Question: undefined QUESTION 8 (15 marks - 3 marks each) Aloha Painting Company has reached the end of its first fiscal year, December 31, 2020. Prepare

undefined

undefined

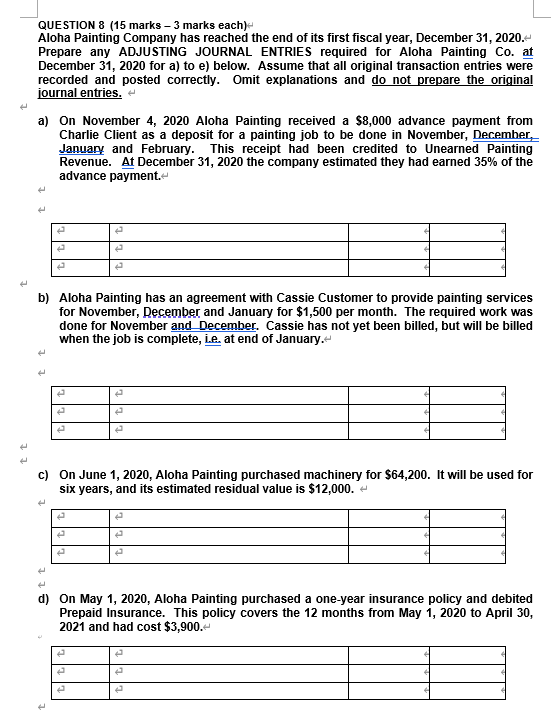

QUESTION 8 (15 marks - 3 marks each) Aloha Painting Company has reached the end of its first fiscal year, December 31, 2020. Prepare any ADJUSTING JOURNAL ENTRIES required for Aloha Painting Co. at December 31, 2020 for a) to e) below. Assume that all original transaction entries were recorded and posted correctly. Omit explanations and do not prepare the original journal entries. a) On November 4, 2020 Aloha Painting received a $8,000 advance payment from Charlie Client as a deposit for a painting job to be done in November, December January and February. This receipt had been credited to Unearned Painting Revenue. Af December 31, 2020 the company estimated they had earned 35% of the advance payment. b) Aloha Painting has an agreement with Cassie Customer to provide painting services for November, December and January for $1,500 per month. The required work was done for November and December. Cassie has not yet been billed, but will be billed when the job is complete, L.e. at end of January. c) On June 1, 2020, Aloha Painting purchased machinery for $64,200. It will be used for six years, and its estimated residual value is $12,000. t d) On May 1, 2020, Aloha Painting purchased a one-year insurance policy and debited Prepaid Insurance. This policy covers the 12 months from May 1, 2020 to April 30, 2021 and had cost $3,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts