Question: undefined Suppose that there exist two securities (A and B) with annual expected returns equal to ra = 3% and rs = 5% and standard

undefined

undefined

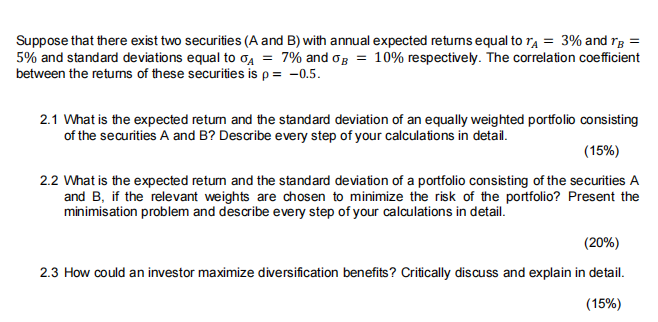

Suppose that there exist two securities (A and B) with annual expected returns equal to ra = 3% and rs = 5% and standard deviations equal to A = 7% and Op = 10% respectively. The correlation coefficient between the returns of these securities is p= -0.5. 2.1 What is the expected return and the standard deviation of an equally weighted portfolio consisting of the securities A and B? Describe every step of your calculations in detail. (15%) 2.2 What is the expected return and the standard deviation of a portfolio consisting of the securities A and B, if the relevant weights are chosen to minimize the risk of the portfolio? Present the minimisation problem and describe every step of your calculations in detail. (20%) 2.3 How could an investor maximize diversification benefits? Critically discuss and explain in detail. (15%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts