Question: undefined E9-39. Constructing the Consolidated Balance Sheet at Acquisition Winston Company purchased all of Marcus Company's common stock for $600,000 cash on January 1, at

undefined

undefined

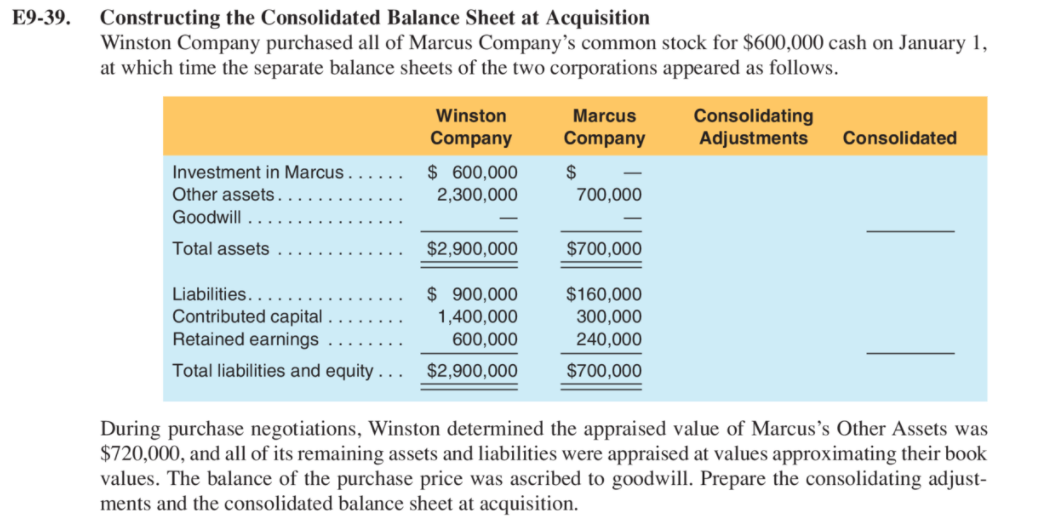

E9-39. Constructing the Consolidated Balance Sheet at Acquisition Winston Company purchased all of Marcus Company's common stock for $600,000 cash on January 1, at which time the separate balance sheets of the two corporations appeared as follows. Marcus Company Consolidating Adjustments Consolidated Winston Company $ 600,000 2,300,000 Investment in Marcus... Other assets Goodwill.. $ 700,000 Total assets $2,900,000 $700,000 Liabilities. Contributed capital Retained earnings Total liabilities and equity ... $ 900,000 1,400,000 600,000 $2,900,000 $160,000 300,000 240,000 $700,000 During purchase negotiations, Winston determined the appraised value of Marcus's Other Assets was $720,000, and all of its remaining assets and liabilities were appraised at values approximating their book values. The balance of the purchase price was ascribed to goodwill. Prepare the consolidating adjust- ments and the consolidated balance sheet at acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts