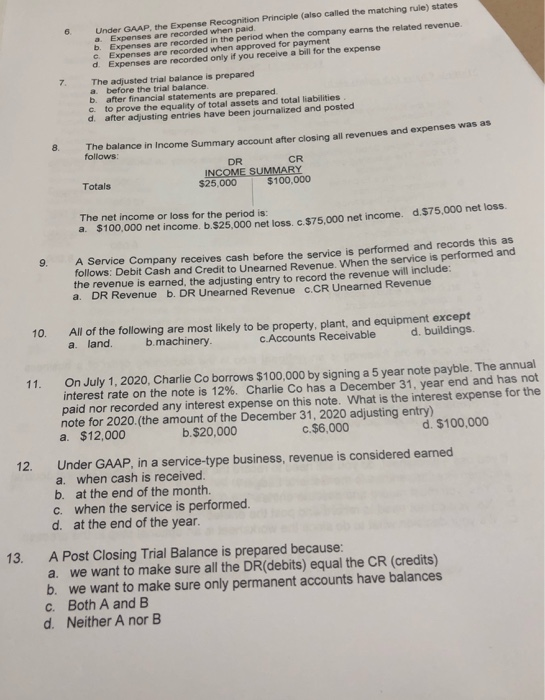

Question: Under GAAP, the Expense Recognition Principle (also called the matching rule) states a Expenses are recorded when paid b. Expenses are recorded in the period

Under GAAP, the Expense Recognition Principle (also called the matching rule) states a Expenses are recorded when paid b. Expenses are recorded in the period when the company earns the related revenue Expenses are recorded when approved for payment d Expenses are recorded only if you receive a bill for the expense The adjusted trial balance is prepared a before the trial balance. b. after financial statements are prepared to prove the equality of total assets and total liabilities d after adjusting entries have been journalized and posted CR The balance in Income Summary account after closing all revenues and expenses was follows: DR INCOME SUMMARY Totals $25,000 $100,000 The net income or loss for the period is: a $100.000 net income. b. $25.000 net loss. C. $75,000 net income. d. $75,000 net loss before the senue, when we will inclu 9. A Service Company receives cash before the service is performed and records this as follows: Debit Cash and Credit to Unearned Revenue. When the service is performed and the revenue is earned, the adjusting entry to record the revenue will include: a DR Revenue b. DR Unearned Revenue c. CR Unearned Revenue 10. All of the following are most likely to be property, plant, and equipment except a. land. b.machinery. c.Accounts Receivable d. buildings. On July 1, 2020, Charlie Co borrows $100,000 by signing a 5 year note payble. The annual interest rate on the note is 12%. Charlie Co has a December 31. year end and has not paid nor recorded any interest expense on this note. What is the interest expense for the note for 2020.(the amount of the December 31, 2020 adjusting entry) a. $12,000 b. $20,000 c. $6,000 d. $100,000 12. Under GAAP, in a service-type business, revenue is considered earned a. when cash is received. b. at the end of the month. c. when the service is performed. d. at the end of the year. A Post Closing Trial Balance is prepared because: a. we want to make sure all the DR(debits) equal the CR (credits) b. We want to make sure only permanent accounts have balances c. Both A and B d. Neither A nor B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts