Question: Under the direct write-off method, what entry is made at the time an actual bad debt occurs? A. Debit bad debt expense, credit the allowance

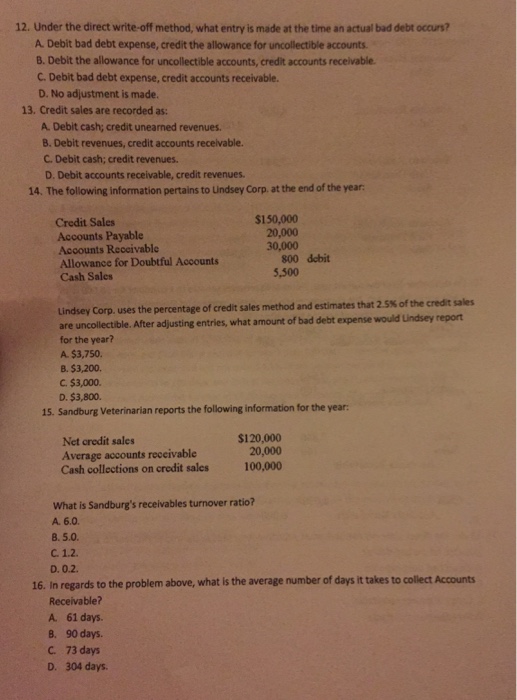

Under the direct write-off method, what entry is made at the time an actual bad debt occurs? A. Debit bad debt expense, credit the allowance for uncollectable accounts. B. Debit the allowance for uncollectable accounts, credit accounts receivable. C. Debit bad debt expense, credit accounts receivable. D. No adjustment is made. Credit sales are recorded as: A. Debit cards: credit unearned revenues. B. Debit revenues, credit accounts receivable. C. Debit cash: credit revenues. D. Debit accounts receivable, credit revenues. The following information pertains to Lindsey Corp. at the end of the year: Credit Sales exist150,000 Account Payable 20,000 Accounts Receivable 30,000Allowance for Doubtful Accounts 800 debit Cash Sales 5, 500 Sandburg Veterinarian reports the following information for the year: Net credit sales exist120,000 Average accounts receivable 20,000 Cash collections on credit sales 100,000 What is Sandburg's receivables turnover ratio? A. 6.0. B. 5.0. C. 1.2. D. 0.2. In regards to the problem above, what is the average number of days it takes to collect Accounts Receivable? A. 61 days. B. 90 days. C. 73 days. D. 304 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts