Question: undefined E) Listen Reggie is married and files a joint return. He reports the following items of income and loss for the year: Salary $

undefined

undefined

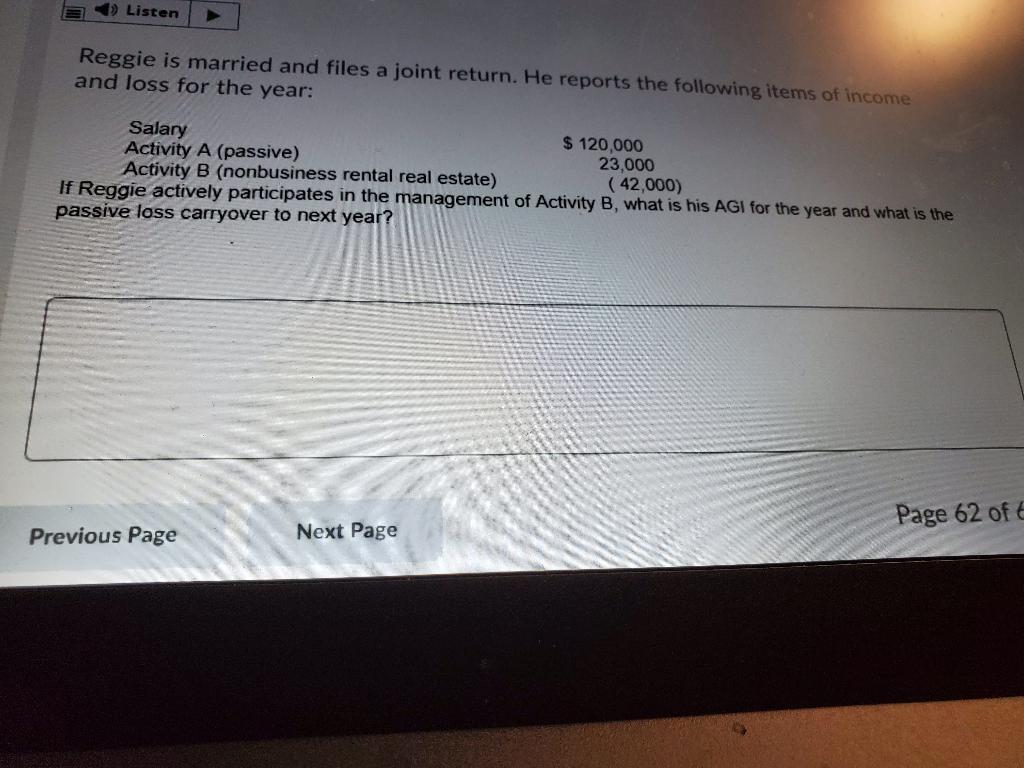

E) Listen Reggie is married and files a joint return. He reports the following items of income and loss for the year: Salary $ 120,000 Activity A (passive) 23,000 Activity B (nonbusiness rental real estate) (42,000) If Reggie actively participates in the management of Activity B, what is his AGI for the year and what is the passive loss carryover to next year? Page 62 oft Previous Page Next Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts