Question: undefined NOTE: You must show your work as required for each question to receive credit. You must do your calculations for each question as required.

undefined

undefined

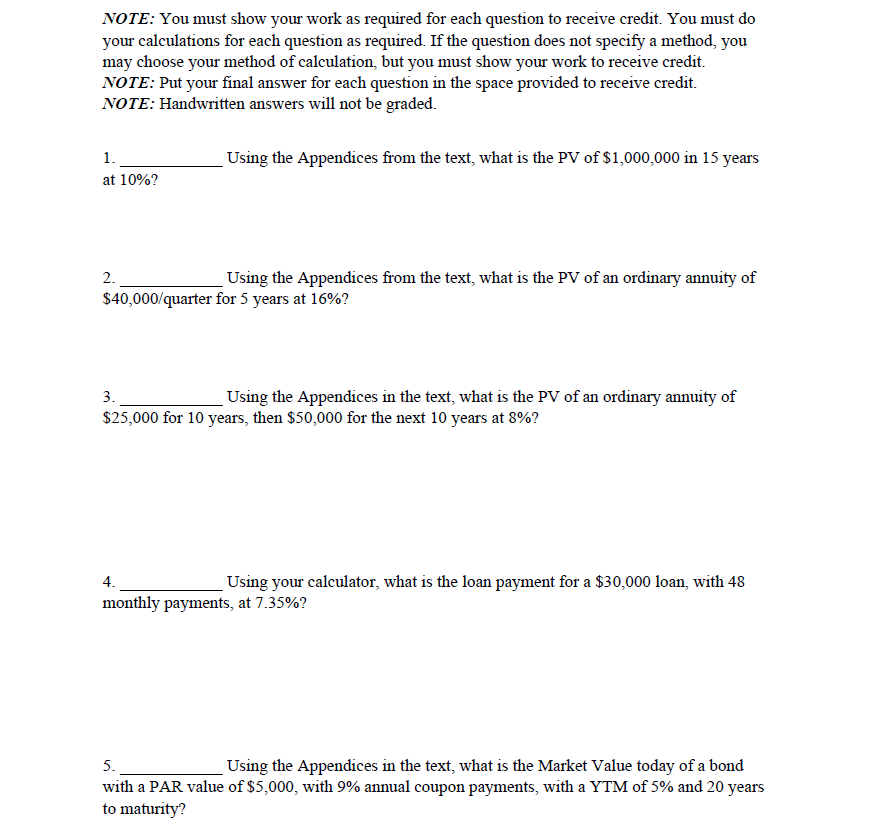

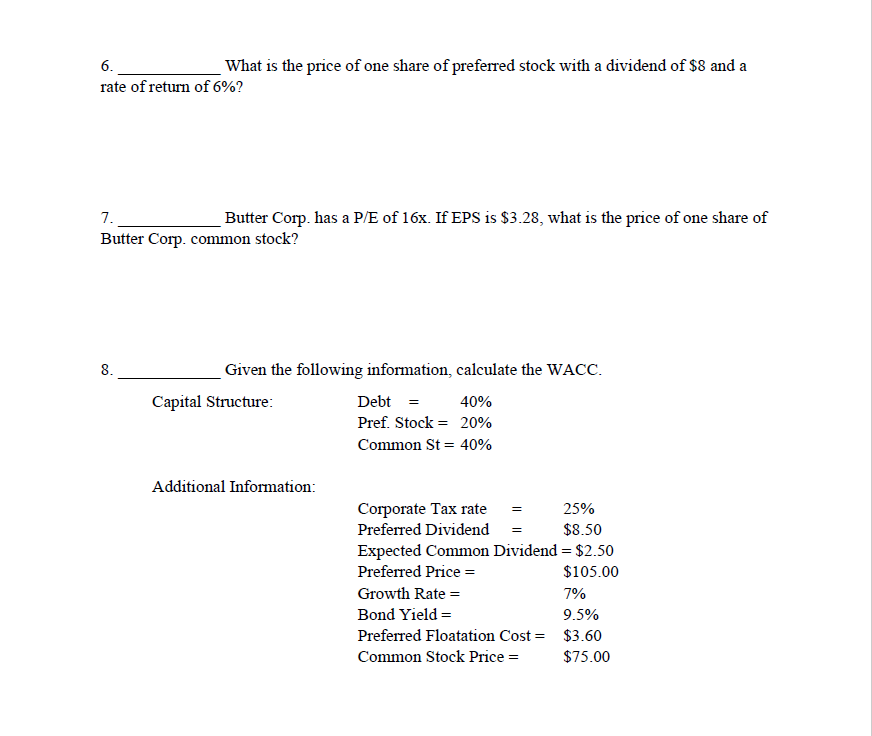

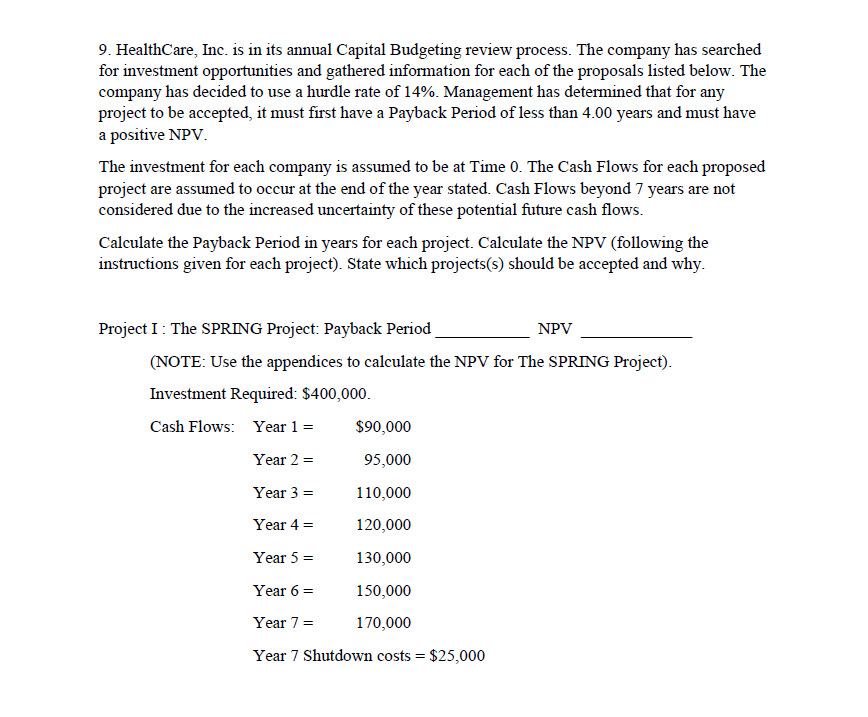

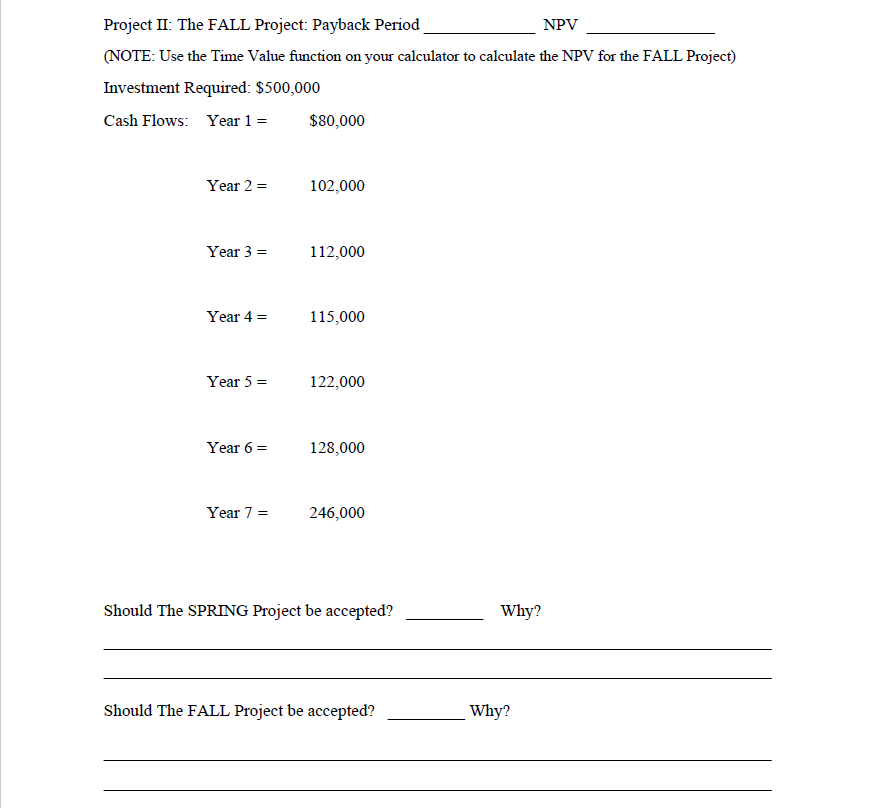

NOTE: You must show your work as required for each question to receive credit. You must do your calculations for each question as required. If the question does not specify a method, you may choose your method of calculation, but you must show your work to receive credit. NOTE: Put your final answer for each question in the space provided to receive credit. NOTE: Handwritten answers will not be graded. Using the Appendices from the text, what is the PV of $1,000,000 in 15 years 1. at 10%? 2. Using the Appendices from the text, what is the PV of an ordinary annuity of $40,000/quarter for 5 years at 16%? 3. Using the Appendices in the text, what is the PV of an ordinary annuity of $25,000 for 10 years, then $50,000 for the next 10 years at 8%? 4. Using your calculator, what is the loan payment for a $30,000 loan, with 48 monthly payments, at 7.35%? 5. Using the Appendices in the text, what is the Market Value today of a bond with a PAR value of $5,000, with 9% annual coupon payments, with a YTM of 5% and 20 years to maturity? 6. What is the price of one share of preferred stock with a dividend of $8 and a rate of return of 6%? 7. Butter Corp. has a P/E of 16x. If EPS is $3.28, what is the price of one share of Butter Corp. common stock? 8. Given the following information, calculate the WACC. Capital Structure: Debt = 40% Pref. Stock = 20% Common St = 40% Additional Information: Corporate Tax rate = 25% Preferred Dividend = $8.50 Expected Common Dividend = $2.50 Preferred Price = $105.00 Growth Rate = 7% Bond Yield = 9.5% Preferred Floatation Cost = $3.60 Common Stock Price = $75.00 9. HealthCare, Inc. is in its annual Capital Budgeting review process. The company has searched for investment opportunities and gathered information for each of the proposals listed below. The company has decided to use a hurdle rate of 14%. Management has determined that for any project to be accepted, it must first have a Payback Period of less than 4.00 years and must have a positive NPV. The investment for each company is assumed to be at Time 0. The Cash Flows for each proposed project are assumed to occur at the end of the year stated. Cash Flows beyond 7 years are not considered due to the increased uncertainty of these potential future cash flows. Calculate the Payback Period in years for each project. Calculate the NPV (following the instructions given for each project). State which projects(s) should be accepted and why. Project I: The SPRING Project: Payback Period NPV (NOTE: Use the appendices to calculate the NPV for The SPRING Project). Investment Required: $400,000. Cash Flows: Year 1 = $90,000 Year 2 = 95,000 Year 3 = 110,000 Year 4 = 120,000 Year 5 = 130,000 Year 6 = 150,000 Year 7 = 170,000 Year 7 Shutdown costs = $25,000 Project II: The FALL Project: Payback Period NPV (NOTE: Use the Time Value function on your calculator to calculate the NPV for the FALL Project) Investment Required: $500,000 Cash Flows: Year 1 = $80,000 Year 2 = 102,000 Year 3 = 112,000 Year 4 = 115,000 Year 5 = 122,000 Year 6 = 128,000 Year 7 = 246,000 Should The SPRING Project be accepted? Why? Should The FALL Project be accepted? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts