Question: undefined Find the data presented in Group Exercise 5 sheet in the Excel file. There are 4 LIBOR (London Inter- Bank Offer Rate) rates for

undefined

undefined

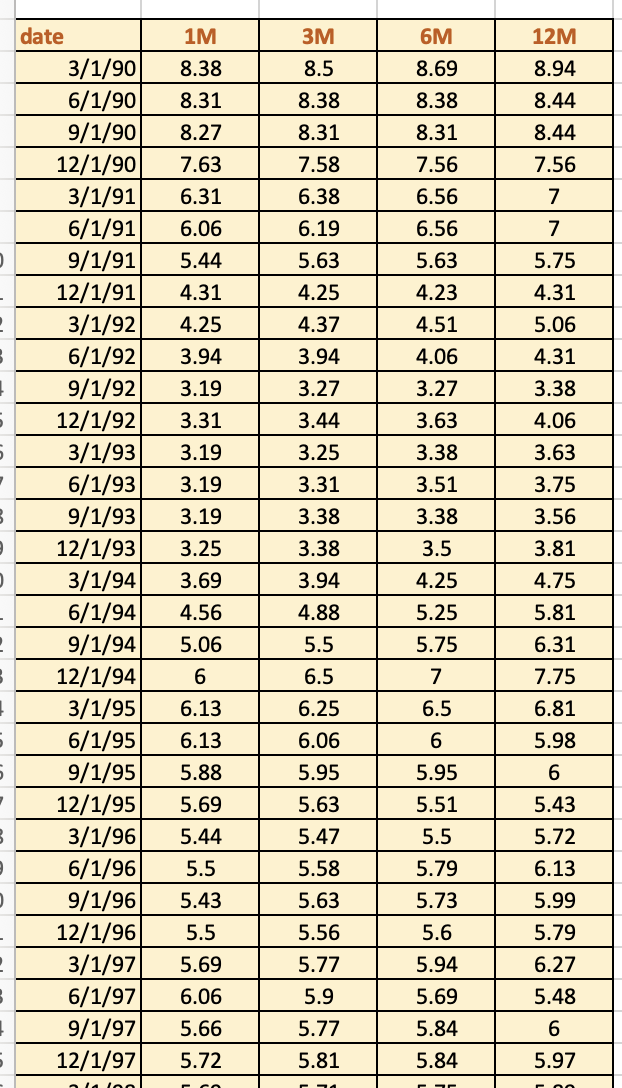

Find the data presented in Group Exercise 5 sheet in the Excel file. There are 4 LIBOR (London Inter- Bank Offer Rate) rates for different maturities (1-month, 3-month, 6-month and 12-month). On 1/1/1990, there was a plain interest rate Swap whose floating leg payments are to be 3-month Libor rate at the beginning of each period. Both fixed and floating leg payments are to be made in March, June, September and December and thus the first floating leg interest rate was set to be 8.38% when the Swap was initiated on 1/1/1990. The nominal (notional) principal of this swap is $10,000,000. 5-1. If there were no premiums set for this Swap (Swap spread = 0. This means each fixed and floating leg party will pay the coupons from each side). When the yield on 1/1/1990 was 8%, calculate the fixed interest rate of this Swap and the market value of the long position of the Swap on 1/1/1990. 5-2. Using the historical LIBOR, calculate the profit (or loss) of the fixed leg on each coupon payment date. Draw the graph. 1M 6M 8.5 12M 8.94 8.69 8.38 8.38 8.44 8.31 8.44 8.38 8.31 8.27 7.63 6.31 6.06 5.44 7.58 7.56 6.38 7 6.19 7 5.75 5.63 4.25 8.31 7.56 6.56 6.56 5.63 4.23 4.51 4.06 3.27 3.63 4.31 4.31 4.25 4.37 5.06 4.31 3.94 3.27 3.38 3.44 7 3 date 3/1/90 6/1/90 9/1/90 12/1/90 3/1/91 6/1/91 9/1/91 12/1/91 3/1/92 6/1/92 9/1/92 12/1/92 3/1/93 6/1/93 9/1/93 12/1/93 3/1/94 6/1/94 9/1/94 12/1/94 3/1/95 6/1/95 9/1/95 12/1/95 3/1/96 6/1/96 9/1/96 12/1/96 3/1/97 6/1/97 9/1/97 12/1/97 . 3.94 3.19 3.31 3.19 3.19 3.19 3.25 3.69 4.56 5.06 6 6.13 6.13 5.88 5.69 5.44 5.5 5.43 5.5 5.69 6.06 5.66 5.72 3.25 3.31 3.38 3.38 3.94 4.88 5.5 6.5 6.25 6.06 5.95 5.63 5.47 5.58 5.63 5.56 5.77 5.9 5.77 5.81 3.38 3.51 3.38 3.5 4.25 5.25 5.75 7 6.5 6 5.95 5.51 5.5 5.79 5.73 5.6 5.94 5.69 5.84 4.06 3.63 3.75 3.56 3.81 4.75 5.81 6.31 7.75 6.81 5.98 6 5.43 5.72 6.13 5.99 5.79 6.27 5.48 S 7 3 3 6 5.84 5.97 Find the data presented in Group Exercise 5 sheet in the Excel file. There are 4 LIBOR (London Inter- Bank Offer Rate) rates for different maturities (1-month, 3-month, 6-month and 12-month). On 1/1/1990, there was a plain interest rate Swap whose floating leg payments are to be 3-month Libor rate at the beginning of each period. Both fixed and floating leg payments are to be made in March, June, September and December and thus the first floating leg interest rate was set to be 8.38% when the Swap was initiated on 1/1/1990. The nominal (notional) principal of this swap is $10,000,000. 5-1. If there were no premiums set for this Swap (Swap spread = 0. This means each fixed and floating leg party will pay the coupons from each side). When the yield on 1/1/1990 was 8%, calculate the fixed interest rate of this Swap and the market value of the long position of the Swap on 1/1/1990. 5-2. Using the historical LIBOR, calculate the profit (or loss) of the fixed leg on each coupon payment date. Draw the graph. 1M 6M 8.5 12M 8.94 8.69 8.38 8.38 8.44 8.31 8.44 8.38 8.31 8.27 7.63 6.31 6.06 5.44 7.58 7.56 6.38 7 6.19 7 5.75 5.63 4.25 8.31 7.56 6.56 6.56 5.63 4.23 4.51 4.06 3.27 3.63 4.31 4.31 4.25 4.37 5.06 4.31 3.94 3.27 3.38 3.44 7 3 date 3/1/90 6/1/90 9/1/90 12/1/90 3/1/91 6/1/91 9/1/91 12/1/91 3/1/92 6/1/92 9/1/92 12/1/92 3/1/93 6/1/93 9/1/93 12/1/93 3/1/94 6/1/94 9/1/94 12/1/94 3/1/95 6/1/95 9/1/95 12/1/95 3/1/96 6/1/96 9/1/96 12/1/96 3/1/97 6/1/97 9/1/97 12/1/97 . 3.94 3.19 3.31 3.19 3.19 3.19 3.25 3.69 4.56 5.06 6 6.13 6.13 5.88 5.69 5.44 5.5 5.43 5.5 5.69 6.06 5.66 5.72 3.25 3.31 3.38 3.38 3.94 4.88 5.5 6.5 6.25 6.06 5.95 5.63 5.47 5.58 5.63 5.56 5.77 5.9 5.77 5.81 3.38 3.51 3.38 3.5 4.25 5.25 5.75 7 6.5 6 5.95 5.51 5.5 5.79 5.73 5.6 5.94 5.69 5.84 4.06 3.63 3.75 3.56 3.81 4.75 5.81 6.31 7.75 6.81 5.98 6 5.43 5.72 6.13 5.99 5.79 6.27 5.48 S 7 3 3 6 5.84 5.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts