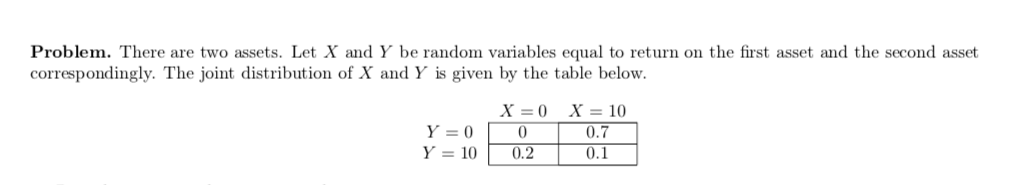

Question: undefined Problem. There are two assets. Let X and Y be random variables equal to return on the first asset and the second asset correspondingly.

undefined

undefined

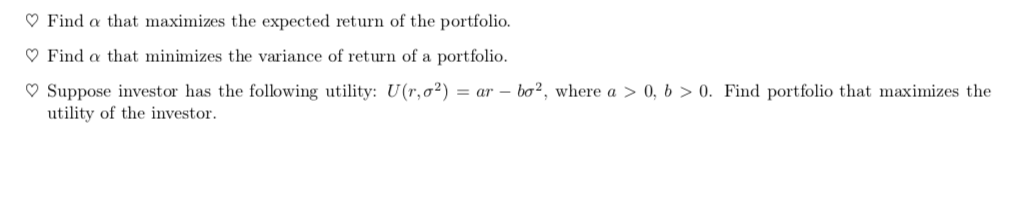

Problem. There are two assets. Let X and Y be random variables equal to return on the first asset and the second asset correspondingly. The joint distribution of X and Y is given by the table below. Y=0 Y = 10 X=0 0 0.2 X = 10 0.7 0.1 Find a that maximizes the expected return of the portfolio. Find a that minimizes the variance of return of a portfolio. Suppose investor has the following utility: U(1,0%) = ar bo?, where a > 0,6 > 0. Find portfolio that maximizes the utility of the investor. Problem. There are two assets. Let X and Y be random variables equal to return on the first asset and the second asset correspondingly. The joint distribution of X and Y is given by the table below. Y=0 Y = 10 X=0 0 0.2 X = 10 0.7 0.1 Find a that maximizes the expected return of the portfolio. Find a that minimizes the variance of return of a portfolio. Suppose investor has the following utility: U(1,0%) = ar bo?, where a > 0,6 > 0. Find portfolio that maximizes the utility of the investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts