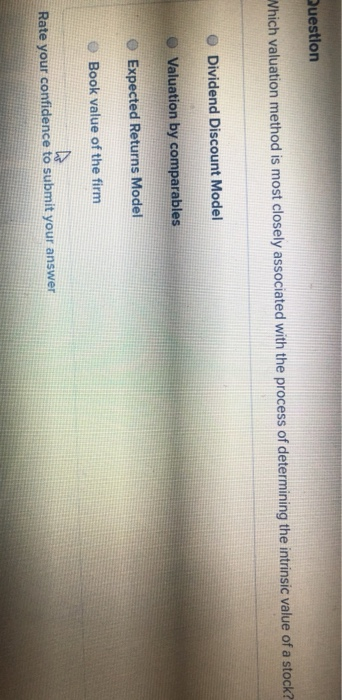

Question: uestlon Which valuation method is most closely associated with the process of determining the intrinsic value of a stock? - Dividend Discount Model O Valuation

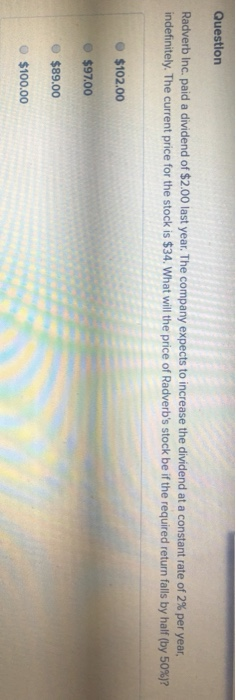

uestlon Which valuation method is most closely associated with the process of determining the intrinsic value of a stock? - Dividend Discount Model O Valuation by comparables O Expected Returns Model O Book value of the firm Rate your confidence to submit your answer Question Radverb Inc. paid a dividend of $2.00 last year. The company expects to increase the dividend at a constant rate of 2% per year, indefinitely. The current price for the stock is $34. What will the price of Radverb's stock be if the required return falls by half (by 50%)? $102.00 $97.00 $89.00 $100.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts