Question: Under 1 7 9 , a taxpayer's Section 1 7 9 deduction must be reduced dollar - for - dollar for each dollar the value

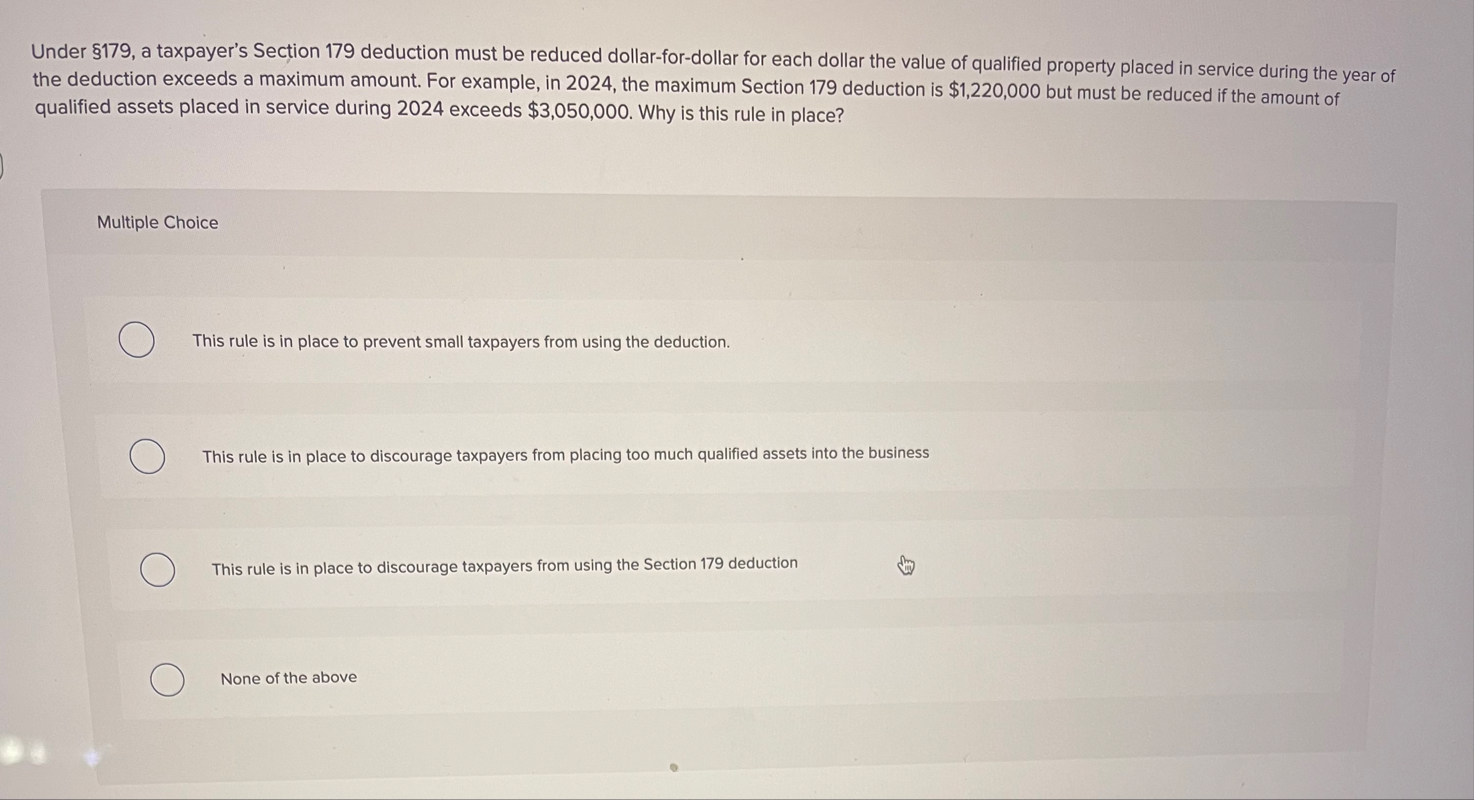

Under a taxpayer's Section deduction must be reduced dollarfordollar for each dollar the value of qualified property placed in service during the year of the deduction exceeds a maximum amount. For example, in the maximum Section deduction is $ but must be reduced if the amount of qualified assets placed in service during exceeds $ Why is this rule in place?

Multiple Choice

This rule is in place to prevent small taxpayers from using the deduction.

This rule is in place to discourage taxpayers from placing too much qualified assets into the business

This rule is in place to discourage taxpayers from using the Section deduction

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock