Question: under MACRS using a 5-year recovery period. Renewing the machine would result in the following projected revenues and expenses (excluding depreciation): Developing Relevant Cash Flows

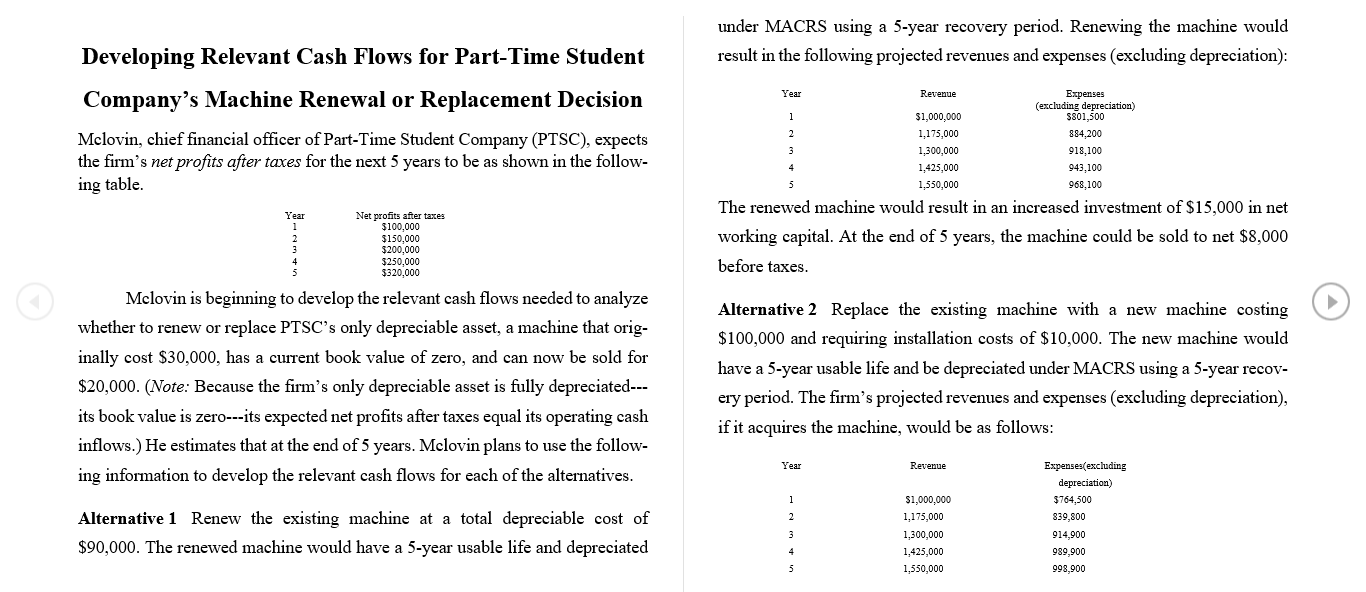

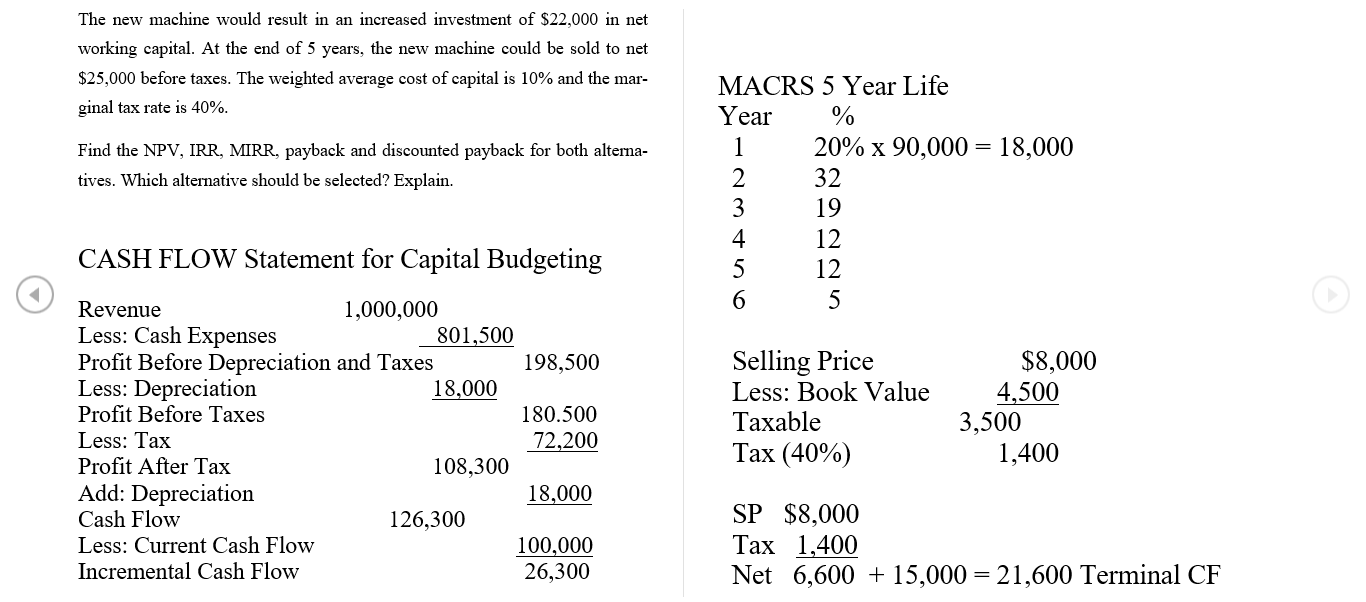

under MACRS using a 5-year recovery period. Renewing the machine would result in the following projected revenues and expenses (excluding depreciation): Developing Relevant Cash Flows for Part-Time Student Company's Machine Renewal or Replacement Decision Mclovin, chief financial officer of Part-Time Student Company (PTSC), expects the firm's net profits after taxes for the next 5 years to be as shown in the follow- ing table. 1 Year Revenue Expenses (excluding depreciation) $1,000,000 $801,500 2 1,175,000 884,200 1,300,000 918,100 1,425,000 943,100 1,550,000 968,100 The renewed machine would result in an increased investment of $15,000 in net working capital. At the end of 5 years, the machine could be sold to net $8,000 before taxes. Year Net profits after taxes $100,000 $150,000 $200,000 $250,000 3320,000 Mclovin is beginning to develop the relevant cash flows needed to analyze whether to renew or replace PTSC's only depreciable asset, a machine that orig- inally cost $30,000, has a current book value of zero, and can now be sold for $20,000. (Note: Because the firm's only depreciable asset is fully depreciated--- its book value is zero---its expected net profits after taxes equal its operating cash inflows.) He estimates that at the end of 5 years. Mclovin plans to use the follow- ing information to develop the relevant cash flows for each of the alternatives. Alternative 2 Replace the existing machine with a new machine costing $100,000 and requiring installation costs of $10,000. The new machine would have a 5-year usable life and be depreciated under MACRS using a 5-year recov- ery period. The firm's projected revenues and expenses (excluding depreciation), if it acquires the machine, would be as follows: Year Revenue Alternative 1 Renew the existing machine at a total depreciable cost of $90,000. The renewed machine would have a 5-year usable life and depreciated $1,000,000 1,175,000 1,300,000 1,425,000 1,350,000 Expenses(excluding depreciation) $764,500 839,800 914,900 989,900 998,900 The new machine would result in an increased investment of $22,000 in net working capital. At the end of 5 years, the new machine could be sold to net $25,000 before taxes. The weighted average cost of capital is 10% and the mar- ginal tax rate is 40%. Find the NPV, IRR, MIRR, payback and discounted payback for both alterna- tives. Which alternative should be selected? Explain. MACRS 5 Year Life Year % 1 20% x 90,000 = 18,000 2 32 3 19 4 12 5 12 6 5 CASH FLOW Statement for Capital Budgeting Revenue 1,000,000 Less: Cash Expenses 801,500 Profit Before Depreciation and Taxes 198,500 Less: Depreciation 18,000 Profit Before Taxes 180.500 Less: Tax 72,200 Profit After Tax 108,300 Add: Depreciation 18,000 Cash Flow 126,300 Less: Current Cash Flow 100,000 Incremental Cash Flow 26,300 Selling Price Less: Book Value Taxable Tax (40%) $8,000 4,500 3,500 1,400 SP $8,000 Tax 1,400 Net 6,600 + 15,000 = 21,600 Terminal CF under MACRS using a 5-year recovery period. Renewing the machine would result in the following projected revenues and expenses (excluding depreciation): Developing Relevant Cash Flows for Part-Time Student Company's Machine Renewal or Replacement Decision Mclovin, chief financial officer of Part-Time Student Company (PTSC), expects the firm's net profits after taxes for the next 5 years to be as shown in the follow- ing table. 1 Year Revenue Expenses (excluding depreciation) $1,000,000 $801,500 2 1,175,000 884,200 1,300,000 918,100 1,425,000 943,100 1,550,000 968,100 The renewed machine would result in an increased investment of $15,000 in net working capital. At the end of 5 years, the machine could be sold to net $8,000 before taxes. Year Net profits after taxes $100,000 $150,000 $200,000 $250,000 3320,000 Mclovin is beginning to develop the relevant cash flows needed to analyze whether to renew or replace PTSC's only depreciable asset, a machine that orig- inally cost $30,000, has a current book value of zero, and can now be sold for $20,000. (Note: Because the firm's only depreciable asset is fully depreciated--- its book value is zero---its expected net profits after taxes equal its operating cash inflows.) He estimates that at the end of 5 years. Mclovin plans to use the follow- ing information to develop the relevant cash flows for each of the alternatives. Alternative 2 Replace the existing machine with a new machine costing $100,000 and requiring installation costs of $10,000. The new machine would have a 5-year usable life and be depreciated under MACRS using a 5-year recov- ery period. The firm's projected revenues and expenses (excluding depreciation), if it acquires the machine, would be as follows: Year Revenue Alternative 1 Renew the existing machine at a total depreciable cost of $90,000. The renewed machine would have a 5-year usable life and depreciated $1,000,000 1,175,000 1,300,000 1,425,000 1,350,000 Expenses(excluding depreciation) $764,500 839,800 914,900 989,900 998,900 The new machine would result in an increased investment of $22,000 in net working capital. At the end of 5 years, the new machine could be sold to net $25,000 before taxes. The weighted average cost of capital is 10% and the mar- ginal tax rate is 40%. Find the NPV, IRR, MIRR, payback and discounted payback for both alterna- tives. Which alternative should be selected? Explain. MACRS 5 Year Life Year % 1 20% x 90,000 = 18,000 2 32 3 19 4 12 5 12 6 5 CASH FLOW Statement for Capital Budgeting Revenue 1,000,000 Less: Cash Expenses 801,500 Profit Before Depreciation and Taxes 198,500 Less: Depreciation 18,000 Profit Before Taxes 180.500 Less: Tax 72,200 Profit After Tax 108,300 Add: Depreciation 18,000 Cash Flow 126,300 Less: Current Cash Flow 100,000 Incremental Cash Flow 26,300 Selling Price Less: Book Value Taxable Tax (40%) $8,000 4,500 3,500 1,400 SP $8,000 Tax 1,400 Net 6,600 + 15,000 = 21,600 Terminal CF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts