Question: uld be supported by schedules or general eu scF Indirect Method, and Net Cash Flow from Operating Activities, Direct Method) Comparative tion for bond interest.

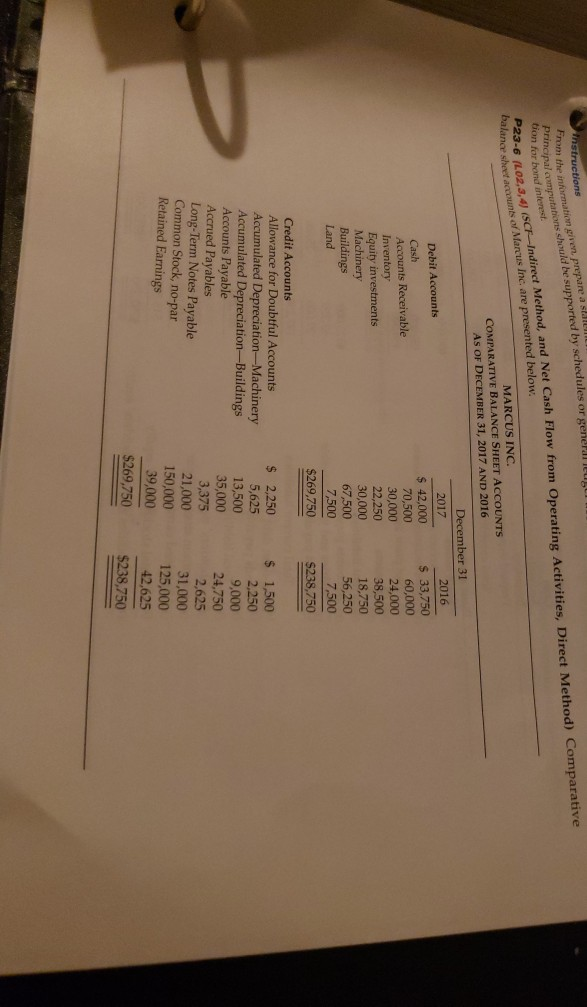

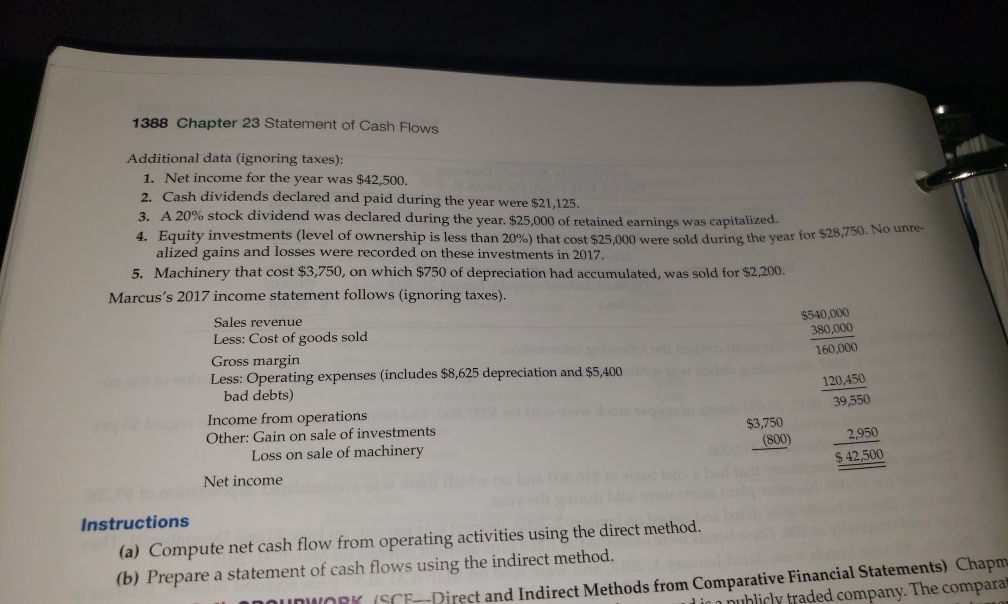

uld be supported by schedules or general eu scF Indirect Method, and Net Cash Flow from Operating Activities, Direct Method) Comparative tion for bond interest. of Marcus Inc. are presented below MARCUS INC. balance sheet accounts COMPARATIVE BALANCE SHEET ACCOUNTS As oF DECEMBER 31, 2017 AND 2016 December 31 2016 2017 Debit Accounts Cash Accounts Receivable 42,000 33,750 60,000 24,000 38,500 18,750 250 7.500 70,500 30,000 Inventory Equity investments Machinery 30,000 67,500 7,500 $269,750 Buildings Land $238,750 Credit Accounts Allowance for Doubtful Accounts Accumulated Depreciation-Machinery Accumulated Depreciation-Buildings Accounts Payable Accrued Payables s 2,250 5,625 13,500 35,000 3,375 21,000 1,500 9,000 24,750 2,625 31,000 125,000 42,625 Long-Term Notes Payable Common Stock, no-par Retained Earnings 39,000 $269,750 $238750 $238,750 1388 Chapter 23 Statement of Cash Flows Additional data (ignoring taxes): 1. Net income for the year was $42,500. 2. Cash dividends declared and paid during the year were $21,125. 3. A 20% stock dividend was declared during the year $25,000 of retained earnings was capitalized. 4 Equity investments level of ownership is less than 20%) that cost $25,000 were sold during the year for $2879. No unre- alized gains and losses were recorded on these investments in 2017. Machinery that cost $3,750, on which $750 of depreciation had accumulated, was sold for $2,200. 5. Marcus's 2017 income statement follows (ignoring taxes). Sales revenue Less: Cost of goods sold Gross margin Less: Operating expenses (includes $8,625 depreciation and $5,400 $540,000 380,000 160,000 bad debts) 120,450 39,550 Income from operations Other: Gain on sale of investments $3,750 (800)2,950 Loss on sale of machinery $ 42,500 Net income Instructions (a) Compute net cash flow from operating activities using the direct method. (b) Prepare a statement of cash flows using the indirect method O(SCF-Pirect and Indirect Methods from Comparative Financial Statements) Chapm i in a nuhlicly traded company. The compara

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts