Question: undefined QUESTION 7 Now we will focus on Risk in a Portfolio Context. See Section 8-3. Match each of the terms below with their definitions

undefined

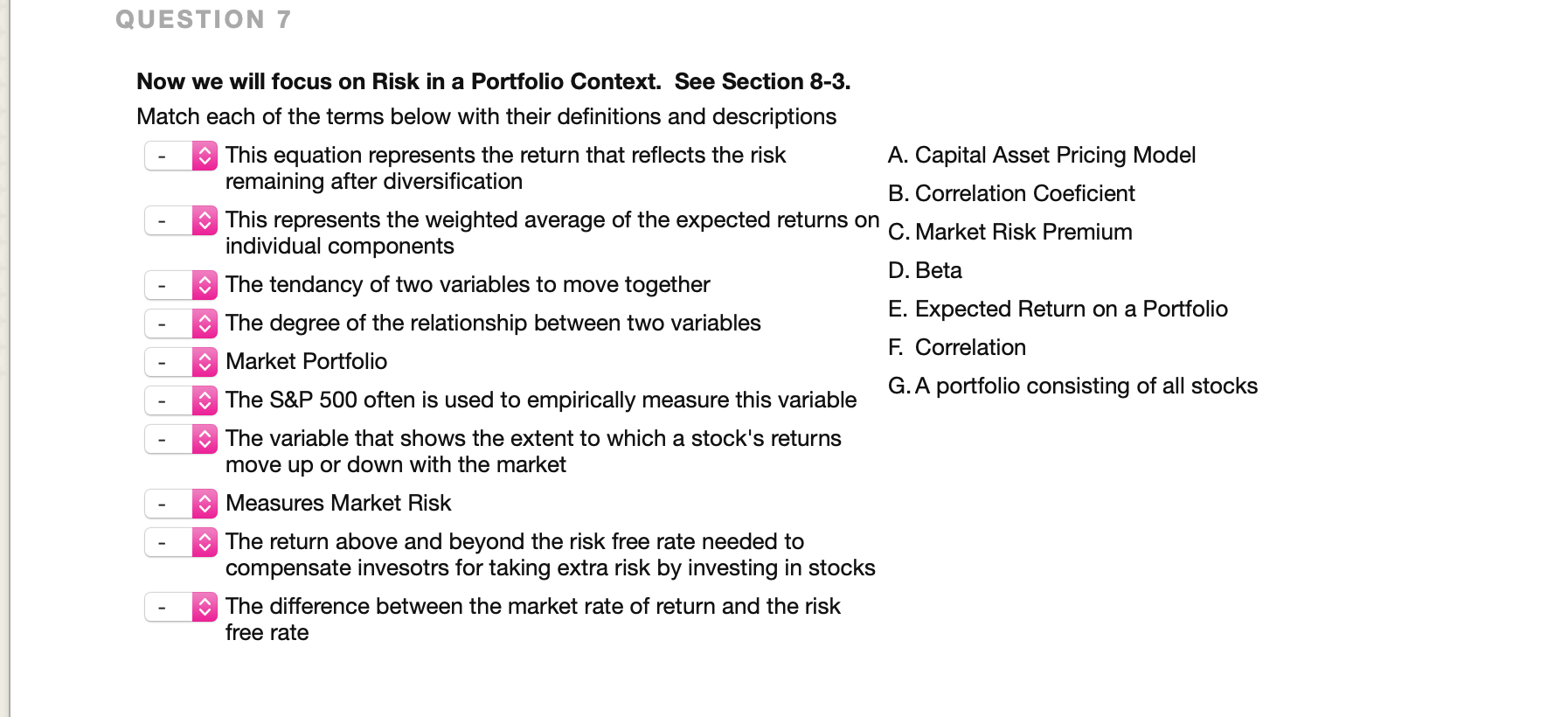

QUESTION 7 Now we will focus on Risk in a Portfolio Context. See Section 8-3. Match each of the terms below with their definitions and descriptions This equation represents the return that reflects the risk A. Capital Asset Pricing Model remaining after diversification B. Correlation Coeficient This represents the weighted average of the expected returns on C. Market Risk Premium individual components D. Beta The tendancy of two variables to move together The degree of the relationship between two variables E. Expected Return on a Portfolio F. Correlation Market Portfolio G. A portfolio consisting of all stocks The S&P 500 often is used to empirically measure this variable The variable that shows the extent to which a stock's returns move up or down with the market Measures Market Risk The return above and beyond the risk free rate needed to compensate invesotrs for taking extra risk by investing in stocks The difference between the market rate of return and the risk free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts