Question: undefined Question 3 Your manager asks you to value the equity of Trail Inc., a company with many crossholdings and a large cash balance. Using

undefined

undefined

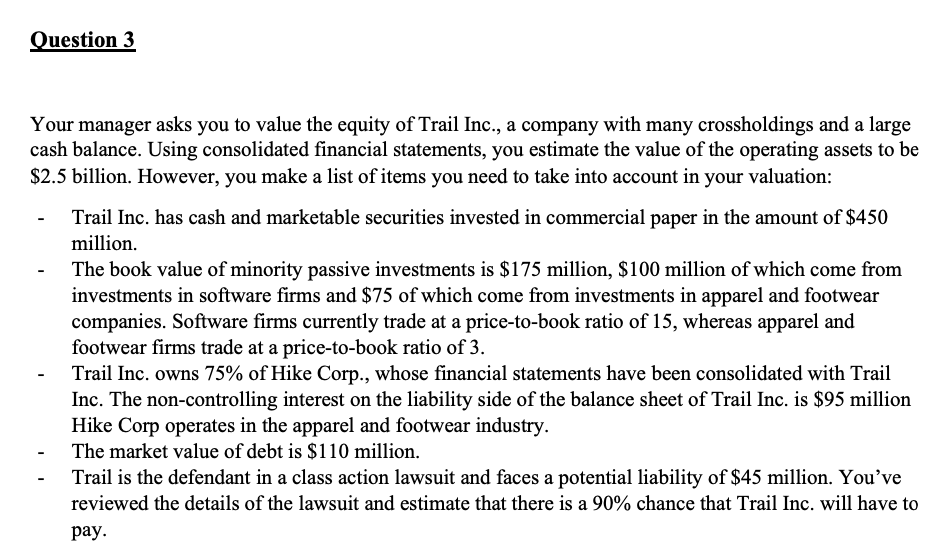

Question 3 Your manager asks you to value the equity of Trail Inc., a company with many crossholdings and a large cash balance. Using consolidated financial statements, you estimate the value of the operating assets to be $2.5 billion. However, you make a list of items you need to take into account in your valuation: Trail Inc. has cash and marketable securities invested in commercial paper in the amount of $450 million. The book value of minority passive investments is $175 million, $100 million of which come from investments in software firms and $75 of which come from investments in apparel and footwear companies. Software firms currently trade at a price-to-book ratio of 15, whereas apparel and footwear firms trade at a price-to-book ratio of 3. - Trail Inc. owns 75% of Hike Corp., whose financial statements have been consolidated with Trail Inc. The non-controlling interest on the liability side of the balance sheet of Trail Inc. is $95 million Hike Corp operates in the apparel and footwear industry. - The market value of debt is $110 million. Trail is the defendant in a class action lawsuit and faces a potential liability of $45 million. You've reviewed the details of the lawsuit and estimate that there is a 90% chance that Trail Inc. will have to pay. Question 3 Your manager asks you to value the equity of Trail Inc., a company with many crossholdings and a large cash balance. Using consolidated financial statements, you estimate the value of the operating assets to be $2.5 billion. However, you make a list of items you need to take into account in your valuation: Trail Inc. has cash and marketable securities invested in commercial paper in the amount of $450 million. The book value of minority passive investments is $175 million, $100 million of which come from investments in software firms and $75 of which come from investments in apparel and footwear companies. Software firms currently trade at a price-to-book ratio of 15, whereas apparel and footwear firms trade at a price-to-book ratio of 3. - Trail Inc. owns 75% of Hike Corp., whose financial statements have been consolidated with Trail Inc. The non-controlling interest on the liability side of the balance sheet of Trail Inc. is $95 million Hike Corp operates in the apparel and footwear industry. - The market value of debt is $110 million. Trail is the defendant in a class action lawsuit and faces a potential liability of $45 million. You've reviewed the details of the lawsuit and estimate that there is a 90% chance that Trail Inc. will have to pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts