Question: Unal Altun ( Unal ) wanted to borrow $ 3 5 0 , 0 0 0 from Royal Bank of Canada ( RBC

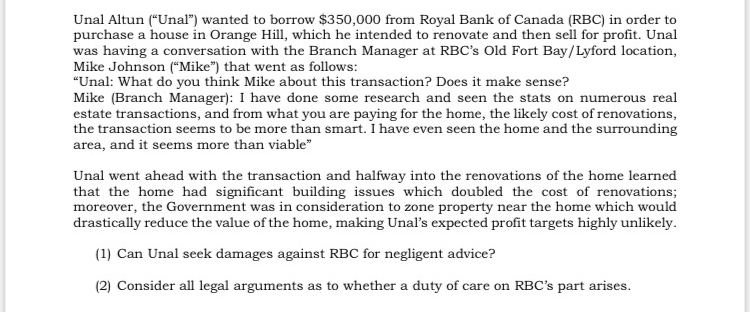

Unal Altun Unal wanted to borrow $ from Royal Bank of Canada RBC in order to purchase a house in Orange Hill, which he intended to renovate and then sell for profit. Unal was having a conversation with the Branch Manager at RBCs Old Fort BayLyford location, Mike Johnson Mike that went as follows:

"Unal: What do you think Mike about this transaction? Does it make sense?

Mike Branch Manager: I have done some research and seen the stats on numerous real estate transactions, and from what you are paying for the home, the likely cost of renovations, the transaction seems to be more than smart. I have even seen the home and the surrounding area, and it seems more than viable"

Unal went ahead with the transaction and halfway into the renovations of the home learned that the home had significant building issues which doubled the cost of renovations; moreover, the Government was in consideration to zone property near the home which would drastically reduce the value of the home, making Unal's expected profit targets highly unlikely.

Can Unal seek damages against RBC for negligent advice?

Consider all legal arguments as to whether a duty of care on RBCs part arises.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock