Question: undefined On 1 July 2020, Sherlock Ltd leased a processing plant to Holmes Ltd. The plant was purchased by Sherlock Ltd on 1 July 2020

undefined

undefined

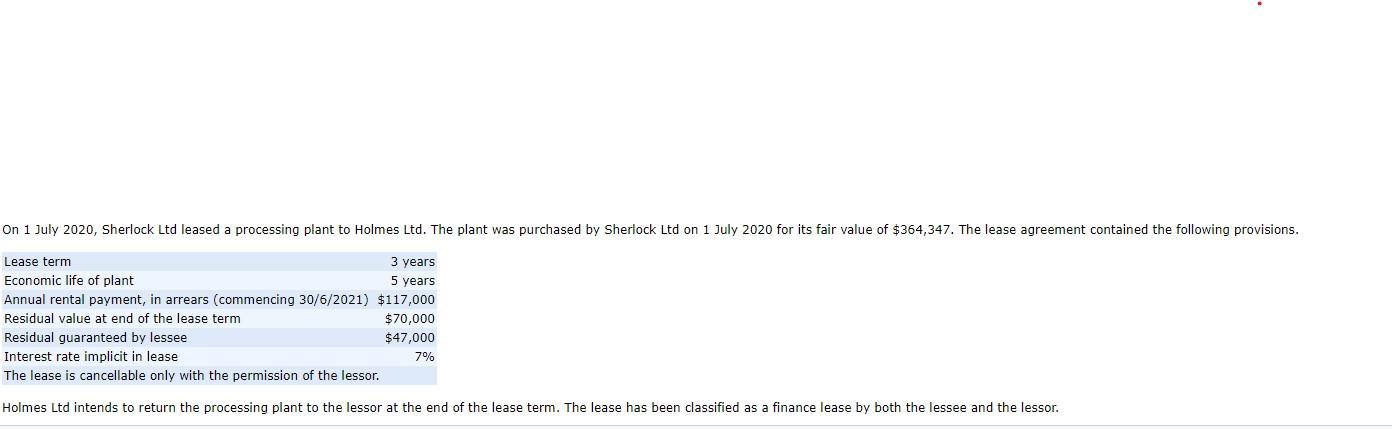

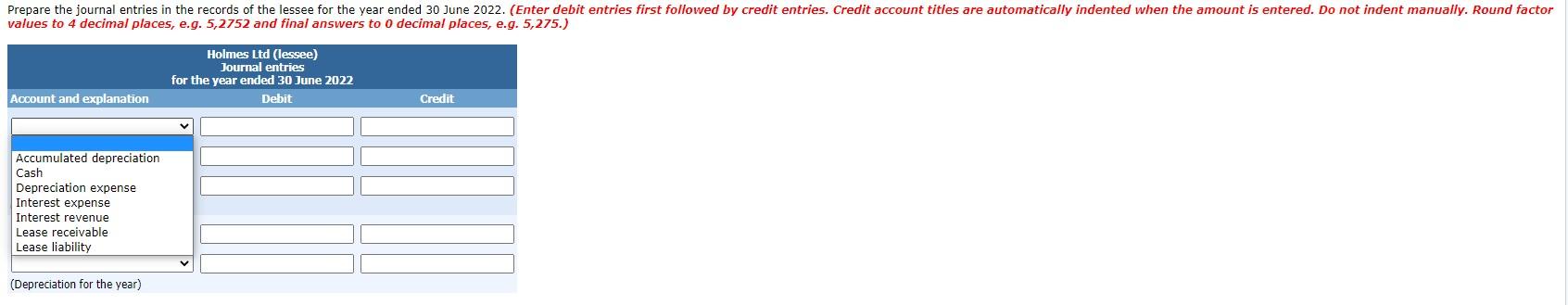

On 1 July 2020, Sherlock Ltd leased a processing plant to Holmes Ltd. The plant was purchased by Sherlock Ltd on 1 July 2020 for its fair value of $364,347. The lease agreement contained the following provisions. Lease term 3 years Economic life of plant 5 years Annual rental payment, in arrears (commencing 30/6/2021) $117,000 Residual value at end of the lease term $70,000 Residual guaranteed by lessee $47,000 Interest rate implicit in lease 7% The lease is cancellable only with the permission of the lessor. Holmes Ltd intends to return the processing plant to the lessor at the end of the lease term. The lease has been classified as a finance lease by both the lessee and the lessor. Prepare the journal entries in the records of the lessee for the year ended 30 June 2022. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round factor values to 4 decimal places, e.g. 5,2752 and final answers to o decimal places, e.g. 5,275.) Holmes Ltd (lessee) Journal entries for the year ended 30 June 2022 Debit Account and explanation Credit Accumulated depreciation Cash Depreciation expense Interest expense Interest revenue Lease receivable Lease liability (Depreciation for the year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts