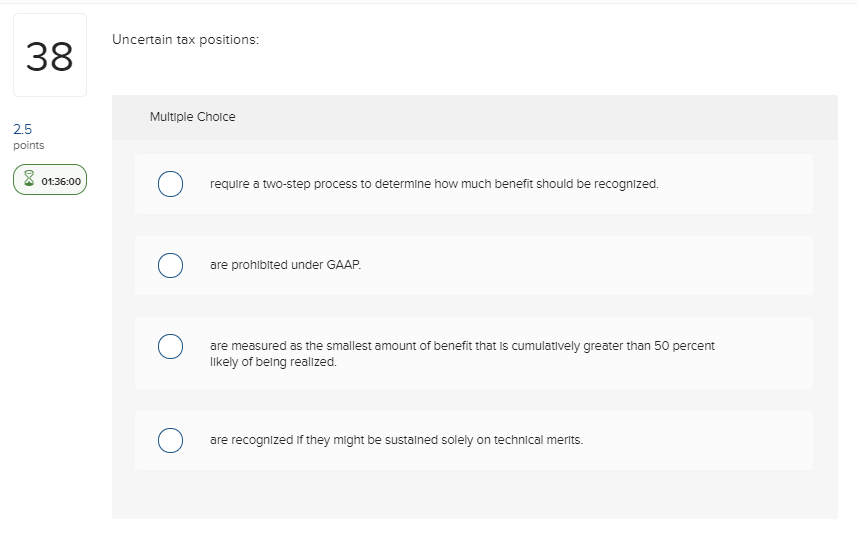

Question: Uncertain tax positions: 38 Multiple Cholce 2.5 points 01:36:00 require a two-step process to determine how much benefit should be recognized are prohiblted under GAAP

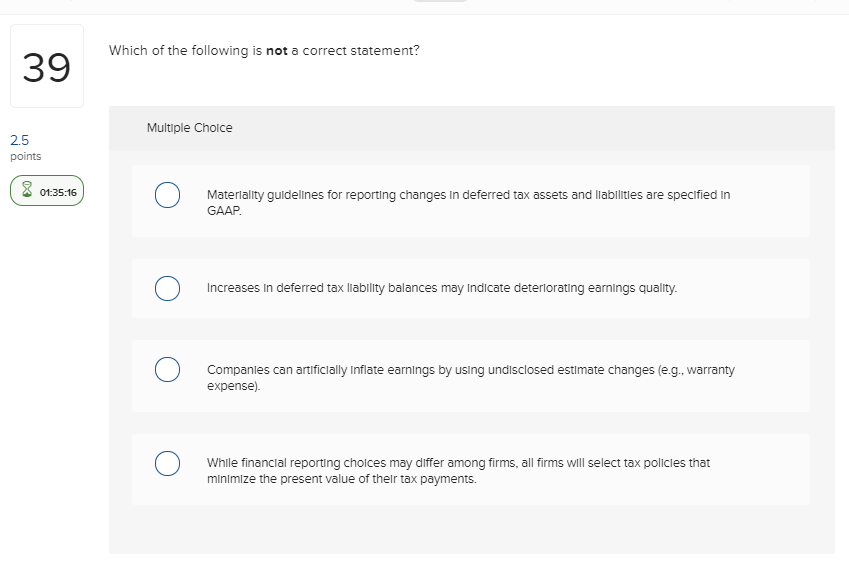

Uncertain tax positions: 38 Multiple Cholce 2.5 points 01:36:00 require a two-step process to determine how much benefit should be recognized are prohiblted under GAAP are measured as the smallest amount of benefit that IS Cumulatively greater than 50 percent likely of being realized. are recognized If they mlght be sustalned solely on technical merits. Which of the following is not a correct statement? 39 Multiple Cholce 2.5 points 01:35:16 Materlality guldelines for reporting changes in deferred tax assets and llabilities are specified in GAAP Increases In deferred tax liability balances may Indicate deterlorating earnings quality. Companles can artificlally Inflate earnings by using undlsclosed estimate changes (e.g, warranty expense) Whille financlal reporting cholces may differ among firms, all firms will select tax policles that minimize the present value of their tax payments Uncertain tax positions: 38 Multiple Cholce 2.5 points 01:36:00 require a two-step process to determine how much benefit should be recognized are prohiblted under GAAP are measured as the smallest amount of benefit that IS Cumulatively greater than 50 percent likely of being realized. are recognized If they mlght be sustalned solely on technical merits. Which of the following is not a correct statement? 39 Multiple Cholce 2.5 points 01:35:16 Materlality guldelines for reporting changes in deferred tax assets and llabilities are specified in GAAP Increases In deferred tax liability balances may Indicate deterlorating earnings quality. Companles can artificlally Inflate earnings by using undlsclosed estimate changes (e.g, warranty expense) Whille financlal reporting cholces may differ among firms, all firms will select tax policles that minimize the present value of their tax payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts