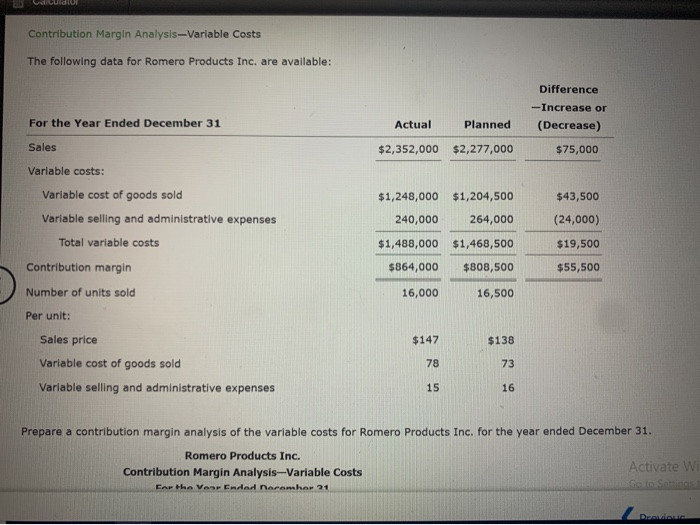

Question: ULUNUN Contribution Margin Analysis-Variable Costs The following data for Romero Products Inc. are available: For the Year Ended December 31 Actual Planned $2,277,000 Difference -

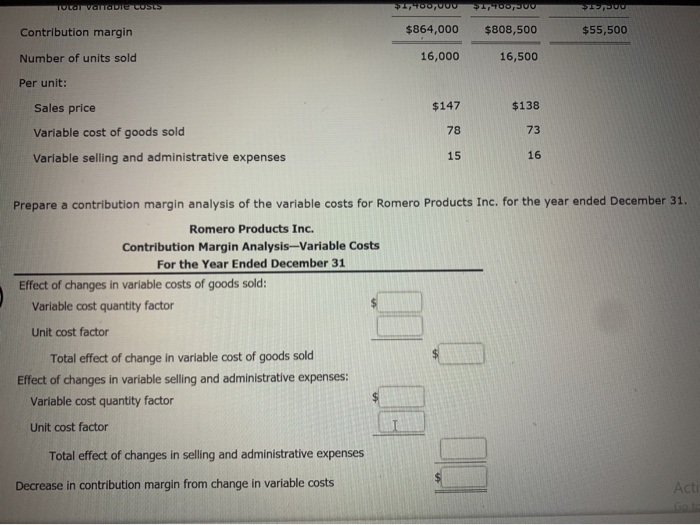

ULUNUN Contribution Margin Analysis-Variable Costs The following data for Romero Products Inc. are available: For the Year Ended December 31 Actual Planned $2,277,000 Difference - Increase or (Decrease) $75,000 Sales $2,352,000 Variable costs: Variable cost of goods sold $1,248,000 240,000 $1,204,500 264,000 $43,500 (24,000) Variable selling and administrative expenses Total variable costs $1,488,000 $1,468,500 $19,500 $55,500 Contribution margin $864,000 $808,500 Number of units sold 16,000 16,500 Per unit: Sales price $147 $138 Variable cost of goods sold Variable selling and administrative expenses Prepare a contribution margin analysis of the variable costs for Romero Products Inc. for the year ended December 31. Romero Products Inc. Contribution Margin Analysis-Variable Costs Cartha Van Endar Naranhar 21 Activate Wi Go to Settings Recu TULI VOITTAVIE CUSTS TOUUUUUUUUU $808,500 $55,500 Contribution margin Number of units sold Per unit: $864,000 16,000 16,500 $147 $138 Sales price Variable cost of goods sold Variable selling and administrative expenses 15 Prepare a contribution margin analysis of the variable costs for Romero Products Inc. for the year ended December 31. Romero Products Inc. Contribution Margin Analysis-Variable Costs For the Year Ended December 31 Effect of changes in variable costs of goods sold: Variable cost quantity factor Unit cost factor Total effect of change in variable cost of goods sold Effect of changes in variable selling and administrative expenses: Variable cost quantity factor Unit cost factor Total effect of changes in selling and administrative expenses Decrease in contribution margin from change in variable costs ACE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts