Question: undefined 3. Comprehensive exercise for Chapter 4 The Big Ship Manufacturing Company manufactures custom made ships. The company utilizes a job order cost system based

undefined

undefined

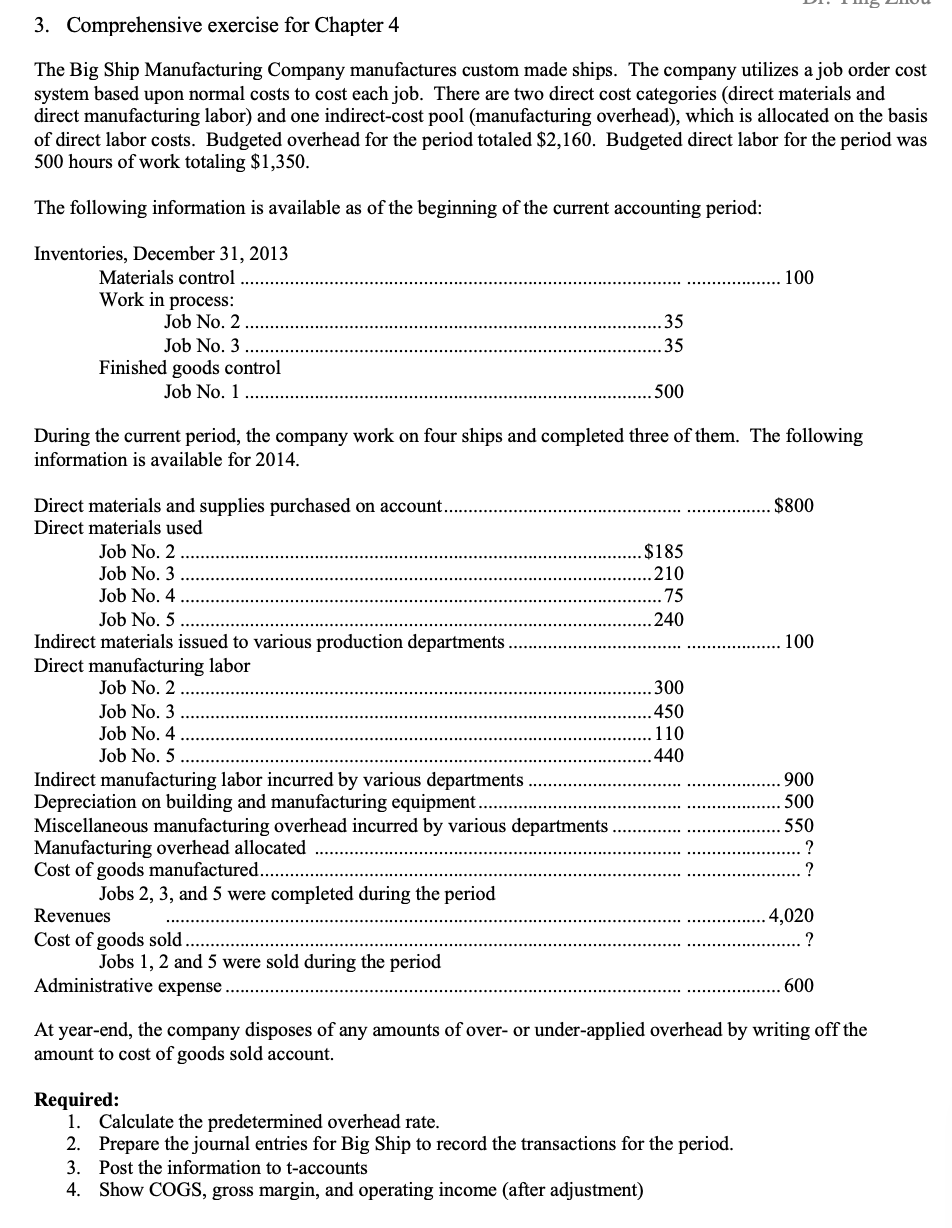

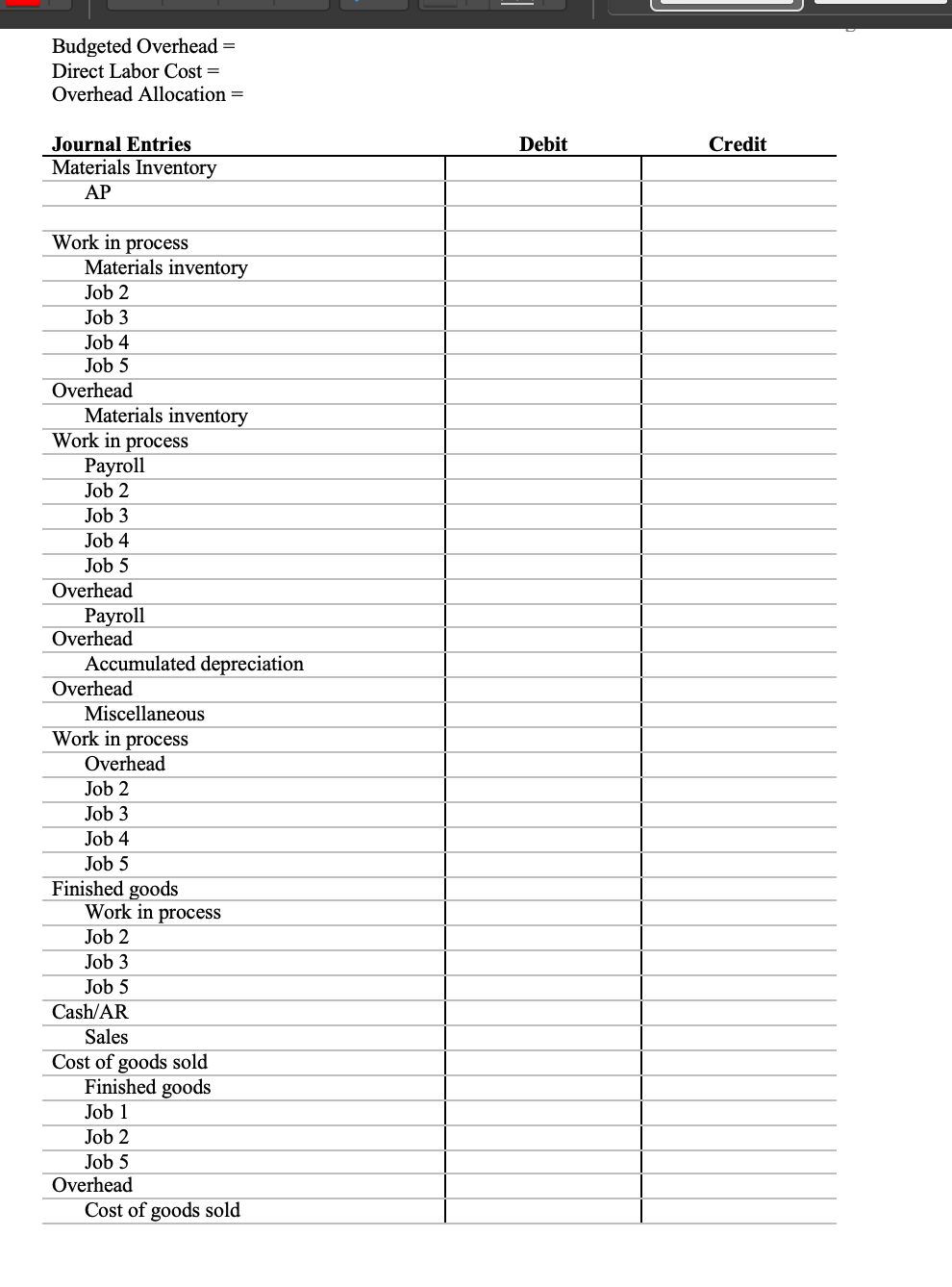

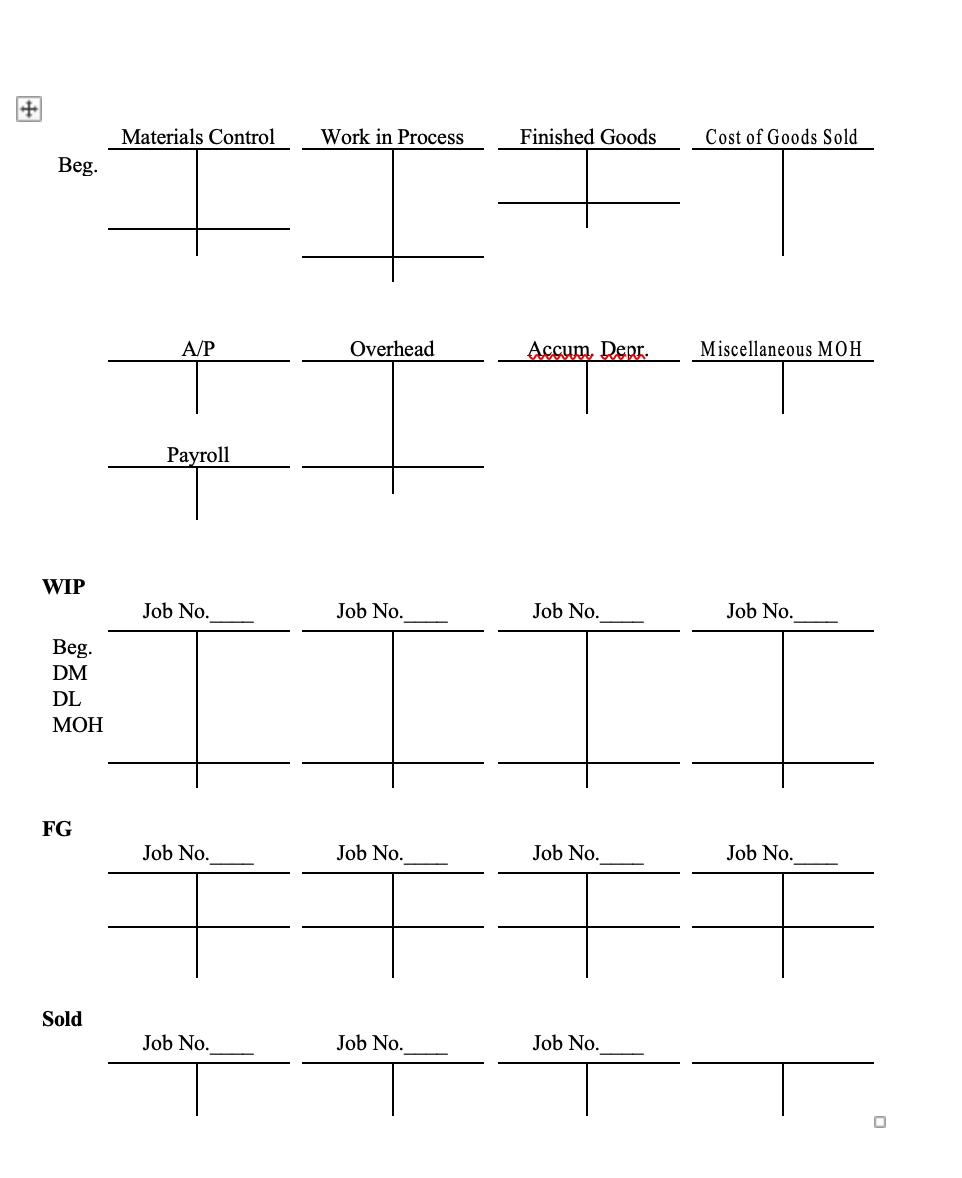

3. Comprehensive exercise for Chapter 4 The Big Ship Manufacturing Company manufactures custom made ships. The company utilizes a job order cost system based upon normal costs to cost each job. There are two direct cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead), which is allocated on the basis of direct labor costs. Budgeted overhead for the period totaled $2,160. Budgeted direct labor for the period was 500 hours of work totaling $1,350. The following information is available as of the beginning of the current accounting period: 100 Inventories, December 31, 2013 Materials control Work in process: Job No. 2 Job No. 3 Finished goods control Job No. 1 35 .35 500 During the current period, the company work on four ships and completed three of them. The following information is available for 2014. $800 $185 .210 75 .240 100 Direct materials and supplies purchased on account. Direct materials used Job No. 2 Job No. 3 Job No. 4 Job No. 5 Indirect materials issued to various production departments Direct manufacturing labor Job No. 2 Job No. 3 Job No. 4 Job No. 5 Indirect manufacturing labor incurred by various departments Depreciation on building and manufacturing equipment.. Miscellaneous manufacturing overhead incurred by various departments Manufacturing overhead allocated Cost of goods manufactured. Jobs 2, 3, and 5 were completed during the period Revenues Cost of goods sold Jobs 1, 2 and 5 were sold during the period Administrative expense 300 450 110 .440 900 500 550 ? ? 4,020 ? 600 At year-end, the company disposes of any amounts of over- or under-applied overhead by writing off the amount to cost of goods sold account. Required: 1. Calculate the predetermined overhead rate. 2. Prepare the journal entries for Big Ship to record the transactions for the period. 3. Post the information to t-accounts 4. Show COGS, gross margin, and operating income (after adjustment) Budgeted Overhead = Direct Labor Cost = Overhead Allocation = Debit Credit Journal Entries Materials Inventory AP Work in process Materials inventory Job 2 Job 3 Job 4 Job 5 Overhead Materials inventory Work in process Payroll Job 2 Job 3 Job 4 Job 5 Overhead Payroll Overhead Accumulated depreciation Overhead Miscellaneous Work in process Overhead Job 2 Job 3 Job 4 Job 5 Finished goods Work in process Job 2 Job 3 Job 5 Cash/AR Sales Cost of goods sold Finished goods Job 1 Job 2 Job 5 Overhead Cost of goods sold Materials Control Work in Process Finished Goods Cost of Goods Sold Beg. A/P Overhead Accum Depr. Miscellaneous MOH Payroll WIP Job No. Job No. Job No. Job No. Beg. DM DL MOH FG Job No. Job No. Job No. Job No. Sold Job No. Job No. Job No. 3. Comprehensive exercise for Chapter 4 The Big Ship Manufacturing Company manufactures custom made ships. The company utilizes a job order cost system based upon normal costs to cost each job. There are two direct cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead), which is allocated on the basis of direct labor costs. Budgeted overhead for the period totaled $2,160. Budgeted direct labor for the period was 500 hours of work totaling $1,350. The following information is available as of the beginning of the current accounting period: 100 Inventories, December 31, 2013 Materials control Work in process: Job No. 2 Job No. 3 Finished goods control Job No. 1 35 .35 500 During the current period, the company work on four ships and completed three of them. The following information is available for 2014. $800 $185 .210 75 .240 100 Direct materials and supplies purchased on account. Direct materials used Job No. 2 Job No. 3 Job No. 4 Job No. 5 Indirect materials issued to various production departments Direct manufacturing labor Job No. 2 Job No. 3 Job No. 4 Job No. 5 Indirect manufacturing labor incurred by various departments Depreciation on building and manufacturing equipment.. Miscellaneous manufacturing overhead incurred by various departments Manufacturing overhead allocated Cost of goods manufactured. Jobs 2, 3, and 5 were completed during the period Revenues Cost of goods sold Jobs 1, 2 and 5 were sold during the period Administrative expense 300 450 110 .440 900 500 550 ? ? 4,020 ? 600 At year-end, the company disposes of any amounts of over- or under-applied overhead by writing off the amount to cost of goods sold account. Required: 1. Calculate the predetermined overhead rate. 2. Prepare the journal entries for Big Ship to record the transactions for the period. 3. Post the information to t-accounts 4. Show COGS, gross margin, and operating income (after adjustment) Budgeted Overhead = Direct Labor Cost = Overhead Allocation = Debit Credit Journal Entries Materials Inventory AP Work in process Materials inventory Job 2 Job 3 Job 4 Job 5 Overhead Materials inventory Work in process Payroll Job 2 Job 3 Job 4 Job 5 Overhead Payroll Overhead Accumulated depreciation Overhead Miscellaneous Work in process Overhead Job 2 Job 3 Job 4 Job 5 Finished goods Work in process Job 2 Job 3 Job 5 Cash/AR Sales Cost of goods sold Finished goods Job 1 Job 2 Job 5 Overhead Cost of goods sold Materials Control Work in Process Finished Goods Cost of Goods Sold Beg. A/P Overhead Accum Depr. Miscellaneous MOH Payroll WIP Job No. Job No. Job No. Job No. Beg. DM DL MOH FG Job No. Job No. Job No. Job No. Sold Job No. Job No. Job No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts