Question: undefined Question 3 Eclipse Inc. is a publicly-traded retail firm with a financial arm. You have been provided with the following information on the firms's

undefined

undefined

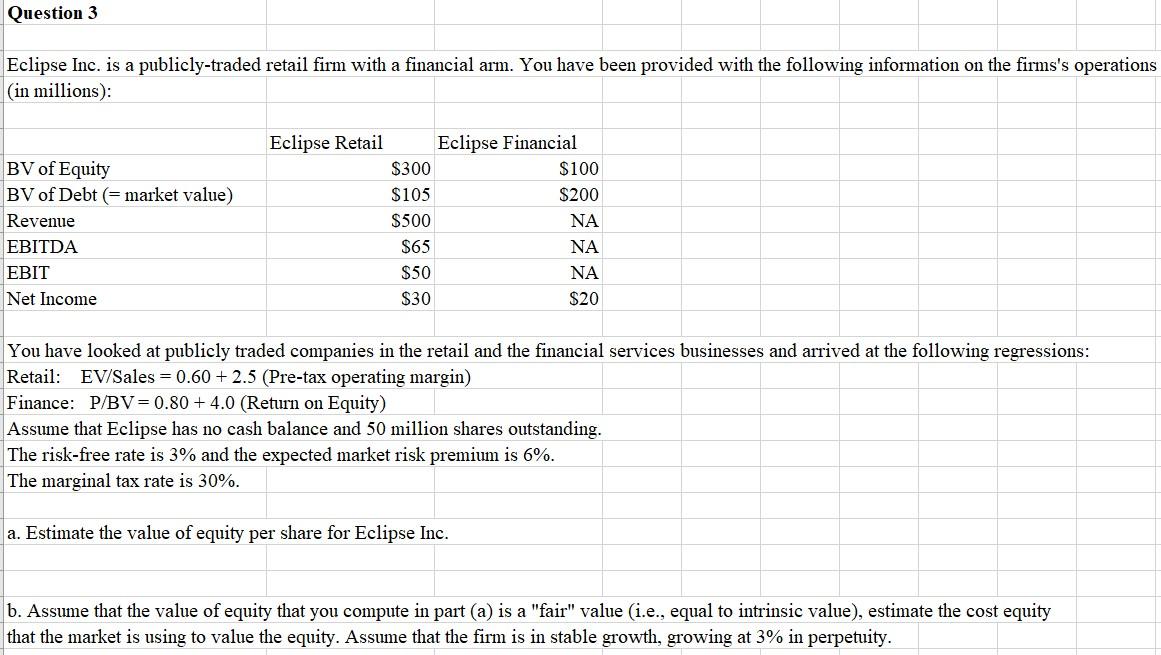

Question 3 Eclipse Inc. is a publicly-traded retail firm with a financial arm. You have been provided with the following information on the firms's operations (in millions): BV of Equity BV of Debt = market value) Revenue EBITDA EBIT Net Income Eclipse Retail Eclipse Financial $300 $100 $105 $200 $500 NA $65 NA $50 NA $30 $20 You have looked at publicly traded companies in the retail and the financial services businesses and arrived at the following regressions: Retail: EV/Sales = 0.60 + 2.5 (Pre-tax operating margin) Finance: P/BV=0.80 +4.0 (Return on Equity) Assume that Eclipse has no cash balance and 50 million shares outstanding. The risk-free rate is 3% and the expected market risk premium is 6%. The marginal tax rate is 30%. a. Estimate the value of equity per share for Eclipse Inc. b. Assume that the value of equity that you compute in part (a) is a "fair" value (i.e., equal to intrinsic value), estimate the cost equity that the market is using to value the equity. Assume that the firm is in stable growth, growing at 3% in perpetuity. Question 3 Eclipse Inc. is a publicly-traded retail firm with a financial arm. You have been provided with the following information on the firms's operations (in millions): BV of Equity BV of Debt = market value) Revenue EBITDA EBIT Net Income Eclipse Retail Eclipse Financial $300 $100 $105 $200 $500 NA $65 NA $50 NA $30 $20 You have looked at publicly traded companies in the retail and the financial services businesses and arrived at the following regressions: Retail: EV/Sales = 0.60 + 2.5 (Pre-tax operating margin) Finance: P/BV=0.80 +4.0 (Return on Equity) Assume that Eclipse has no cash balance and 50 million shares outstanding. The risk-free rate is 3% and the expected market risk premium is 6%. The marginal tax rate is 30%. a. Estimate the value of equity per share for Eclipse Inc. b. Assume that the value of equity that you compute in part (a) is a "fair" value (i.e., equal to intrinsic value), estimate the cost equity that the market is using to value the equity. Assume that the firm is in stable growth, growing at 3% in perpetuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts