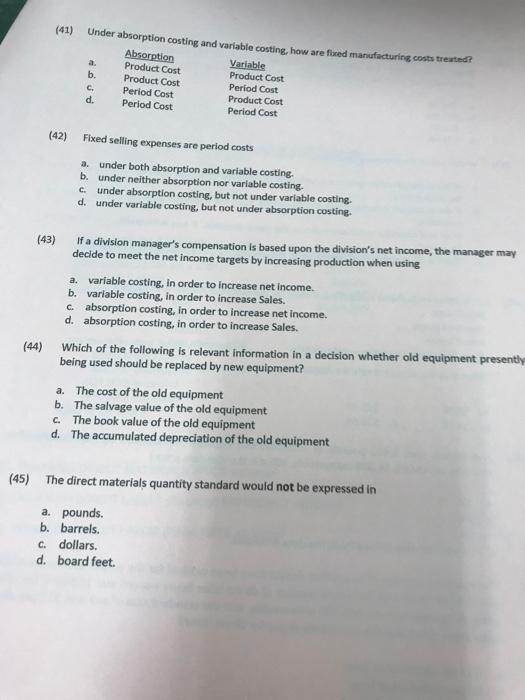

Question: Under absorption costing and variable costing, how are fixed manufacturing costs treated? Fixed selling expenses are period costs a. under both absorption and variable costing.

Under absorption costing and variable costing, how are fixed manufacturing costs treated? Fixed selling expenses are period costs a. under both absorption and variable costing. B. under neither absorption nor variable costing. c. under absorption costing, but not under variable costing. d. under variable costing, but not under absorption costing. If a division manager's compensation is based upon the division's net income, the manager may decide to meet the net income targets by increasing production when using a. variable costing, in order to increase net income. b. variable costing, in order to increase Sales. c. absorption costing, in order to increase net income. d. absorption costing, in order to increase Sales. Which of the following is relevant information in a decision whether old equipment presently being used should be replaced by new equipment? a. The cost of the old equipment b. The salvage value of the old equipment c. The book value of the old equipment d. The accumulated depreciation of the old equipment The direct materials quantity standard would not be expressed in a. pounds. b. barrels. c. dollars. D. board feet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts