Question: undefined AutoSave OFF A 2 C .. Q e CHO9_SM_5e_Student.xls - Compatibility Mode Review View Tell me Home Insert Draw Page Layout Formulas Data Share

undefined

undefined

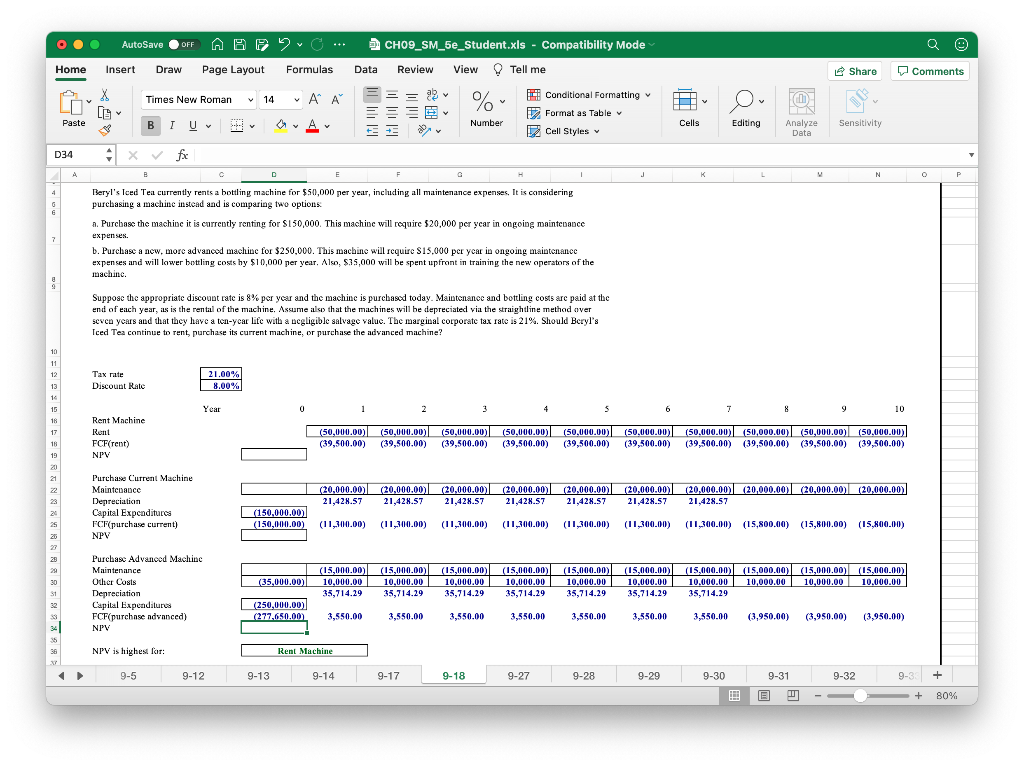

AutoSave OFF A 2 C .. Q e CHO9_SM_5e_Student.xls - Compatibility Mode Review View Tell me Home Insert Draw Page Layout Formulas Data Share Comments Times New Roman 14 v P A II 121 III 11 y % Conditional Formatting 17 Format as Table v Cell Styles Paste B IU . Number OA Cells Editing y Sensitivity Analyze Data D34 4 x fx A e F J K N P Beryl's Iced Tea currently rents a bottling machine for $50,000 per year, including all maintenance expenses. It is considering purchasing a machine instead and is comparing two options a. P Purchase the machine it is currcotly renting for $150,000. This machine will require 520,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $250,000. This machine will require S15.000 per year in ongoing maintenance expenses and will lower bottling costs hy $10,000 per year. Also, $35,000 will be spent upfront in training the new operators of the machine, Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, is is the rental of the machine. Assume also that the machines will be depreciated via the straightline method over seven years and that they have a ten-year life with a scgligible salvage value. The marginal corporate tax rate is 21%. Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine? Tax rate Discount Rate 21.00% 8.00% % 10 11 12 13 14 15 16 17 18 19 Year 0 1 2 4 S 6 7 9 10 Rent Machine Rent FCF(rent) NPV (50,000.00) (50,000.00) (50,000.00) (50,000.00) (50,000.00)| (50,000.00)| (50,000.00 (50,000.00) (50,000.00) (50,000.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) Purchase Current Machine Maintenance Depreciation Capital Expenditures FCF(purchase current) NPV (20,000.00 21,428.57 (20,000.00 (20,000.00) (20,000.00) (20,000.00 (20,000.00) (20,000.00 (20,000.00) (20,000.00) (20,000.00) (20,000.00) (20,000.00) 21,428.57 21,428.57 21,428.57 21,428.57 21,428.57 21.428.57 20 25 20 (150,000.00) (150,000.00) (11,300.00) (11,300.00) ) (11,300.00) (11,300.00) (11,300.00) (11,300.00) (11,300.00) (15,800.00) (15,800.00) (15,800.00) (15,800.00) 27 292 (35,000.00 30 S1 Purchase Advanced Machine Maintenance Other Costs Depreciation Capital Expenditures FCF(purchnsendvanced) NPV (15,000.00) 10,000.00 35,714.29 (15,000.00) 10.000.00 35,714.29 (15,000.00) (15,000.00) 10.000.00 10.000.00 35,714.29 35,714.29 (15,000.00) 10.000.00 35,714.29 (15,000.00) 10.000.00 35,714.29 (15,000.00) (15,000.00) (15,000.00) (15,000.00) 10.000.00 10,000.00 10,000.00 10.000.00 35,714.29 (250,000.00) (277.650.00 3,550,00 3,550.00 3,550.00 3,550.00 3,550.00 3,350.00 3,550.00 (3,950.00) (3,950.00) (3,950.00) 34 36 NPV is highest for: Rent Machine 9-5 9-12 9-13 9-14 9-17 9-18 9-27 9-28 9-29 9-30 9-31 9-32 9-3 + + 80% AutoSave OFF A 2 C .. Q e CHO9_SM_5e_Student.xls - Compatibility Mode Review View Tell me Home Insert Draw Page Layout Formulas Data Share Comments Times New Roman 14 v P A II 121 III 11 y % Conditional Formatting 17 Format as Table v Cell Styles Paste B IU . Number OA Cells Editing y Sensitivity Analyze Data D34 4 x fx A e F J K N P Beryl's Iced Tea currently rents a bottling machine for $50,000 per year, including all maintenance expenses. It is considering purchasing a machine instead and is comparing two options a. P Purchase the machine it is currcotly renting for $150,000. This machine will require 520,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $250,000. This machine will require S15.000 per year in ongoing maintenance expenses and will lower bottling costs hy $10,000 per year. Also, $35,000 will be spent upfront in training the new operators of the machine, Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, is is the rental of the machine. Assume also that the machines will be depreciated via the straightline method over seven years and that they have a ten-year life with a scgligible salvage value. The marginal corporate tax rate is 21%. Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine? Tax rate Discount Rate 21.00% 8.00% % 10 11 12 13 14 15 16 17 18 19 Year 0 1 2 4 S 6 7 9 10 Rent Machine Rent FCF(rent) NPV (50,000.00) (50,000.00) (50,000.00) (50,000.00) (50,000.00)| (50,000.00)| (50,000.00 (50,000.00) (50,000.00) (50,000.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) (39,500.00) Purchase Current Machine Maintenance Depreciation Capital Expenditures FCF(purchase current) NPV (20,000.00 21,428.57 (20,000.00 (20,000.00) (20,000.00) (20,000.00 (20,000.00) (20,000.00 (20,000.00) (20,000.00) (20,000.00) (20,000.00) (20,000.00) 21,428.57 21,428.57 21,428.57 21,428.57 21,428.57 21.428.57 20 25 20 (150,000.00) (150,000.00) (11,300.00) (11,300.00) ) (11,300.00) (11,300.00) (11,300.00) (11,300.00) (11,300.00) (15,800.00) (15,800.00) (15,800.00) (15,800.00) 27 292 (35,000.00 30 S1 Purchase Advanced Machine Maintenance Other Costs Depreciation Capital Expenditures FCF(purchnsendvanced) NPV (15,000.00) 10,000.00 35,714.29 (15,000.00) 10.000.00 35,714.29 (15,000.00) (15,000.00) 10.000.00 10.000.00 35,714.29 35,714.29 (15,000.00) 10.000.00 35,714.29 (15,000.00) 10.000.00 35,714.29 (15,000.00) (15,000.00) (15,000.00) (15,000.00) 10.000.00 10,000.00 10,000.00 10.000.00 35,714.29 (250,000.00) (277.650.00 3,550,00 3,550.00 3,550.00 3,550.00 3,550.00 3,350.00 3,550.00 (3,950.00) (3,950.00) (3,950.00) 34 36 NPV is highest for: Rent Machine 9-5 9-12 9-13 9-14 9-17 9-18 9-27 9-28 9-29 9-30 9-31 9-32 9-3 + + 80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts