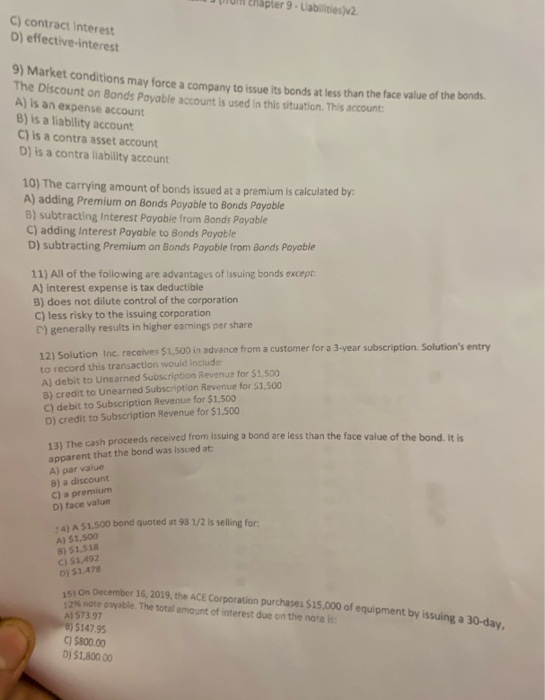

Question: un napter 9 - Liabilities)12. C) contract interest D) effective interest 9) Market conditions may force a company to issue its bonds at less than

un napter 9 - Liabilities)12. C) contract interest D) effective interest 9) Market conditions may force a company to issue its bonds at less than the face value of the The Discount on Bonds Payable account is used in this situation. This account: A) is an expense account B) is a liability account C) is a contra asset account D) is a contra liability account 10) The carrying amount of bonds issued at a premium is calculated by: A) adding Premium on Bonds Payable to Bonds Payable B) subtracting Interest Payable from Bonds Payable C) adding Interest Payable to Bonds Payable D) subtracting Premium on Bonds Payable from Bonds Payable 11) All of the following are advantages of issuing bonds except: A) Interest expense is tax deductible B) does not dilute control of the corporation C) less risky to the issuing corporation C) generally results in higher earnings per share 12 Solution Inc. receives $1.500 in advance from a customer for a 3-vear subscription Solution's entry to record this transaction would include: A) debit to Unearned Subscription Revenue for $1,500 B) credit to Unearned Subscription Revenue for $1,500 C) debit to Subscription Revenue for $1,500 D) credit to Subscription Revenue for $1.500 reeds received from issuing a bond are less than the face value of the band, it is 13) The cash proceeds received from issuing a bon apparent that the bond was issued at: A) par value B) a discount C) premium D) face value A $1.500 bond quoted at 98 1/2 is selling for: A) $1,500 3) 51,518 C) $1.492 D $1478 December 16, 2019, the ACE Corporation purchases $15,000 of equipment by cine 12 note payable. The total amount of interest due on the notes: A) 573.97 87 $147.95 $800.00 DJ $1,800 00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts