Question: undefined Homework: Problem Set 5 Save Score: 0 of 1 pt 10 of 10 (1 complete) HW Score: 10%, 1 of 10 pts P10-8 (similar

undefined

undefined

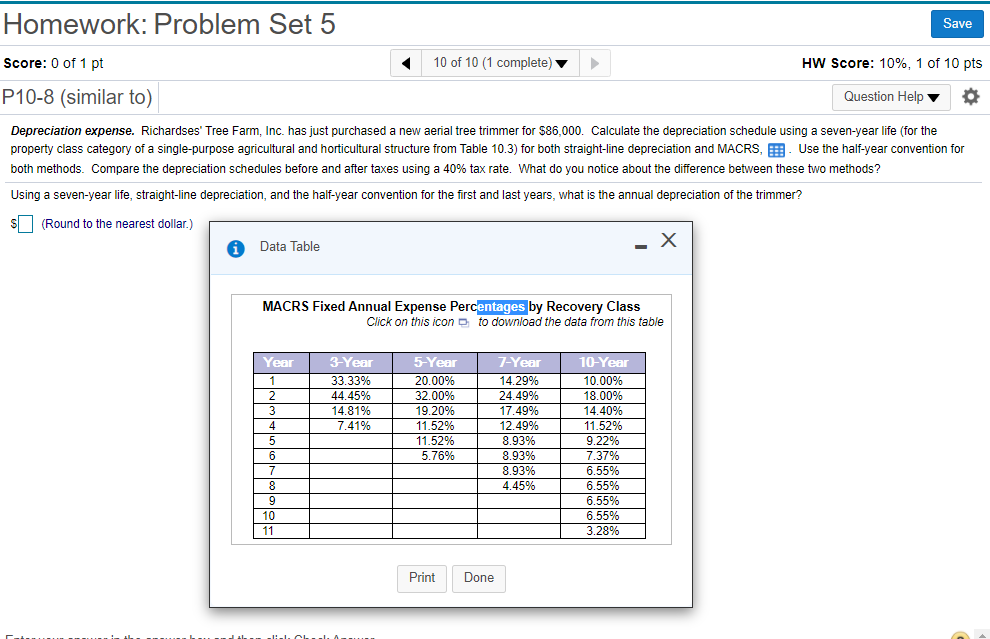

Homework: Problem Set 5 Save Score: 0 of 1 pt 10 of 10 (1 complete) HW Score: 10%, 1 of 10 pts P10-8 (similar to) Question Help Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $86,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure from Table 10.3) for both straight-line depreciation and MACRS, B. Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? Using a seven-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the trimmer? $(Round to the nearest dollar.) Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 4 5 3-Year 33.33% 44.45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% LL 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 11.52% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% 5.76% 7 8 9 10 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts