Question: undefined Todd has been asked to calculate the weighted average cost of capital (WACC) for an important client (TLC Inc.) of the company. TLC has

undefined

undefined

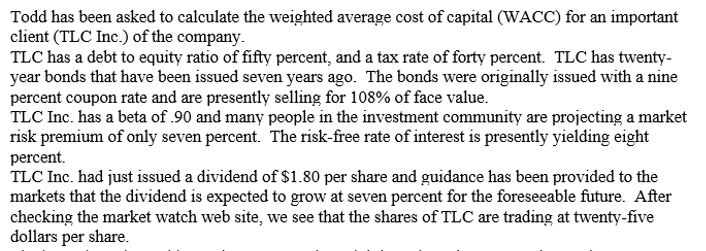

Todd has been asked to calculate the weighted average cost of capital (WACC) for an important client (TLC Inc.) of the company. TLC has a debt to equity ratio of fifty percent, and a tax rate of forty percent. TLC has twenty- year bonds that have been issued seven years ago. The bonds were originally issued with a nine percent coupon rate and are presently selling for 108% of face value. TLC Inc. has a beta of 90 and many people in the investment community are projecting a market risk premium of only seven percent. The risk-free rate of interest is presently yielding eight percent TLC Inc. had just issued a dividend of $1.80 per share and guidance has been provided to the markets that the dividend is expected to grow at seven percent for the foreseeable future. After checking the market watch web site, we see that the shares of TLC are trading at twenty-five dollars per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts