Question: undefined Free PDF Reader X File Home www.freepdfsolutions.com 1/4 File Selection Zoom Page Layout Find Pages Bookmarks Thumbnails QUESTION 2 a) A financial analyst for

undefined

undefined

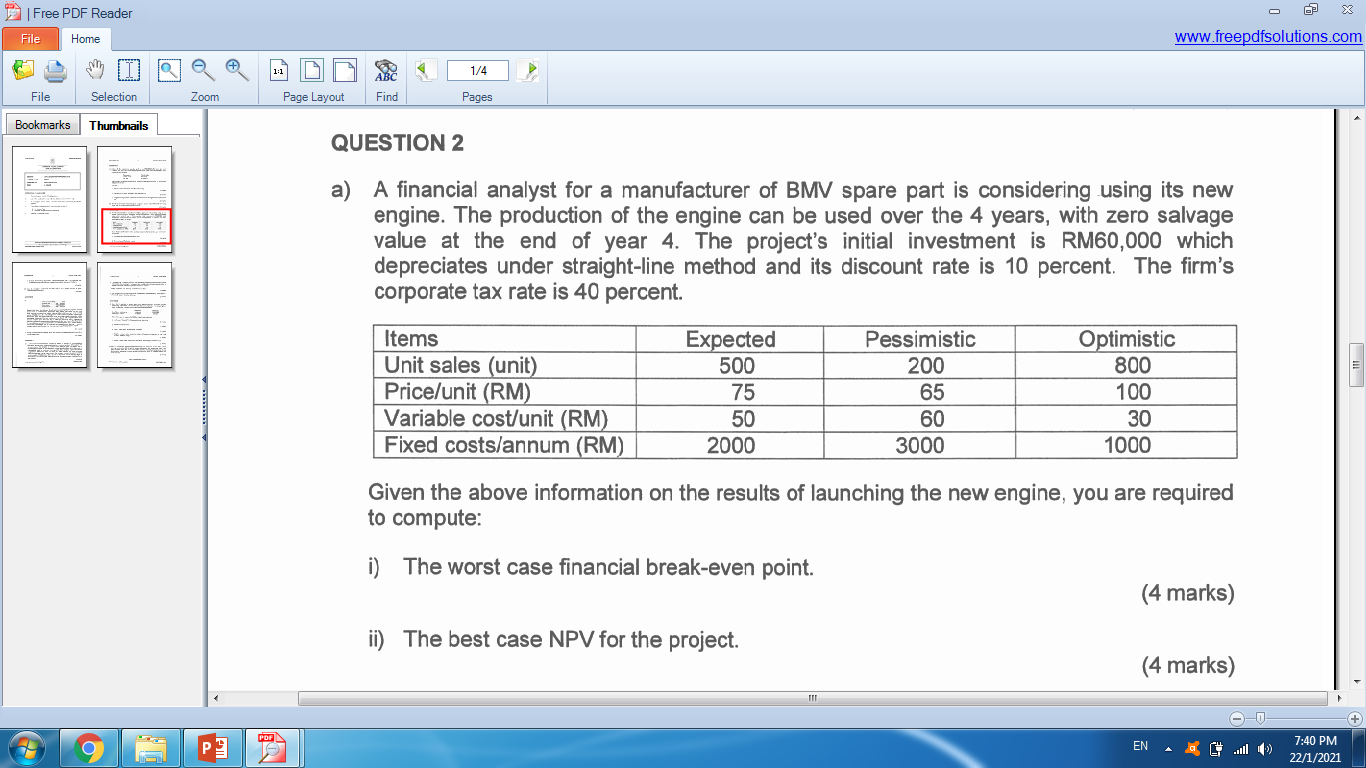

Free PDF Reader X File Home www.freepdfsolutions.com 1/4 File Selection Zoom Page Layout Find Pages Bookmarks Thumbnails QUESTION 2 a) A financial analyst for a manufacturer of BMV spare part is considering using its new engine. The production of the engine can be used over the 4 years, with zero salvage value at the end of year 4. The project's initial investment is RM60,000 which depreciates under straight-line method and its discount rate is 10 percent. The firm's corporate tax rate is 40 percent. Items Unit sales (unit) Price/unit (RM) Variable cost/unit (RM) Fixed costs/annum (RM) Expected 500 75 50 2000 Pessimistic 200 65 60 3000 Optimistic 800 100 30 1000 Given the above information on the results of launching the new engine, you are required to compute: i) The worst case financial break-even point. (4 marks) ii) The best case NPV for the project. (4 marks) -O PDF EN 7:40 PM 22/1/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts