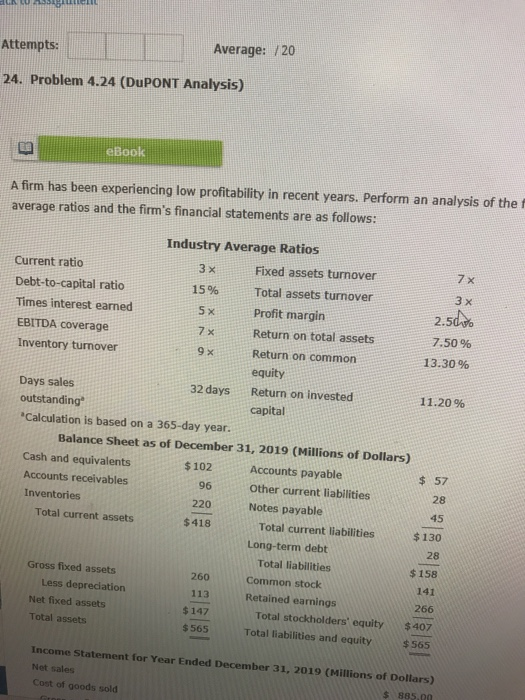

Question: UN LU S ell Attempts: Average: /20 24. Problem 4.24 (DUPONT Analysis) eBook A firm has been experiencing low profitability in recent years. Perform an

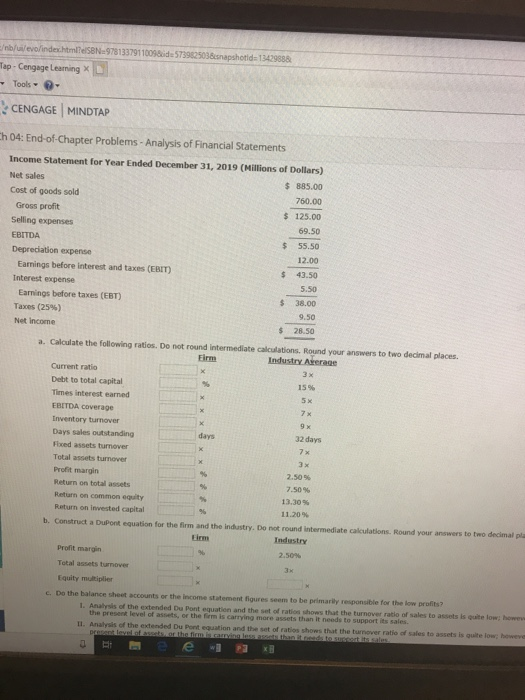

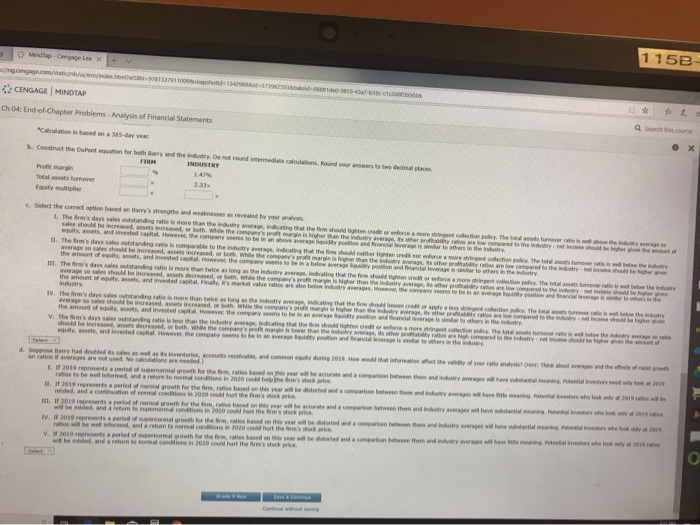

UN LU S ell Attempts: Average: /20 24. Problem 4.24 (DUPONT Analysis) eBook A firm has been experiencing low profitability in recent years. Perform an analysis of the average ratios and the firm's financial statements are as follows: x x x Industry Average Ratios Current ratio 3x Fixed assets turnover 7X Debt-to-capital ratio Total assets turnover 3 x Times interest earned Profit margin 2.5056 EBITDA coverage Return on total assets 7.50% Inventory turnover Return on common 13.30% equity Days sales 32 days Return on invested 11.20 % outstanding capital *Calculation is based on a 365-day year. Balance Sheet as of December 31, 2019 (Millions of Dollars) Cash and equivalents $ 102 Accounts payable $ 57 Accounts receivables Other current liabilities Inventories Notes payable Total current assets Total current liabilities $130 Long-term debt Total liabilities Gross fixed assets $ 158 260 Common stock Less depreciation 113 Retained earnings Net fixed assets 266 Total stockholders' equity Total assets $407 $565 Total liabilities and equity $ 565 96 28 $418 $147 Income Statement for Year Ended December 31, 2019 (Millions of Dollars) Net sales Cost of goods sold $ 885.00 shot 13429588 /b/u/evo/index.html?SBN 97813379110058573962503& Tap - Cengage Learning * Tools CENGAGE MINDTAP Ch 04: End-of-Chapter Problems - Analysis of Financial Statements Income Statement for Year Ended December 31, 2019 (Millions of Dollars) Net sales $ 885.00 Cost of goods sold 760.00 Gross profit $ 125.00 Selling expenses 69.50 EBITDA $ 55.50 Depreciation expense 12.00 Earnings before interest and taxes (FRIT) $ 43.50 Interest expense Earnings before taxes (EBT) Taxes (25%) Net Income $ 38.00 a. Calculate the following ratios. Do not round Intermediate calculations. Round your answers to two decimal places Firm Industry Average Current ratio Debt to total capital Times interest earned EBITDA coverage Inventory turnover Days sales outstanding 32 days Faxed assets turnover Total assets turnover Profit margin 2.50% Return on total assets 7.50% Return on common equity 13.30% Return on invested capital b. Construct a DuPont equation for the firm and the industry. Do not round Intermediate calculations. Round your answers to two decimal pla Industry Profit margin Total assets turnover Equity multiplier c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits? 1. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite lowhe the present level of assets, or them is carrying more assets than it needs to support is sales II. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover rate of sales teases is quite lowe 1 152 Mod.Cengage in x + CENGAGE MINDTAP ho End of Chapter Problems Analys of Financial Statement X INDUSTRY Total t urnover yu The n ding to their www that the horro w ho need w orthwhile the comment industry w the amount of guilt and red c o ver the consenso e in a blower III. The firm' s sales standing is more than twee song the w i th the c r on the here were then than the h e water the den TV. The firm's day average se anding rate more than w e ong the industry w i ng that the two the maha r wrote e ction . The werden other de decreased both the we them m o and r to b th p e a they wer rt is that the e e the industry the the n o 2018 modos de concedinstve is to be well informed and return to normal conditions in 2020 d h e firm's work If 2019 recents a period of growth for the front based on this year we did som e thin g 2009 december IV. If 2010 represented with for the firm, Fotos on this year will be c ome the y were darah UN LU S ell Attempts: Average: /20 24. Problem 4.24 (DUPONT Analysis) eBook A firm has been experiencing low profitability in recent years. Perform an analysis of the average ratios and the firm's financial statements are as follows: x x x Industry Average Ratios Current ratio 3x Fixed assets turnover 7X Debt-to-capital ratio Total assets turnover 3 x Times interest earned Profit margin 2.5056 EBITDA coverage Return on total assets 7.50% Inventory turnover Return on common 13.30% equity Days sales 32 days Return on invested 11.20 % outstanding capital *Calculation is based on a 365-day year. Balance Sheet as of December 31, 2019 (Millions of Dollars) Cash and equivalents $ 102 Accounts payable $ 57 Accounts receivables Other current liabilities Inventories Notes payable Total current assets Total current liabilities $130 Long-term debt Total liabilities Gross fixed assets $ 158 260 Common stock Less depreciation 113 Retained earnings Net fixed assets 266 Total stockholders' equity Total assets $407 $565 Total liabilities and equity $ 565 96 28 $418 $147 Income Statement for Year Ended December 31, 2019 (Millions of Dollars) Net sales Cost of goods sold $ 885.00 shot 13429588 /b/u/evo/index.html?SBN 97813379110058573962503& Tap - Cengage Learning * Tools CENGAGE MINDTAP Ch 04: End-of-Chapter Problems - Analysis of Financial Statements Income Statement for Year Ended December 31, 2019 (Millions of Dollars) Net sales $ 885.00 Cost of goods sold 760.00 Gross profit $ 125.00 Selling expenses 69.50 EBITDA $ 55.50 Depreciation expense 12.00 Earnings before interest and taxes (FRIT) $ 43.50 Interest expense Earnings before taxes (EBT) Taxes (25%) Net Income $ 38.00 a. Calculate the following ratios. Do not round Intermediate calculations. Round your answers to two decimal places Firm Industry Average Current ratio Debt to total capital Times interest earned EBITDA coverage Inventory turnover Days sales outstanding 32 days Faxed assets turnover Total assets turnover Profit margin 2.50% Return on total assets 7.50% Return on common equity 13.30% Return on invested capital b. Construct a DuPont equation for the firm and the industry. Do not round Intermediate calculations. Round your answers to two decimal pla Industry Profit margin Total assets turnover Equity multiplier c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits? 1. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite lowhe the present level of assets, or them is carrying more assets than it needs to support is sales II. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover rate of sales teases is quite lowe 1 152 Mod.Cengage in x + CENGAGE MINDTAP ho End of Chapter Problems Analys of Financial Statement X INDUSTRY Total t urnover yu The n ding to their www that the horro w ho need w orthwhile the comment industry w the amount of guilt and red c o ver the consenso e in a blower III. The firm' s sales standing is more than twee song the w i th the c r on the here were then than the h e water the den TV. The firm's day average se anding rate more than w e ong the industry w i ng that the two the maha r wrote e ction . The werden other de decreased both the we them m o and r to b th p e a they wer rt is that the e e the industry the the n o 2018 modos de concedinstve is to be well informed and return to normal conditions in 2020 d h e firm's work If 2019 recents a period of growth for the front based on this year we did som e thin g 2009 december IV. If 2010 represented with for the firm, Fotos on this year will be c ome the y were darah

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts