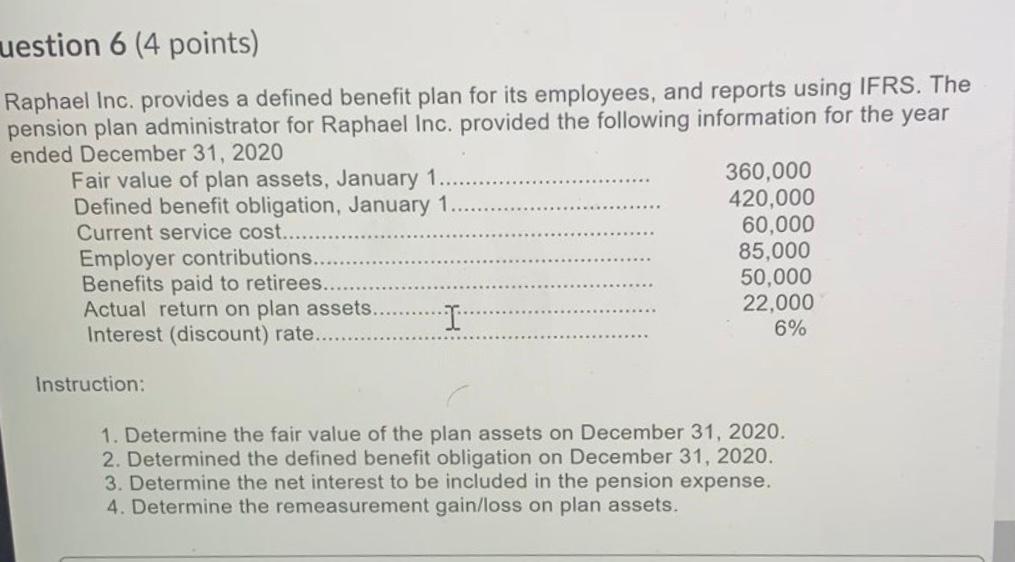

Question: uestion 6 (4 points) Raphael Inc, provides a defined benefit plan for its employees, and reports using IFRS. The pension plan administrator for Raphael Inc.

uestion 6 (4 points) Raphael Inc, provides a defined benefit plan for its employees, and reports using IFRS. The pension plan administrator for Raphael Inc. provided the following information for the year ended December 31, 2020 Fair value of plan assets, January 1. 360,000 Defined benefit obligation, January 1... 420,000 Current service cost.... 60,000 Employer contributions. 85,000 Benefits paid to retirees.. 50.000 Actual return on plan assets. 22.000 I Interest (discount) rate. 6% Instruction: 1. Determine the fair value of the plan assets on December 31, 2020. 2. Determined the defined benefit obligation on December 31, 2020. 3. Determine the net interest to be included in the pension expense. 4. Determine the remeasurement gain/loss on plan assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts