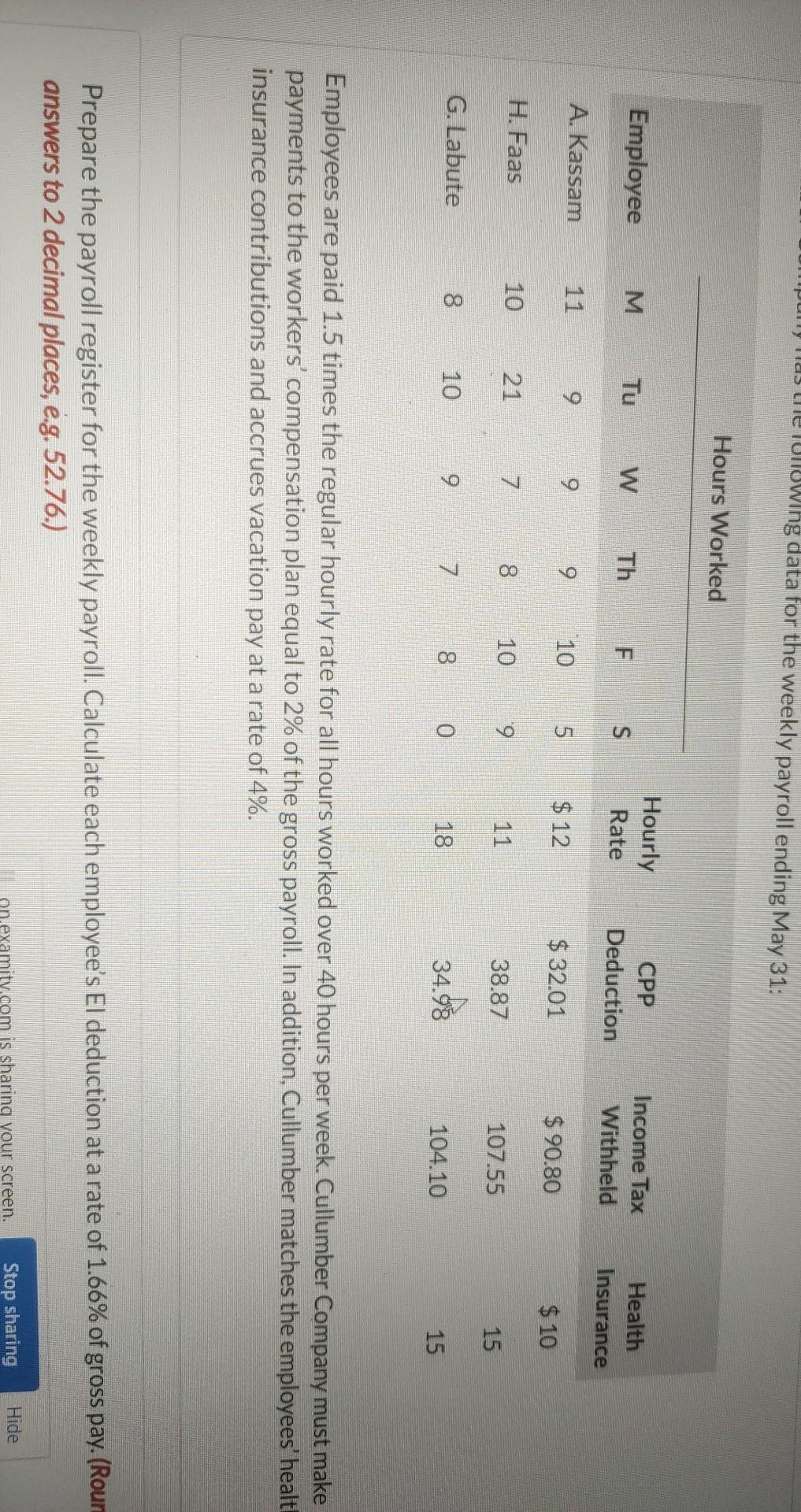

Question: Umpuny has menowing data for the weekly payroll ending May 31: Hours Worked Employee M Tu W Th Hourly Rate F un S CPP Deduction

Umpuny has menowing data for the weekly payroll ending May 31: Hours Worked Employee M Tu W Th Hourly Rate F un S CPP Deduction Income Tax Withheld Health Insurance A. Kassam 9 9 9 10 5 un $ 12 $ 32.01 $ 90.80 $ 10 H. Faas 10 21 7 8. 10 9 11 38.87 107.55 15 G. Labute 8. 10 9 7. 8 8. 0 18. 34.98 104.10 15 Employees are paid 1.5 times the regular hourly rate for all hours worked over 40 hours per week. Cullumber Company must make payments to the workers' compensation plan equal to 2% of the gross payroll. In addition, Cullumber matches the employees' healt insurance contributions and accrues vacation pay at a rate of 4%. Prepare the payroll register for the weekly payroll. Calculate each employee's El deduction at a rate of 1.66% of gross pay. (Rour answers to 2 decimal places, .g. 52.76.) examity.com is sharing your screen. Stop sharing Hide the payroll and Cullumber Company's employee benefits. (Credit account titles are automatically indented Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amoun Fmal places, e.g. 52.76.) Account Titles and Explanation Debit C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts