Question: undefined answer, not the working. Question 1 (Total 20 marks) 1. Assume you are a trader with Citi Bank. The Singapore dollar-U.S. dollar (SGD/$) spot

undefined

undefined

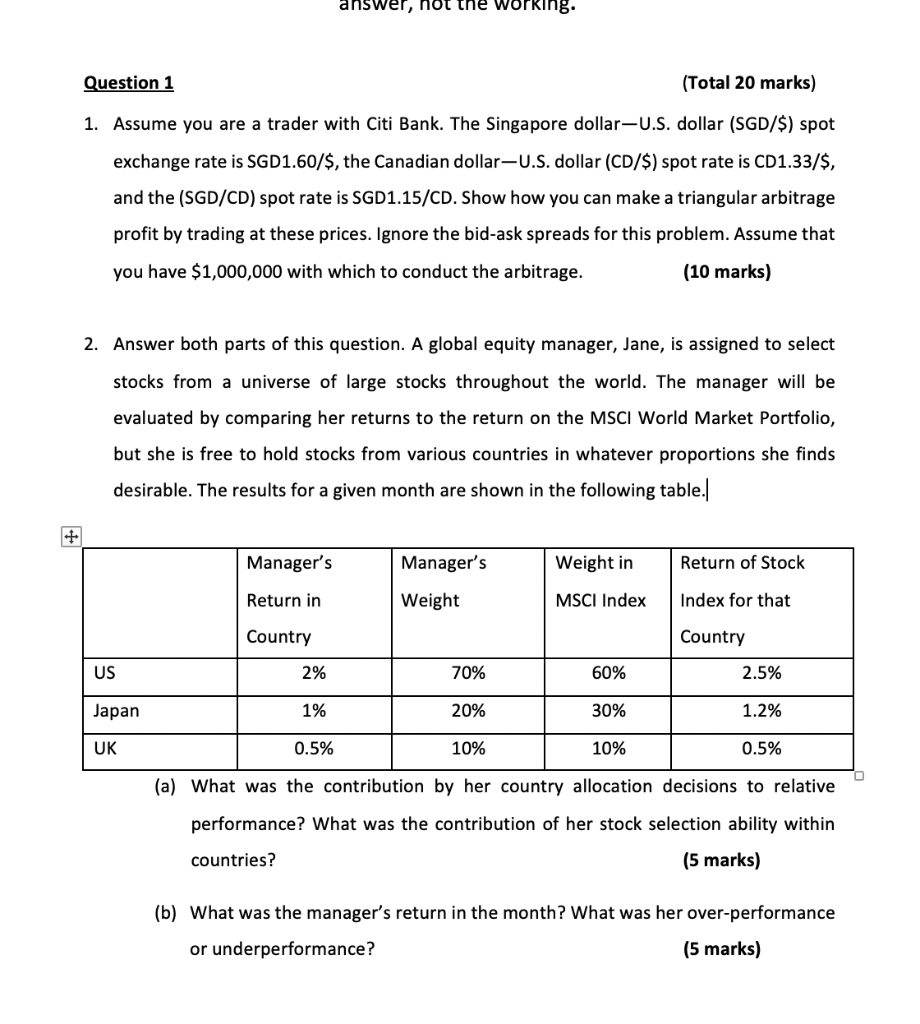

answer, not the working. Question 1 (Total 20 marks) 1. Assume you are a trader with Citi Bank. The Singapore dollar-U.S. dollar (SGD/$) spot exchange rate is SGD1.60/$, the Canadian dollar-U.S. dollar (CD/$) spot rate is CD1.33/$, and the (SGD/CD) spot rate is SGD1.15/CD. Show how you can make a triangular arbitrage profit by trading at these prices. Ignore the bid-ask spreads for this problem. Assume that you have $1,000,000 with which to conduct the arbitrage. (10 marks) 2. Answer both parts of this question. A global equity manager, Jane, is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. The results for a given month are shown in the following table. Manager's Manager's Weight in Return of Stock Return in Weight MSCI Index Index for that Country Country US 2% 70% 60% 2.5% Japan 1% 20% 30% 1.2% UK 0.5% 10% 10% 0.5% (a) What was the contribution by her country allocation decisions to relative performance? What was the contribution of her stock selection ability within countries? (5 marks) (b) What was the manager's return in the month? What was her over-performance or underperformance? (5 marks) answer, not the working. Question 1 (Total 20 marks) 1. Assume you are a trader with Citi Bank. The Singapore dollar-U.S. dollar (SGD/$) spot exchange rate is SGD1.60/$, the Canadian dollar-U.S. dollar (CD/$) spot rate is CD1.33/$, and the (SGD/CD) spot rate is SGD1.15/CD. Show how you can make a triangular arbitrage profit by trading at these prices. Ignore the bid-ask spreads for this problem. Assume that you have $1,000,000 with which to conduct the arbitrage. (10 marks) 2. Answer both parts of this question. A global equity manager, Jane, is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. The results for a given month are shown in the following table. Manager's Manager's Weight in Return of Stock Return in Weight MSCI Index Index for that Country Country US 2% 70% 60% 2.5% Japan 1% 20% 30% 1.2% UK 0.5% 10% 10% 0.5% (a) What was the contribution by her country allocation decisions to relative performance? What was the contribution of her stock selection ability within countries? (5 marks) (b) What was the manager's return in the month? What was her over-performance or underperformance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts