Question: UI Work In Process (FIFO) Refer to E3-9 for information regarding Ridgecrest Company. Required: Complete all requirements for E3-9 using the FIFO method. E3-11 Calculating

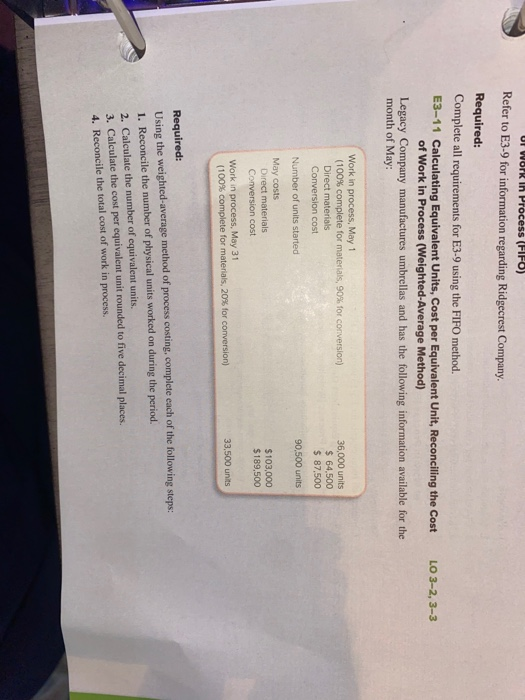

UI Work In Process (FIFO) Refer to E3-9 for information regarding Ridgecrest Company. Required: Complete all requirements for E3-9 using the FIFO method. E3-11 Calculating Equivalent Units, Cost per Equivalent Unit, Reconciling the Cost of Work in Process (Weighted-Average Method) Legacy Company manufactures umbrellas and has the following information available for the month of May: LO 3-2, 3-3 Work in process, May 1 (100% complete for materials, 90% for conversion) Direct materials Conversion cost Number of units started 36,000 units $ 64,500 $ 87,500 90,500 units May costs Direct materials Conversion cost $103,000 $189,500 Work in process, May 31 (100% complete for materials, 20% for conversion) 33,500 units Required: Using the weighted-average method of process costing, complete each of the following steps: 1. Reconcile the number of physical units worked on during the period. 2. Calculate the number of equivalent units. 3. Calculate the cost per equivalent unit rounded to five decimal places. 4. Reconcile the total cost of work in process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts