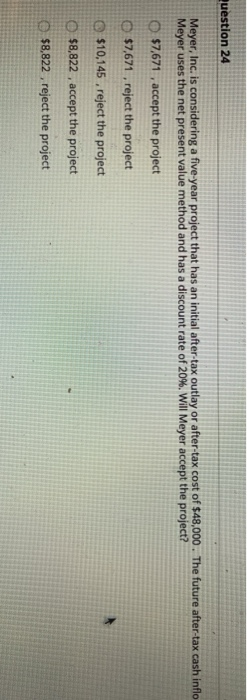

Question: uestion 24 Meyer, Inc. is considering a five-year project that has an initial after-tax outlay or after-tax cost of $48,000. The future after-tax cash inflo

uestion 24 Meyer, Inc. is considering a five-year project that has an initial after-tax outlay or after-tax cost of $48,000. The future after-tax cash inflo Meyer uses the net present value method and has a discount rate of 20%. Will Meyer accept the project? $7,671 , accept the project $7,671, reject the project $10,145,reject the project $8,822 , accept the project $8,822, reject the project Save Answer 6 points 0. The future after-tax cash inflows from its project for years 1, 2, 3, 4 and 5 are all the same at $19,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock