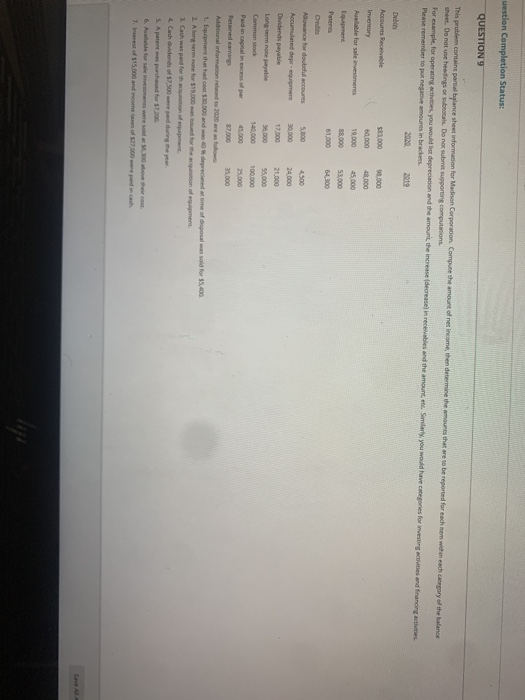

Question: uestion Completion Status: QUESTION 9 This problem contains partial balance sheet information for Madison Corporation Compute the amount of income tren decermine the amoures that

uestion Completion Status: QUESTION 9 This problem contains partial balance sheet information for Madison Corporation Compute the amount of income tren decermine the amoures that are to be reported for eachem when each cargary of the balance sheet. Do not use heading or s tats. Do not sunt supporting computacions For example, for operating activides you would is depreciation and the amount the increase decrease in recevables and the amount est. Samry you would have categories for investic es and financing Please remember to put negative amounts in bradets 2020 A Accounts Receivable $83.000 90.000 60.000 tle for sale investments 19.000 45.000 Equipment 88,000 53.000 Paters 61,000 54.100 Credits Allowance for doubtful 5800 4500 Accumulated deprement 30,000 24000 Didends payable 17.000 Long term not payable 35,000 55.000 Commons 140,000 100,000 Paid in canal in excess of par 45.000 25.000 Retained earnings 37,900 35.000 Additional information releed to 2020 are as follow 1. Equipment that had co .000 and was deprecated at time of posal was sold for $5.400 2. Along term for $19.000 wand for the acquisition of e ment 21.000 4. Cash dividends $7.500wered during the year SA patent was purchased for $7.200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts