Question: undefined Question 4 (Total 20 marks) 1. The current spot exchange rate is $1.50/ and the three-month forward rate is $1.55/. Based on your analysis

undefined

undefined

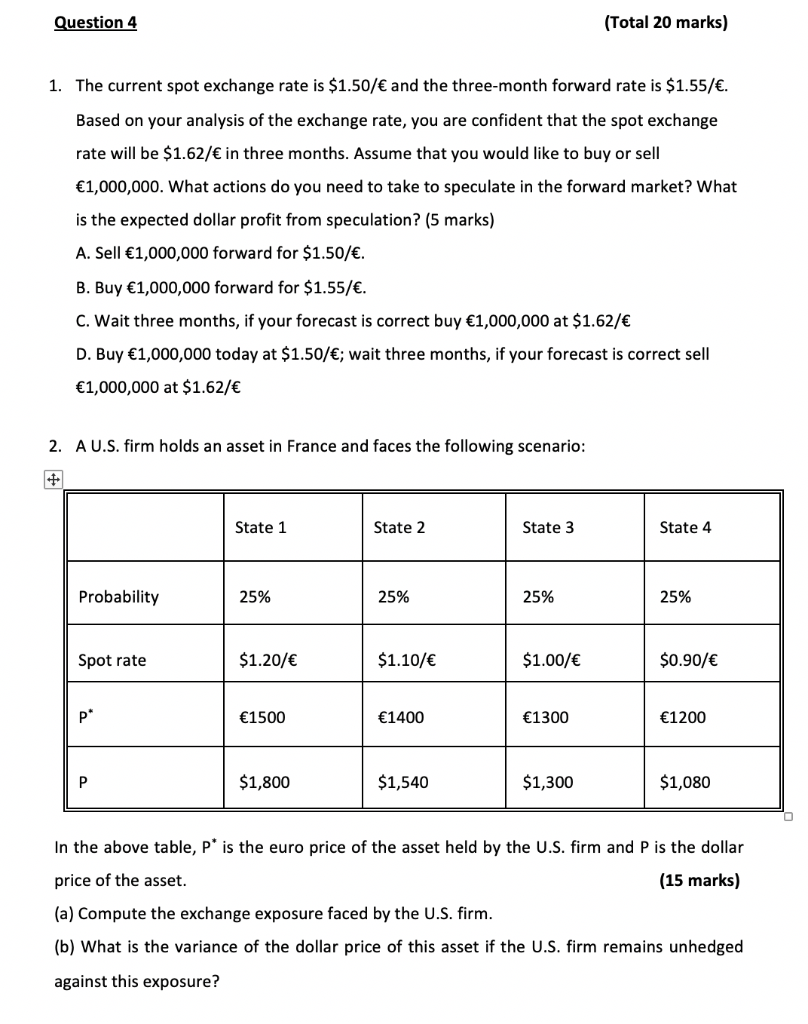

Question 4 (Total 20 marks) 1. The current spot exchange rate is $1.50/ and the three-month forward rate is $1.55/. Based on your analysis of the exchange rate, you are confident that the spot exchange rate will be $1.62/ in three months. Assume that you would like to buy or sell 1,000,000. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation? (5 marks) A. Sell 1,000,000 forward for $1.50/. B. Buy 1,000,000 forward for $1.55/. C. Wait three months, if your forecast is correct buy 1,000,000 at $1.62/ D. Buy 1,000,000 today at $1.50/; wait three months, if your forecast is correct sell 1,000,000 at $1.62/ 2. A U.S. firm holds an asset in France and faces the following scenario: State 1 State 2 State 3 State 4 Probability 25% 25% 25% 25% Spot rate $1.20/ $1.10/ $1.00/ $0.90/ p" 1500 1400 1300 1200 P $1,800 $1,540 $1,300 $1,080 In the above table, p* is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset. (15 marks) (a) Compute the exchange exposure faced by the U.S. firm. (b) What is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure? Question 4 (Total 20 marks) 1. The current spot exchange rate is $1.50/ and the three-month forward rate is $1.55/. Based on your analysis of the exchange rate, you are confident that the spot exchange rate will be $1.62/ in three months. Assume that you would like to buy or sell 1,000,000. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation? (5 marks) A. Sell 1,000,000 forward for $1.50/. B. Buy 1,000,000 forward for $1.55/. C. Wait three months, if your forecast is correct buy 1,000,000 at $1.62/ D. Buy 1,000,000 today at $1.50/; wait three months, if your forecast is correct sell 1,000,000 at $1.62/ 2. A U.S. firm holds an asset in France and faces the following scenario: State 1 State 2 State 3 State 4 Probability 25% 25% 25% 25% Spot rate $1.20/ $1.10/ $1.00/ $0.90/ p" 1500 1400 1300 1200 P $1,800 $1,540 $1,300 $1,080 In the above table, p* is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset. (15 marks) (a) Compute the exchange exposure faced by the U.S. firm. (b) What is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts