Question: undefined The expected return on Big Time Toys is 5 percent and its standard deviation is 23 percent. The expected return on Chemical Industries is

undefined

undefined

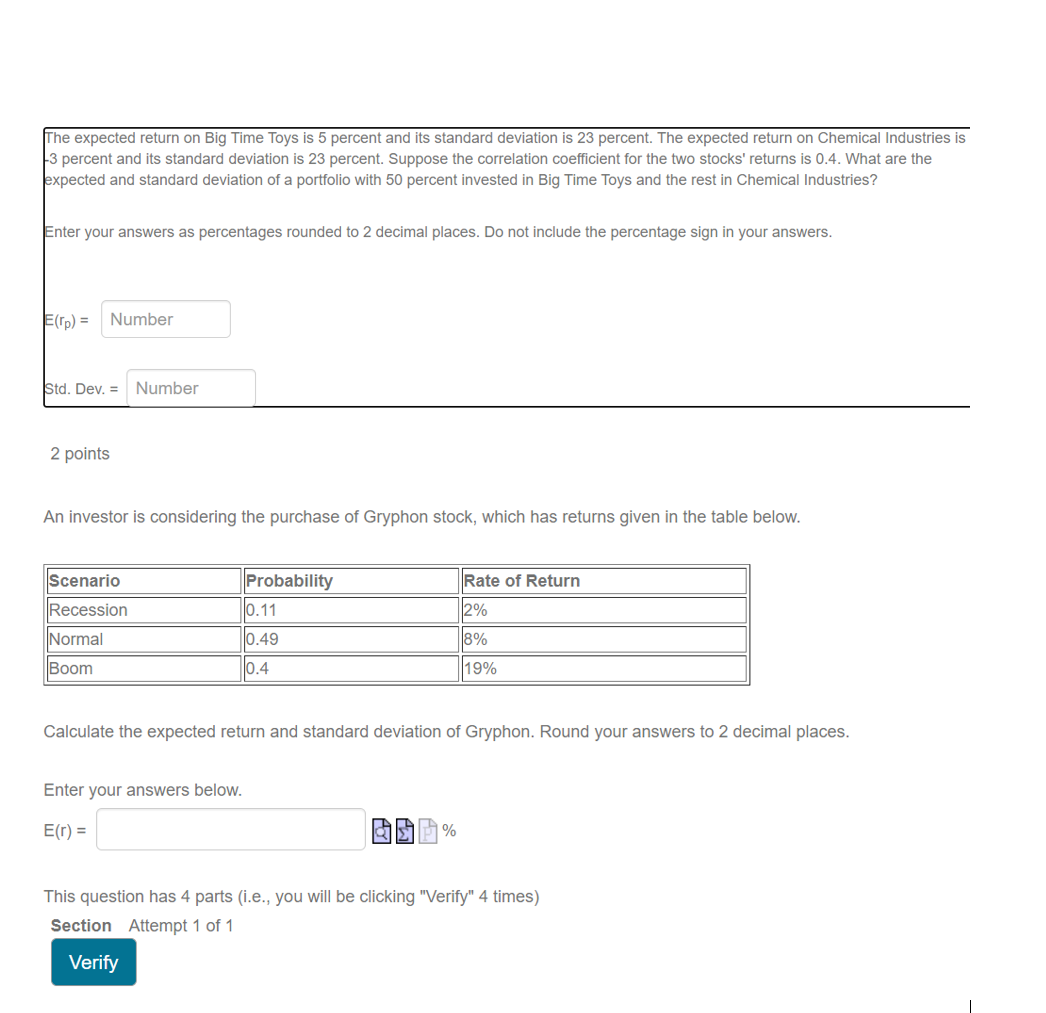

The expected return on Big Time Toys is 5 percent and its standard deviation is 23 percent. The expected return on Chemical Industries is 3 percent and its standard deviation is 23 percent. Suppose the correlation coefficient for the two stocks' returns is 0.4. What are the expected and standard deviation of a portfolio with 50 percent invested in Big Time Toys and the rest in Chemical Industries? Enter your answers as percentages rounded to 2 decimal places. Do not include the percentage sign in your answers. (rp) = Number Std. Dev. = Number 2 points An investor is considering the purchase of Gryphon stock, which has returns given in the table below. Scenario Rate of Return 2% Recession Probability 10.11 0.49 10.4 Normal 18% 19% Boom Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places. Enter your answers below. E(I) = |S % This question has 4 parts (i.e., you will be clicking "Verify" 4 times) Section Attempt 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts