Question: ugh, this is mind bending stuff. help please S. (io points),Morison Memorial iHospial purchased the following plant assets on January 1, 20X1: Estimated Useful Life

ugh, this is mind bending stuff. help please

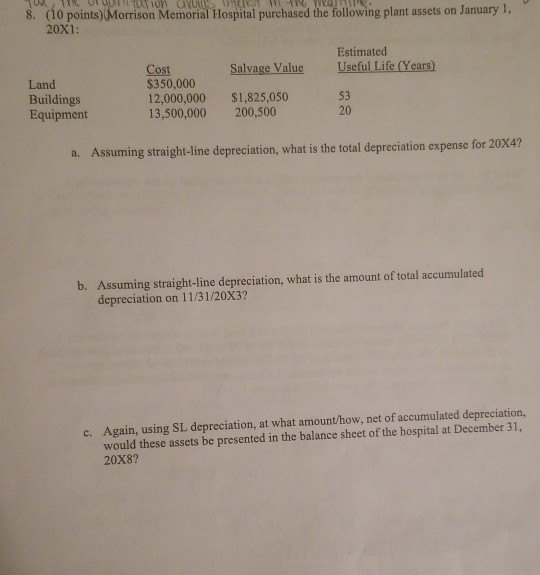

S. (io points),Morison Memorial iHospial purchased the following plant assets on January 1, 20X1: Estimated Useful Life (Years) Cost $350,000 12,000,000 $1,825,050 13,500,000 200,500 Salvage Value Land Buildings Equipment 53 20 Assuming straight-line depreciation, what is the total depreciation expense for 20X4? a. Assuming straight-line depreciation, what is the amount of total accumulated depreciation on 11/31/20x3? b. c. Again, using SL depreciation, at what amount/how, net of accumulated depreciation, would these assets be presented in the balance sheet of the hospital at December 31, 20X8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts