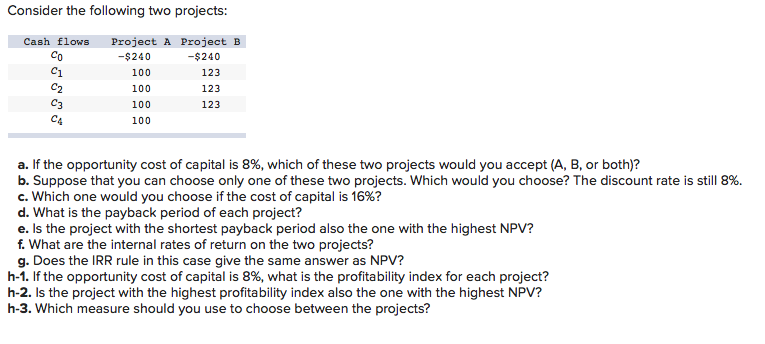

Question: undefined Consider the following two projects: Cash flows C1 Project A Project B -$240 -$240 100 123 100 123 100 123 100 C2 C3 C4

undefined

undefined

Consider the following two projects: Cash flows C1 Project A Project B -$240 -$240 100 123 100 123 100 123 100 C2 C3 C4 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h-1. If the opportunity cost of capital is 8%, what is the profitability index for each project? h-2. Is the project with the highest profitability index also the one with the highest NPV? h-3. Which measure should you use to choose between the projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts