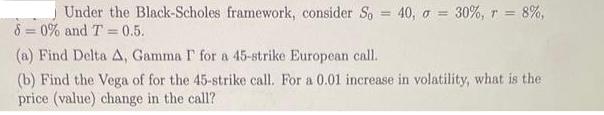

Question: Under the Black-Scholes framework, consider So= 40, = 30%, r = 8%, 60% and T=0.5. (a) Find Delta A, Gamma I for a 45-strike

Under the Black-Scholes framework, consider So= 40, = 30%, r = 8%, 60% and T=0.5. (a) Find Delta A, Gamma I for a 45-strike European call. (b) Find the Vega of for the 45-strike call. For a 0.01 increase in volatility, what is the price (value) change in the call?

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

a Delta for a 45strike European call Delta ... View full answer

Get step-by-step solutions from verified subject matter experts