Question: undefined Two projects A and B are to be evaluated economically where the MARR is 12%. Project A: Initial investment is $228,000 where $148,000 is

undefined

undefined

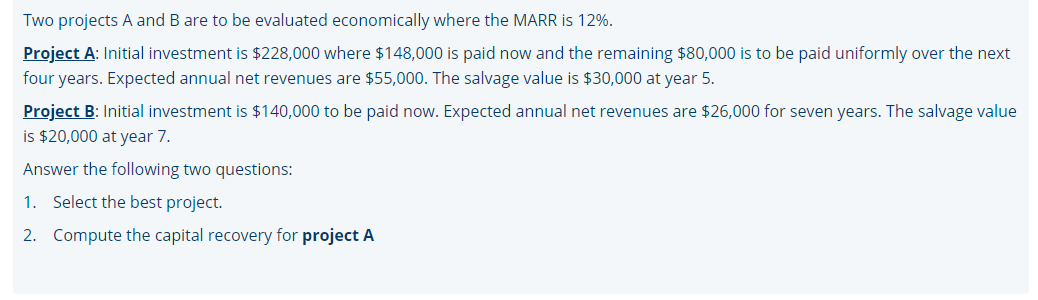

Two projects A and B are to be evaluated economically where the MARR is 12%. Project A: Initial investment is $228,000 where $148,000 is paid now and the remaining $80,000 is to be paid uniformly over the next four years. Expected annual net revenues are $55,000. The salvage value is $30,000 at year 5. Project B: Initial investment is $140,000 to be paid now. Expected annual net revenues are $26,000 for seven years. The salvage value is $20,000 at year 7. Answer the following two questions: 1. Select the best project. 2. Compute the capital recovery for project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts