Question: undefined As we know, dollar-weighted average return is a more accurate way to measure security return performance if we buy or sell securities from time

undefined

undefined

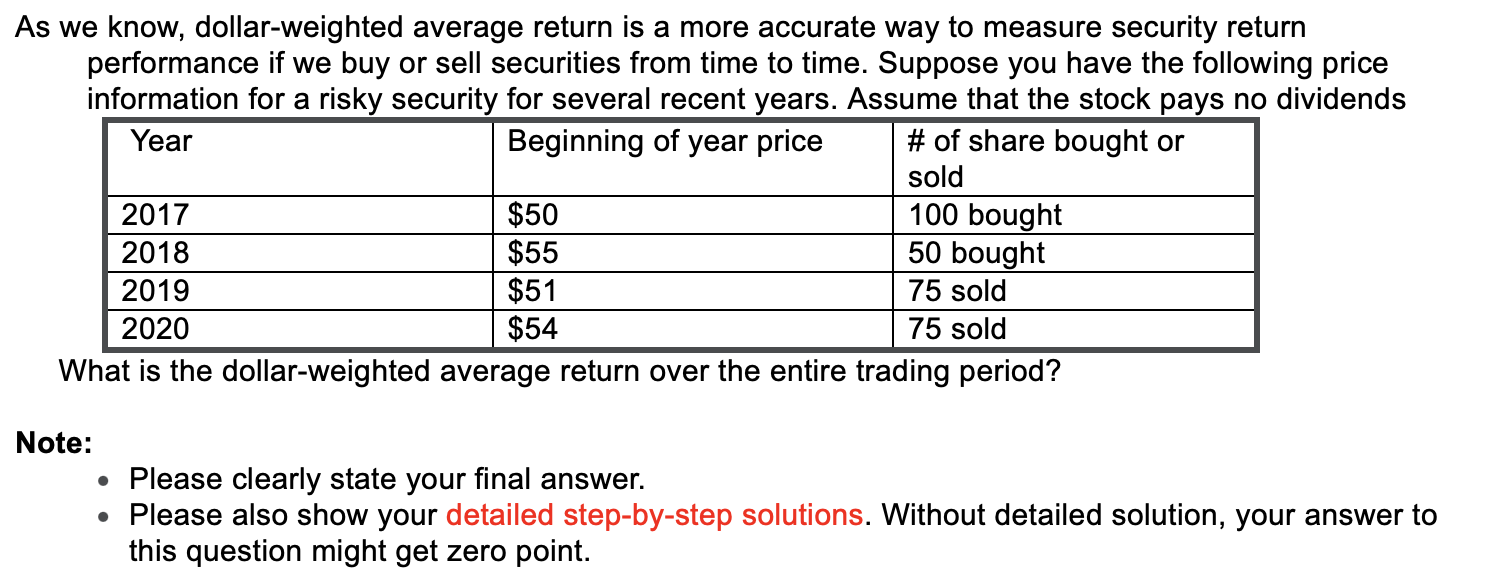

As we know, dollar-weighted average return is a more accurate way to measure security return performance if we buy or sell securities from time to time. Suppose you have the following price information for a risky security for several recent years. Assume that the stock pays no dividends Year Beginning of year price # of share bought or sold 2017 $50 100 bought 2018 $55 50 bought 2019 $51 75 sold 2020 $54 75 sold What is the dollar-weighted average return over the entire trading period? Note: Please clearly state your final answer. Please also show your detailed step-by-step solutions. Without detailed solution, your answer to this question might get zero point. As we know, dollar-weighted average return is a more accurate way to measure security return performance if we buy or sell securities from time to time. Suppose you have the following price information for a risky security for several recent years. Assume that the stock pays no dividends Year Beginning of year price # of share bought or sold 2017 $50 100 bought 2018 $55 50 bought 2019 $51 75 sold 2020 $54 75 sold What is the dollar-weighted average return over the entire trading period? Note: Please clearly state your final answer. Please also show your detailed step-by-step solutions. Without detailed solution, your answer to this question might get zero point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts