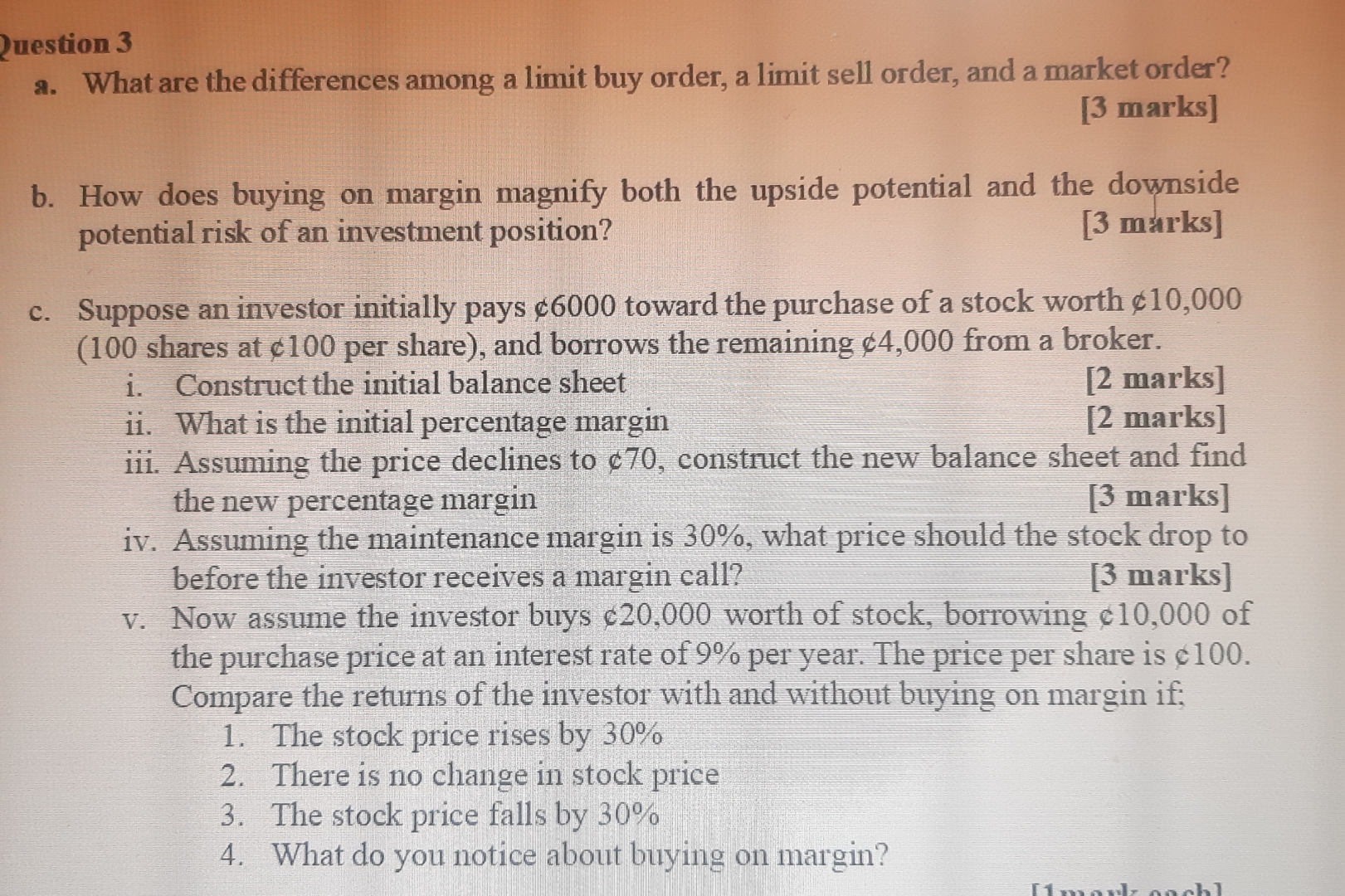

Question: uestion 3 a . What are the differences among a limit buy order, a limit sell order, and a market order? [ 3 marks ]

uestion

a What are the differences among a limit buy order, a limit sell order, and a market order?

marks

b How does buying on margin magnify both the upside potential and the downside potential risk of an investment position?

marks

c Suppose an investor initially pays toward the purchase of a stock worth shares at per share and borrows the remaining from a broker.

i Construct the initial balance sheet

marks

ii What is the initial percentage margin

marks

iii. Assuming the price declines to & construct the new balance sheet and find the new percentage margin

marks

iv Assuming the maintenance margin is what price should the stock drop to before the investor receives a margin call?

marks

v Now assume the investor buys worth of stock, borrowing of the purchase price at an interest rate of per year. The price per share is Compare the returns of the investor with and without buying on margin if;

The stock price rises by

There is no change in stock price

The stock price falls by

What do you notice about buying on margin?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock