to the investment in Zambia in question 25, what would be the cash flew in AS at an exchange rate of ZK 1-AS A.S. Ines 1 and 2 after the withholding tax of 10% is paid 11 O AS 9000.000 in year 1 and AS 8.000.000 in year 2. O AS 9.000.000 each AS 6.000.000 in year 1 and AS 9.000.000 in year 2. OS 8.000.000 each year. 12 Question 27 11 point) With reference to the investment in Zambia in question 25, what would be the present value of the AS cash flow in year 1, at a discount rate of 10%.net of the 10% withholding tax and at the exchange rate of 0.51 2 ** AS 8.181.810 O AS 9.385.537 Od 137.374,856 Od AS 7.216,054 Question 28 11 point With reference to the investment in Zambia in question 25, what would be the present value of the AS cash flow in year 2 at a discount rate of 10%, net of the 10% withholding tax and at the exchange rate 0.5? OAS 7A38016 OB AS 5.461.486 O AS7304257 di AS 627452 Question 29 il print Withere to the investment in Zanta in question 25, what would be the et value of the Ascow in year 1, at a country of 10 of the 101 within and the change rate of 0:47 10 R ONAS6006417 OH AS 5.945 35 O A55.727.396 OAS 4545,454 Question 11 point Witherence to the inters in Zantaina 25what would be the This AS a ON